What's the Endgame for the Arab Spring?

Politics / Middle East Jun 27, 2011 - 05:58 PM GMTBy: HRA_Advisory

The many "typical" issues with downside potential that markets have been dealing are still some ways away from sufficient resolution to calm markets. One that has slipped off the economic pages, but is still causing much chatter on the political front, is the ongoing movement in the Arab world for changes of government. Though not as up front with the market crowd as when it began, it is still having its impact on markets.

The many "typical" issues with downside potential that markets have been dealing are still some ways away from sufficient resolution to calm markets. One that has slipped off the economic pages, but is still causing much chatter on the political front, is the ongoing movement in the Arab world for changes of government. Though not as up front with the market crowd as when it began, it is still having its impact on markets.

Few observers doubt the potential good this movement in the Arab Street portends. About the same number would suggest they can see just what it will have brought in a year's time. It's that added layer of opaque on a global economy already being rapidly repositioned that is causing an itch. The editorial this month attempts to put the Arab street movement in some historic context. We understand the concern about uncertainty, but see a lot of potential as well.

Since markets continue to focus on potential downside issues, we continue to focus on updates in this issue. We are tracking a growing list of spec stories and expect to lay a few of them out during the summer doldrums. For the time being it is still best to look for opportunity and then wait for the markets to indicate it's time to act on it.

David Coffin & Eric Coffin

US equity markets had continued to benefit from export driven bottom line growth, but are now sagging on hesitancy about the US domestic economy ahead of QEII buoyancy drying up in June. The Dollar decline that allowed export strength has also boosted US import costs. This could mean a modest US summer driving season unless recent declines in oil prices continue.

China's inflation concern has taken up more of its policy. The tighter Yuan policy isn't showing up in the inflation rate but it will have some impact and mean that growth engine downshifts. On top of that the vagaries of nature and street crowds continue to add uncertainty.

We began the year with an "expect the unexpected" stance. May began with the death of bin Laden, which caused only the barest ripple of market applause. We stir entrails this time of year on whether to look for bargains early in the northern summer, or not -- a tough call this year.

The sector we focus on has been consolidating after doing very well. This downward move accelerated recently, which could hasten the start of a buying period. The recovery of the broader equity market after March events seems to be stalling after new highs again in the past couple of weeks. It's not looking comfortable though, and volumes are low. Are the market's about to repeat last summer's pause?

"Events" have been hard on the algorithmic. The muddle of just-in-time manufacturing waylaid by tsunami wasn't expected, but adjustments can be made for it. It's possible to program varied responses to currency and bond or inflation related policy shifts. However, aging powers having to choose between the old buddy system or newly emboldened Arabic Street is quite variable rich.

Despite these weakening events, inflationary pressure would be the most likely cause for a pause. It's not the G7 economies that are the big concern for us. The real pressure is in the growth economies that the high income economies still need for export support. This pressure comes from resource price gains and most worryingly from high food prices and simple demand growth across many local markets. This again is event related.

Weather events have been getting a lot of ink lately, the most recent being the unusually heavy and deadly North American storm season. Our sympathy goes out to the victims of the southern US tornado onslaught, but it is slower motion events that concern markets. Weak crops and high food inflation are becoming a plague. Those still looking for a second market collapse and double dip recession will remind us the '30s dust bowl deepened the Depression. Markets run on perception so analogies like this can have an impact.

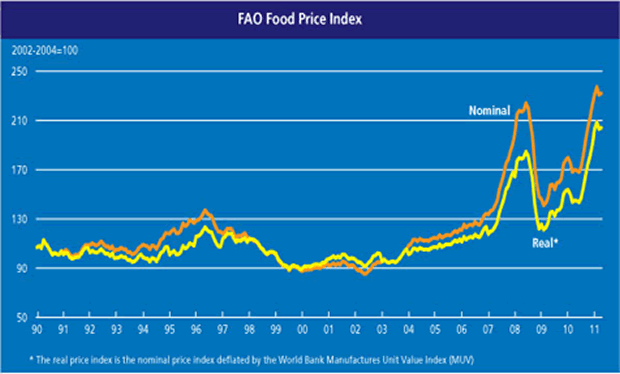

Perception aside, the problem is a real and serious one. The chart above, courtesy of the Food and Agriculture Organization of the UN, shows their food price index hitting new all-time highs, in both nominal and real terms. The price measure is already well above the levels reached in 2008. The one cause for optimism is that the commodity rout going on the past few sessions is driving speculative money out of grain and other "soft" markets too. This helps, but speculators aren't the main Within the pile of issues hitting this market, the one with the oddest feel is what some are calling the "Arab Spring".

Although there have been few protests in large oil producers, oil is part of the concern. It's unclear how broad an area this Spring may impact, and what it may mean in a region that has been a focus of foreign security concerns for a long time. Simply put it's a wild card, but then some wild cards are welcome.

Arab "Spring" of course alludes to overturning totalitarian regimes of Eastern Europe as the Soviet system fell apart. Some of the parallel themes in North Africa and southwestern Asia seem to be fairly obvious. However the markets' twitchiness underscores some real and important differences between that early '90s Spring and the Arab one of the early '10s.

Neither the Soviet experiment's highly centralized, "planned" economy nor the brutality of Stalinism attached to it early on is unique to human experience. They combined in Russia, which had been pegged as a coming power a century before the Soviet experiment got underway. Its failing's aside, the Soviet system did generate both high science and high art with Russian accents.

Even the global competition between Russia and the USA that became the Cold War was probably over well before it got underway. Few would have predicted Marxist musings coming into play (Marx would probably have thought Russia unripe for a "workers utopia"). The Soviet dictatorship of the proletariat lasting as long as it did testifies to Russia's strengths going in.

Those strengths kept the system going despite the hollowing out caused by centralized planning. It was too late for the system by the time its rot was finally accepted at the top. By then digging out the rot simply weakened the system further and it crumbled in a spectacular whoosh that opened the way for the eastern European "Springs".

How well Soviet satellites have done since then has reflected what they were before being taken over by the Soviet expansion. Areas of Eastern Europe that democratized during earlier springs have made real the trappings of democracy built into the system. Areas with no such history have fared less well.

Coming out of a short lived and globe spanning empire also helped the cause in Eastern Europe. Much has had to be undone and we certainly don't mean to suggest its been easy. Still, pre Soviet days were a living memory and establishing ties to the kindred west has been relatively straight forward. The east European Spring has been a renewal.

Contrast this with the Arab world that was established and flowered centuries before Russia began taking root on the western steppes. In fact both the zenith of the Arab empire and the start of Russian unification began with the westward push of the Mongols. In the Arab core that is a recent event.

The "mid-East" was our first region of cultivation and city building. Egypt has been the center of North Africa for many millennia. Street protests have been part of the region's politics throughout that history. The question for the market isn't so much why has the Arab Street risen, but rather why now?

Facebook and Twitter may deserve some organizational credit, but are hardly the cause. Certainly there are large groups of young, educated and underemployed people through the region, but that isn't new. A better clue is the Syrian placards written in Chinese seeking aid from the outside world.

In both China and India new deals between elites and broader populations are bringing prosperity. If the same doesn't happen in the Arab world, and other areas for that matter, the broader population may get left out of the new deals to be cut with these rising economic powers. China's first aircraft carrier is in the works, a sign its concern for 'security' will equal that of the West.

Security + Arab has equaled crude oil for over a century now, but that is more external to the region than local. Clearly the more important message is that people want a greater say in choosing their own futures. Neither the rants of Al Qaida-like groups nor the promise of some eventual payday from western investment is at play here. Real choice is.

It is true that countries with real ties and outlines of western style democracies have so far had an easier time of generating change. As with Eastern Europe, having the mechanisms of choice in place has been useful. The hard parts are however just underway.

No one, including the protest leaders, can outline what this movement will bring in terms of policy shifts. The protesters have been clear that whatever comes it needs to come from within. An understandable stance given that "uncertainty" has been the main bugaboo for ignoring bad leadership that was friendly with western democracies. This time, you take what you get.

Markets really do hate uncertainty so the ill ease they are demonstrating simply makes sense, at that level. That doesn't mean a bad outcome should be expected. In fact, this Arab Spring looks as likely to be a tonic for uncertainty in the medium term.

The concern isn't about the desire to democratize, but about the lack of much experience with western norms for democracy. Some are also concerned that Islam isn't built for the concept. Western democratic norms actually developed to overcome the ridged centralization of the Christian world through the Vatican. Islam has its own theological divisions, but not a centralizing institution vaguely like the Vatican once was.

Talking shops the Arab world and Islam do have. The real change so far has been that their voices have become more effective, and that is the real wellspring of democracy. We can't pretend to know the details of what comes from this movement or that we will like all of them as they arrive. However, we don't know the details of what comes from the market focused democratizing going on in China, or other regions, either. So far those have meant more balance and more prosperity.

The less Pollyanna view of uncertainty in the Arab world is potential oil supply disruption. Concern about "peak oil" is matched by concern about unfriendly Arab regimes coming to power. We have said before that peak oil, like peak copper or iron ore, is really about needing higher prices to bring new "lower grade" sources to the table. These are found in the oil rich Middle East as much as anywhere else.

A "Comment" article in this weekend's Toronto based National Post speaks to that potential in Israel where a well-funded company is setting up to test oil reserves in shale. The article speaks in terms of security concerns and the politics of oil hampering development of this resource in the past. That may be true, and the lead Canada's oil sands have been able to get amongst high cost sources, because it is in a secure area, speaks to that. But the cost issue is part of the deal.

The mid-East and North Africa as a whole could be generating more oil if risk premiums were to come down. The crowds in the street, who mostly just want to speak their minds and eat better, are protesting their own leadership with little focus on which foreign powers have been backing them. A muddle of other issues can certainly come into play, but the crowds aren't likely to oppose investment if they think it will help put food on the table. The system now in place, fed in part by keeping tension high, hasn't been doing that well enough.

Mideast political risk premiums won't be coming down before this Arab Spring has solidified around some guiding principles. Those will differ in different parts of the region, and only if those principles encourage investment will they generate reduced premiums. It will take a while for this process to work through and for direction to be recognized. Markets will be edgy while the process continues.

However, no one has put an alternative route to lower risk premiums on the table. We doubt there is one.

The Arab Spring is just one more uncertainty in a market full of them. The more "western" issues like debts, deficits and stimulus will play out through the summer. If there is to be resolution to those issues (or really well handled extend and pretend) it's likely to come in the next ninety days. Until at least a couple of those uncertainties are dealt with things will be soft. Going with the flow and waiting for a turn, hopefully in the dog days of summer, makes more sense for now than fighting the tape.

HRA has had some big wins in the iron ore and potash sector and we think it will continue to generate headlines and gains for a long time to come. One iron ore company in particular generated 650% gains for HRA subscribers and is being bought out - AND we now have another new highly prospective iron ore company that we will tell you about in this exclusive report that we're offering to you for FREE. This is a big, highly profitable market sector you'll want to learn more about today. Click here to receive our latest free report!

Ω

Sign up to receive HRA commentary, interviews and our latest free special report on Iron Ore & Potash, including a new HRA recommended company! www.hraadvisory.com

By David Coffin and Eric Coffin

http://www.hraadvisory.com

David Coffin and Eric Coffin are the editors of the HRA Journal, HRA Dispatch and HRA Special Delivery; a family of publications that are focused on metals exploration, development and production companies. Combined mining industry and market experience of over 50 years has made them among the most trusted independent analysts in the sector since they began publication of The Hard Rock Analyst in 1995. They were among the first to draw attention to the current commodities super cycle and the disastrous effects of massive forward gold hedging backed up by low grade mining in the 1990's. They have generated one of the best track records in the business thanks to decades of experience and contacts throughout the industry that help them get the story to their readers first. Please visit their website at www.hraadvisory.com for more information.

© 2011 Copyright HRA Advisory - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

HRA Advisory Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.