Greek Austerity Package Gets Favorable Vote, Will Bond Yields Head North?

Interest-Rates / Euro-Zone Jun 30, 2011 - 04:32 AM GMTBy: Asha_Bangalore

The Greek parliament voted in favor of the austerity package and the second vote to implement this law is scheduled for June 29. In the meanwhile, 2-year U.S. Treasury note yield moved up 13 basis points in four trading days (0.48% as of June 28 vs. 0.35% as of June 23) and was trading at 0.45% as of this writing.

The Greek parliament voted in favor of the austerity package and the second vote to implement this law is scheduled for June 29. In the meanwhile, 2-year U.S. Treasury note yield moved up 13 basis points in four trading days (0.48% as of June 28 vs. 0.35% as of June 23) and was trading at 0.45% as of this writing.

Yields on German government securities closed higher today, with yield in the 3-5 year space at 1.95% vs. 1.81% as of June 28 (see Chart 5).

The implication here is that the temporary benefit of the safe-haven status of U.S. and Germany government securities has probably run its course. It is important to note that bond yields in the U.S. are likely to show only a sideways movement in the months ahead as consumer spending has slowed, regional factory surveys indicate weakening factory conditions, hiring was significantly soft in May and the housing market remains in a slump.

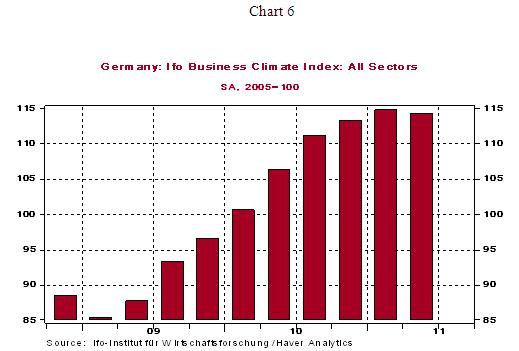

Overseas, the German economy is showing signs of slowing. The Ifo business conditions index edged down slightly in the second (see Chart 6) and it is widely held that the German economy is unlikely to post the stronger performance of the first quarter in the rest of 2011.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.