A Financial Permanent Crisis

Stock-Markets / Financial Markets 2011 Jul 08, 2011 - 12:37 PM GMTBy: Andy_Sutton

As the financial world breathed a collective sigh of relief as the Greek Parliament voted to impose further austerity measures on the people of Greece, I wondered aloud to no one in particular how many times we’d have to see this movie before people finally realize that this crisis is a permanent one. There are many analogies that we could use to illustrate what has gone on, but probably the best is a trauma patient coming into the hospital with a severed carotid artery. Instead of performing surgery and repairing the wound, doctors throw the unlucky fellow on a gurney with a piece of gauze taped over the incision. Every so often they check back in, throw another piece of gauze on it and walk out, never fixing the problem. That is precisely what is going on with regards to the Eurozone mess. And America’s too. Lots of tape and gauze with precious little in the way of real solutions has been the norm for quite some time now and there is no reason to think that this will change unless it is out of dire necessity.

As the financial world breathed a collective sigh of relief as the Greek Parliament voted to impose further austerity measures on the people of Greece, I wondered aloud to no one in particular how many times we’d have to see this movie before people finally realize that this crisis is a permanent one. There are many analogies that we could use to illustrate what has gone on, but probably the best is a trauma patient coming into the hospital with a severed carotid artery. Instead of performing surgery and repairing the wound, doctors throw the unlucky fellow on a gurney with a piece of gauze taped over the incision. Every so often they check back in, throw another piece of gauze on it and walk out, never fixing the problem. That is precisely what is going on with regards to the Eurozone mess. And America’s too. Lots of tape and gauze with precious little in the way of real solutions has been the norm for quite some time now and there is no reason to think that this will change unless it is out of dire necessity.

In my opinion, there are (at least) three overriding macro themes that are driving this crisis, and will continue to do so. Like most other recent economic and financial dislocations, it will go until it doesn’t. Looking at the macro drivers below, it is easy to see why this is the case: old habits die hard and most importantly, this crisis, along with most others, is insanely profitable for a select few.

The Psycho-Moral Problem

When you really tear away at all the media glitz and veneer applied to the global debt mess, you can find several underlying causes. The first is greed. The second, and this one has been a rather recent development, is laziness. I often wonder if America would be able to undergo another industrial revolution similar to the first one in today’s world. I seriously doubt it. We seem to be good at building shopping malls and restaurants, then borrowing money to patronize these establishments. In the aggregate though, we really haven’t built much in the way of productive capacity in a generation, let alone manned and operated it. Do we even remember how? What is really coming to the forefront is that we are by no means alone in this suspiciously insane endeavor; the people of Europe have been doing a mighty fine job of living beyond their means as well. Europe has had its own ‘great society’ upheaval similar to America’s turn down the wrong path in the 1960’s.

This drive to create a social utopia, or in economic terms, a post-scarcity world, has created exactly that which it was supposed to avoid – long-term scarcity. Why did these attempts occur? Gross misunderstandings of economics? Many think so, but when you read the articles, papers, and other correspondence written by many of the players in these movements it becomes rather clear that they were interested more in power accumulation than anything else. And two continents got wrapped up into it to the point where we have no idea how to live without it. Here in the US, over half of the population receives some type of transfer payment from the government. For the purposes of this article, I am not making the distinction between people who paid into programs like social security and Medicare and those who didn’t. The point is governments have become little more than a very expensive conduit between the ‘working’ class and those who are collecting from them. And, it has been this way so long that people cannot fathom a world that is any different. When they are confronted with drastic change, well, you saw what happened in Athens – and is still going on despite the fact that the media has moved on to more pressing and important matters such as Nancy Grace’s newfound popularity.

The bottom line is that the Eurozone and America both need a massive attitude adjustment. 2008 didn’t even put a dent in the entitlement mentality in either locale. Imagine what it will take to change our way of thinking.

Rating Agency Competitive Downgrades

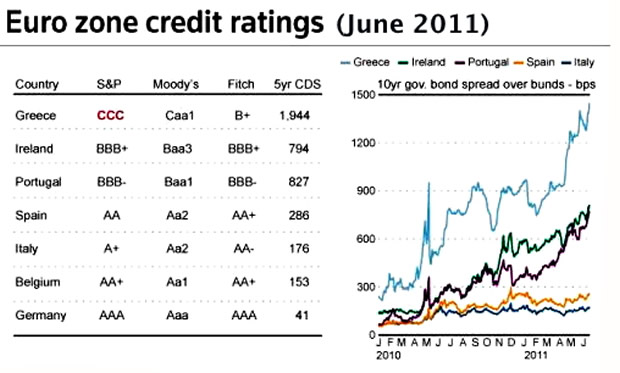

The final two bullet points likely fall under the broad category of financial and economic cannibalism. For years now, I’ve marveled both publicly and privately about the willingness of the major credit rating agencies to maintain the sterling debt rating of the USGovt despite a growing fiscal morass that is now only first being truly recognized. Let’s make the assumption that the people who run these agencies are not illiterate and actually know what is going on. Unfortunately, this logic has proven to be spot on as is evidenced by the constant beatings applied to Eurozone countries by the majors (S&P / Moody’s).

This strategy of competitive downgrades serves to exacerbate the debt issue at its core, pretty much guaranteeing that none of these countries will ever clear their debts. Of course that is the whole point. The current action dovetails rather well with John Perkins’ assertions in “Confessions of an Economic Hitman.” Keep in mind also that while all these downgrades on PIIGS sovereign debt have taken place, the USGovt has received only ‘stern’ warnings regarding its own fiscal black hole. Clearly Moody’s and S&P are in the business of protecting the status quo. We saw the depths of rating agency fraud beginning in the early part of 2008 when highly rated mortgage tranches suddenly came up lame. We will see this again, this time in USGovt Treasury bonds. The status quo will be protected, even if a company or two takes a dive in the process. Think Lehman Brothers.

Outrage from the Eurozone has intensified, particularly with yesterday’s severe downgrading of Portugal’s debt by Moody’s. The cut came as a newly elected government had just pushed through an ambitious austerity program. In the past year, Portugal has been cut from Aa2 (two steps below the rating of the USGovt) to Ba2, which is below investment grade and otherwise known as ‘junk’. This has all transpired despite the fact that Portugal has at least been trying to get its house in order. Meanwhile, Washington does zilch and maintains a top rating? These strategic hits on countries that are totally at the whim of the IMF and/or regional central banks reek of foul play. Calls for ‘more responsible behavior’ by Eurozone officials should be replaced with investigations into the ratings agencies themselves, given their duplicitous actions (and lack of action in some cases) regarding credit ratings.

It is also probably a reasonable assumption that both major ratings agencies and the raft of second-tier firms knew going in what was going to happen regarding the Eurozone. Much of the fallout follows the tenets of common sense. The endless bailouts are no different than our own broken system. Whether or not these bailouts are covered by the media is of no consequence. They’ve been going on for years and will continue to go on. The point is, shouldn’t the ratings have gone down sooner? There will be those that will argue that cutting ratings in 2008 or sooner would have precipitated the crisis in and of itself. This is probably precisely why the balloon hasn’t gone up yet on America’s bond ratings. However, it would appear that the ratings have been cut strategically to allow financial entities to game the system, hence my earlier comments regarding financial and economic cannibalism.

Similar to the yield curve, there is a ratings curve in the Eurozone, which creates a multitude of opportunities for trading profits. This goes back to the cardinal rule of large firm investing a la Jim Cramer: when there is no volatility, create some. And if you put a few countries into IMF receivership along the way, well that is just a cost of doing business, right?

Hedge Fund Bets

This probably qualifies as a corollary to my earlier point about parties gaming the system, but I think we need to expound on this just a little bit. My entire point here is that once again, the biggies are playing with fire. And they will get burned. Not maybe. Obviously there are no guarantees in life, but I’d say this one ranks up there with the sun coming up. It is going to happen. This is a continuing testimony to the greed involved in our society and financial system and precisely why I lobbied hard and spoke out against any bailouts in 2008. These people needed to go bankrupt. Instead they were allowed to compromise the financial system and with it, the economy. With the wounds barely healed, if they’ve healed at all, these same folks are right back at it again.

True to form, George Soros has had plenty to say about the Eurozone mess. Remember, he is the same fellow that said ‘I’m having a good crisis’ in 2009 while people were losing homes, jobs, and retirement savings. He added that it was the culmination of his life’s work. Oddly enough, the Daily Mail, which originally posted the story, has since pulled the offensive comments. He commented recently,

“We are on the verge of an economic collapse which starts, let’s say, in Greece, but it could easily spread,” billionaire investor George Soros said during a panel discussion in Vienna on June 26. “The financial system remains extremely vulnerable.”

The fact that the self-appointed master of the currency raid has pointed out the fragility of the financial system foreshadows directly to the near certainty that there will in fact be another crisis. Again to my earlier point, it is insanely profitable for a select few. Hedge funds are firmly betting on the extension of the Greek tragedy to the rest of the Eurozone, and some are even betting on the metastasis of the problem across the Atlantic as well.

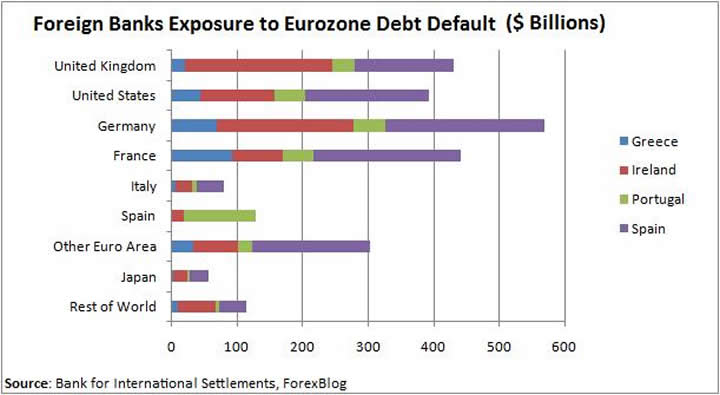

The major point to understand here is that there is no way to even quantify the risks associated with getting in on the sovereign debt mess. If you had 192 or so standalone countries, each with its own central bank like we used to have, it would be difficult enough just because of the propensity of banks and other financial actors to invest across borders. The idea of the regional currency and central bank was to curtail the risk inherent to the system, but instead, it has done the exact opposite because now there are so many actors gaming the system simultaneously. The idea of having a bunch of Dick Fulds operating on the razor’s edge with the global financial system on the line is a scary proposition. Sooner or later, someone is going to make a mistake and that is going to be it.

Once again, it will come down to the derivatives taking the paper empire to the woodshed. It isn’t even so much the millstone of the hundreds of billions in Eurozone debt that is spread all over the globe. There are bets on that debt, default swaps, options, and a full array of side bets on the debt itself, then bets on the side bets themselves and so on out to the 4th or 5th degree in many cases. The derivative issue was never even really addressed. It was the 800-pound elephant in 2008 and it is still standing there. Why? Because it is insanely profitable for a select few. Which comes back to my original point: we have a true moral crisis at the root of our economic and financial woes. None of the symptoms can be fixed until we get at the real causes and human nature is a tough nut to crack. See why I’m such a pessimist?

We have released a new complimentary report entitled “If You Have Paper Assets.. There are Three Things you MUST Consider”. It is a 10-page report that identifies some logical approaches you can take with regards to your paper investments if you’re one of the many people that still needs them to generate cash flow and income. Bear in mind this is in no way meant to supplant our firm position that each investor needs to have a sizable portion of their portfolio in physical precious metals, however, but is meant to augment the non-metals portion of your overall strategy. The report is available by clicking here.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.