Missing the August 2nd U.S. Debt Ceiling Deadline Still Not Likely

Stock-Markets / Financial Markets 2011 Jul 28, 2011 - 04:20 AM GMTBy: Chris_Ciovacco

After the market closed on July 27, we reviewed the latest news from Washington looking for information that can help us over the next six calendar days. Our current interpretation is that a deal will get done in some shape, form, or fashion.

After the market closed on July 27, we reviewed the latest news from Washington looking for information that can help us over the next six calendar days. Our current interpretation is that a deal will get done in some shape, form, or fashion.

A Bloomberg story noted that the credit markets are not overly concerned about the political banter in our nation’s capital:

Banks in the U.S. are scrutinizing credit-market movements as they look for distress ahead of next week’s deadline to raise the U.S. debt ceiling. So far, those metrics aren’t showing signs of panic.

“If the debt ceiling was such a problem, there’d be a lot more volatility in the credit markets,” said Leon Wagner, who co-founded GoldenTree Asset Management LP, a New York hedge fund focused on debt markets. “What we’re seeing is really just statistical bouncing around a normal trend line. That’s healthy in credit markets.”

Despite their public face of fighting with a singular focus for their constituents, important players in the debt saga are conceding that compromise is slowly coming into the process. From Reuters:

Senator Reid said he could easily modify his bill to incorporate elements of Boehner’s bill in a way that could win support from both parties in the Senate.

“There will be sufficient cooperation so a bill will pass that allows the debt limit to be lifted, with deficit reduction,” Democratic Senator Max Baucus said.

What about the concern that they are running out of time to get a bill passed by both chambers of Congress and signed by the President? The Associated Press reported:

Senator Reid was asked if there was a “drop-dead date” for a deal to pass the House, be amended by the Senate and reach President Barack Obama in time to avoid default.

“Magic things can happen here in Congress in a very short period of time under the right circumstances,” he said.

Amid all the heated rhetoric, it was easy to miss the fact that the differences between the sides actually seemed to be narrowing.

What happens if both bills fail to pass in both the Senate and House? The Wall Street Journal touched on this topic:

At the White House, officials anticipate that neither the Boehner nor Reid plans can get through both houses of Congress, and they are crafting alternatives that could be finalized over the weekend and put to a vote Monday or Tuesday.

We noted on July 27 that the impact of a debt downgrade may be less severe than many believe. The word on the street has been that Standard & Poor’s may downgrade U.S. debt even if one of the current bills becomes law. The Wall Street Journal reported that is not necessarily the current stance of Standard & Poor’s:

Deven Sharma, president of Standard & Poor’s, told a congressional committee the credit ratings agency does not think the United States will default on its debt. “Our analysts don’t believe they would,” he said.

Mr. Sharma said some of the proposed budget plans could help the U.S. bring debt and deficit levels within a range to maintain its AAA debt ratings.

Pressed by panel members on the prospects of a U.S. default, Mr. Sharma said a downgrade does not suggest a default is probable.

“If we change the ratings, it means that the risk levels have gone up, it doesn’t mean it’s going to default. If we believed that, they would change it to default status,” he said.

The New York Times had a similar report that discounted the inevitability of a ratings downgrade:

The president of another rating agency, Standard & Poor’s, also said that deficit-reduction plans currently being considered in Congress could be sufficient to allow the United States to keep its triple-A credit rating.

Deven Sharma, disavowed recent news reports that quoted an S.&P. analyst as saying that Congress would need to achieve at least $4 trillion in deficit cuts over 10 years to maintain the country’s triple-A rating.

Mr. Sharma told a House subcommittee that the $4 trillion figure was “within the threshold” of what the agency thinks is necessary. But he declined to draw a bright line, saying only that “some of the plans” being considered on Capitol Hill could reduce the U.S. debt burden to a level that was “in the range of the threshold of a triple-A rating.”

Shifting gears to stock market sentiment, which can be a contrary indicator when it reaches extremes, Tarquin Coe, a Senior Technical Analyst for “Investors Intelligence”, posted the following on Seeking Alpha:

Bottom line – the market has not yet reached the optimism evident at medium-term market tops. New 2011 highs for the big board indexes are yet to be registered and we see the potential for such records to be notched before the end of the summer. This week’s weakness is an opportunity to accumulate.

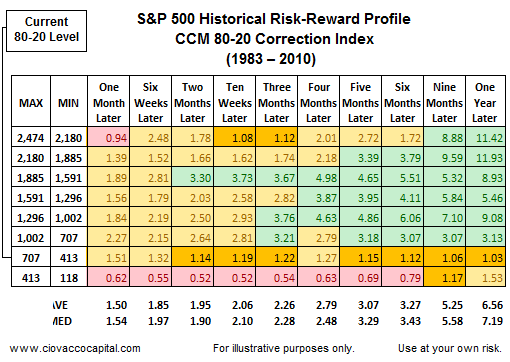

The CCM 80-20 Correction Index has weakened, but remains in bull market territory closing at 882 on July 27. Stocks have tended to regain their footing while within the current range. We could see some more downside in stocks and still remain in the current range.

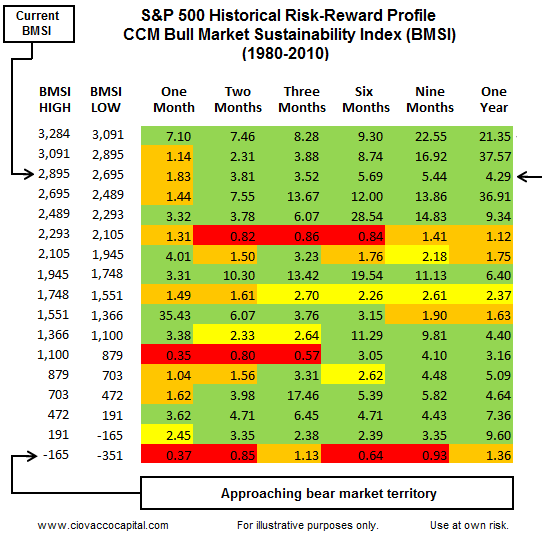

The CCM Bull Market Sustainability Index (BMSI) remains well in bull market territory, but there is quite a bit more orange, yellow, and red not too far below current levels. We would prefer to see the BMSI hold above 2,293; it closed at 2,843 on July 27.

We will maintain our exposure to stocks (SPY), gold (GLD) and silver (SLV) while keeping an eye on developments in Washington and the risk-reward profile of stocks and commodities. As noted after the close on July 27, we hope to see the weekly chart of the S&P 500 regain some traction in the next few trading sessions.

By Chris Ciovacco

Ciovacco Capital Management

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.