Sharp Increase in Central Bank Gold Reserves, South Korea Up 17-Fold, Thailand 15.5% in 2 Months

Commodities / Gold and Silver 2011 Aug 02, 2011 - 12:41 PM GMTBy: GoldCore

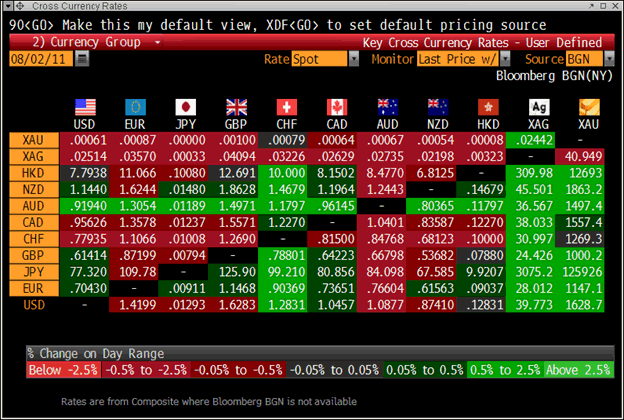

Gold is higher in all currencies today except for the Swiss franc and is trading at USD 1,629.20 , EUR 1,147.30 , GBP 1,000.20 and CHF 1,270.10 per ounce. Gold’s London AM fix was USD 1624.00, EUR 1145.28, GBP 997.30 (10:41 GMT).

Gold is higher in all currencies today except for the Swiss franc and is trading at USD 1,629.20 , EUR 1,147.30 , GBP 1,000.20 and CHF 1,270.10 per ounce. Gold’s London AM fix was USD 1624.00, EUR 1145.28, GBP 997.30 (10:41 GMT).

Gold reached new record nominal highs in euros and Canadian dollars yesterday at EUR 1,149.60/oz and CAD 1,566.48/oz yesterday and remains close to these record highs today, and close to record highs in most fiat currencies.

Cross Currency Rates

European indices are lower after Asian indices fell (Nikkei -1.2%, Sensex -1.1%, Shanghai -0.72%, Hang Seng -1.07, STI -1.25% and the South Korea’s Kospi was the worst performer falling 2.35%).

The Italian MIB is down another 0.9% and jitters abound about Italian banks and banking sector.

Gold in Euros – 30-Day (Tick)

Spanish and particularly Italian bonds are under pressure today with the Spanish 10-year rising to 6.37% and the Italian 10-year rising to 6.21%. Spain and Italy’s debt markets are beginning to look like Portugal and Ireland’s prior to their bond yields surged to over 10%.

Gold in GBP– 30-Day (Tick)

Further confirmation in the continuing stealth accumulation of bullion by central banks came overnight with confirmation that South Korea's central bank bought 25 tonnes of gold over the past two months. The gold is worth $1.24 billion and resulted in a 17-fold increase in their gold reserves.

Thailand’s gold reserves rose by 15.5% in the two months and rose to about 4.07 million ounces in June, from about 3.523 million ounces in May, according to figures on the Bank of Thailand’s website accessed by Bloomberg this morning.

South Korea is the world’s seventh-biggest foreign-exchange reserve holder and 64% of its reserves are in U.S. dollars. The bank said that it also holds euros and other assets and the move was about achieving diversification.

The BOK’s reserves, stored in London in the vaults of the Bank of England, increased 25 tonnes to 39.4 tonnes (from 14.4 tonnes) but remain meager when compared to the size of their foreign exchange reserves.

BOK's gold holdings, at today’s market prices, account for 0.7% of its reserves, up from 0.2% prior to the purchase.

The BOK reserves were at a record high of $311.03 billion at the end of July which puts this $1.25 billion gold purchase in perspective.

Their gold reserves and those of other Asian central banks, particularly the People’s Bank of China, remain meager when compared to those of western central banks and the U.S.

Earlier this year, Thailand, whose gold holdings account for only 2.9 percent of reserves, bought 9.3 tonnes of gold. Russia purchased 41.8 tonnes and Mexico bought 99.2 tonnes.

China is the world's sixth largest gold holder and the biggest among Asian banks with 1,054.1 tonnes, equivalent to just 1.6% of their massive currency reserves.

According to the World Gold Council, governments hold an average of 10 per cent of foreign exchange reserves in gold. Larger economies such as the US, France and Germany hold more than 50 per cent.

"As a real safe asset, gold helps us to cope effectively with changes in international financial market," said Jaehyun Joo of the Bank of Korea.

"We expect that gold would serve as a safety net for official foreign reserve and enhance the stability of the Bank Of Korea's foreign reserve management," Mr Joo added.

Mr Joo’s comments reflect the mindset of people and central bankers in Asia who realize gold’s store of value importance and are increasingly concerned about the euro, the dollar and the global financial and monetary system.

The “Asian put” continues to place a very stable floor under the gold market and means that gold is not seeing any meaningful correction.

This is likely to continue for the foreseeable future and means that investors would be advised to allocate to gold sooner rather than later as a meaningful price correction is unlikely.

Some weakness in gold may be seen if we experience another bout of misplaced ‘market euphoria’ and risk appetite once the debt deal is fully completed. However, this will likely be more short term weakness as the medium and long term fundamentals remain sound.

Smart money and official demand for gold remains robust as a very fragile global economic recovery, stubbornly high inflation in many countries and sovereign debt and contagion risks lead to diversification into gold.

For the latest news, commentary, infographics and videos on gold and financial markets follow us on Twitter

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.