UnHappy 40th Birthday for Fiat U.S. Dollar

Currencies / US Dollar Aug 15, 2011 - 03:56 AM GMTBy: Jeff_Berwick

August 15 marks the 40th birthday of the Federal Reserve Note as a completely fiat currency.

August 15 marks the 40th birthday of the Federal Reserve Note as a completely fiat currency.

On that date, on August 15, 1971, Richard Nixon commandeered the airwaves to announce the closing of the gold window. According to him, this was necessary to protect the US dollar from attacks from the "international money speculators'.

According to Nixon, the problems weren't caused by the debt and inflation produced by the military industrial complex and the fractional reserve banking system in the sixties in support of the Vietnam war and the expansion of American empire (following WWII). It was not that the so called "civil" war turned the concept of government upside down and empowered the Federal government, or the creation of the system of public debt by the Hamiltonians who believed that putting people in hock solidifies public support of their government. No, we didn't need to do away with the central bank, burdensome competition restricting regulation or the use of force in matters of money... and many of the same problems that are setting the streets in Athens on fire.

The problem, according to Nixon, wasn't that the US had been bankrupted again, this time by Lyndon B. Johnson's disastrous Vietnam War starting in 1965 and his welfare programs (War on Poverty).

No, none of these were the problem. What was the problem according to Nixon? It was the universal scapegoat used by all governments and central bankers: the speculators.

The reason Nixon was forced to close the gold window was that overspending on the wars and welfare programs left them with empty coffers and neither they nor Congress were willing, or able, to raise taxes to support an increasingly unpopular war. So, Johnson and then Nixon borrowed, and then spent, billions of dollars. In the process, they infused a huge amount of money into the economy, which led to serious inflation. It also led to a balance of trade problem in which the U.S. was importing far more than it was exporting. As a result, more and more US dollars came to be held outside the country.

To keep foreign countries from trading in their surplus dollars for gold, Nixon, in 1971, unilaterally decreed that, from now on, the U.S. would not exchange dollars for gold for anyone. It was the second de-facto default since the Federal Reserve was created.

The Slippery Slope

The first default, in 1933, set the US on a course for failure. By seizing real money (gold) and issuing currency only somewhat backed by that gold, the underpinnings of a free market economy had been seriously weakened. By 1971, again, this system, politically, was untenable. On August 15, 1971, the US underwent its second default and the countdown to the next default began, this time at a more accelerated pace.

Every chart pertaining to money or the price of things, whether they be commodities, houses or stocks, all changed on that date.

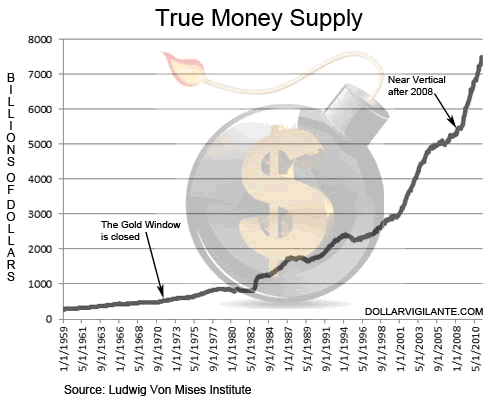

The money supply, unchained by anything, went from being on a mild incline to near vertical by 2008.

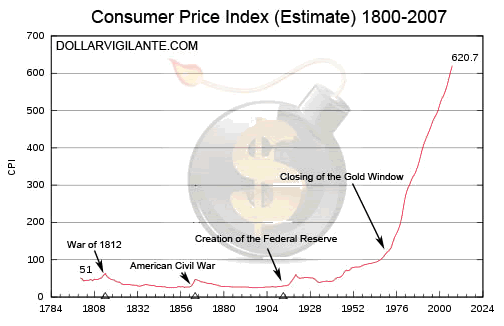

And, although the Consumer Price Index is not a good way to gauge the effects of monetary inflation on prices, it does provide some basis for understanding of its effects over the long term:

Again, after a century of declining prices the creation of the Federal Reserve began an uptick in prices by 1920 and after 1971, it went vertical.

Prices haven't skyrocketed since 1971 - not in real terms. Only in terms of the constantly depreciating dollar, a collapse that has only increased since its gold backing was removed.

Will the fiat dollar live to see 50? Highly unlikely - at least not in its current form. It will be lucky to see 42 at the rate it is going. So, enjoy your birthday while it lasts, dollar. Your fate, the same as every other unbacked fiat currency in history, draws near.

This evening we are releasing the August issue of TDV where we talk much more in depth about the coming collapse and strategies and info for how best to survive the coming storm. Subscribe today to become a part of our community of dollar crash survivors.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.