Subprime Housing Crash Gets Political - The Big Five Year Mortgage Rate Freeze Plan

Stock-Markets / Financial Markets Dec 08, 2007 - 09:23 AM GMT The blame game is beginning and fingers are now being pointed at political appointees (usually given their jobs because of massive donations). Roland Arnall, founder of Ameriquest and current Ambassador to the Netherlands is a rather prominent target. “ Indeed, a host of class-action suits have been launched over the last two years which accuse the former Ameriquest of having engaged in predatory practices (the company was sold this year after it settled one suit for $325m, without acknowledging wrongdoing). Some American lawyers and subprime borrowers are now threatening to turn their fire on Mr Arnall as well – notwithstanding his current job in the Hague.”

The blame game is beginning and fingers are now being pointed at political appointees (usually given their jobs because of massive donations). Roland Arnall, founder of Ameriquest and current Ambassador to the Netherlands is a rather prominent target. “ Indeed, a host of class-action suits have been launched over the last two years which accuse the former Ameriquest of having engaged in predatory practices (the company was sold this year after it settled one suit for $325m, without acknowledging wrongdoing). Some American lawyers and subprime borrowers are now threatening to turn their fire on Mr Arnall as well – notwithstanding his current job in the Hague.”

Henry Paulson has a long and winding road ahead.

Henry Paulson's credibility is at stake as a Secretary of the Treasury with financial industry smarts is crafting a market-driven response to the largest banking crisis in more than a decade. The objections to his plan are many, including the observation that many who signed on for low teaser rates cannot even hold on to their houses before the interest rates reset. And within minutes of the government's briefing Thursday, ratings agency Standard & Poor's - charged with its own share of complicity in the subprime mess - said that the plan to freeze mortgage reset rates for five years could lead to further downgrades to the securities they back. Not to mention that many pensions and insurance companies have not yet revealed their exposure to the subprime mess.

Now Paulson wants to share the pain with state and local governments who wish to perform rescues in their own housing markets. Any takers?

Consumers see no reason for improvement.

Consumer sentiment hasn't been this low since 1992, with the single exception of the month after Hurricane Katrina. “D ecember's consumer sentiment index hit 74.5, down from the prior month's reading of 76.1, according to the Reuters/University of Michigan survey. Wall Street economists had expected December sentiment to fall 75.0.” Ian Shepherdson, chief U.S. economist with High Frequency Economics Ltd., said the expectations level hitting Katrina levels is bad news. "Back then, sentiment rebounded quite quickly, but we can see no reason now for things to improve," Shepherdson wrote.

The market's ability to surprise is back.

Last week, the domestic indices completed a minimum retracement of their first leg down. That signalled the potential for another major decline to resume. It didn't. A possible reason? Despite the subprime debacle worsening, there were no new revelations this week to put investors on edge until today .

Last week, the domestic indices completed a minimum retracement of their first leg down. That signalled the potential for another major decline to resume. It didn't. A possible reason? Despite the subprime debacle worsening, there were no new revelations this week to put investors on edge until today .

It is well known that consumers account for as much as 70% of the U.S. economic growth. So the notion that somehow things will be worked out may not stand against today's revelation. The media attributes today's decline to profit taking ahead of Tuesday's Fed meeting. That may be so, but the S&P 500 has also hit a common retracement level for this rally. More excitement ahead?

Treasury Bonds are in reversal.

Yesterday's Treasury bond market closed below an important support for the rally yesterday. That means bonds are in full retreat for now. Bonds fell sharply again today, as the payroll numbers cast some doubt on how much the Fed will cut interest rates next week. The Labor Department added an estimated 94,000 new jobs in November, while revising the September and October statistics. Unfortunately, 51,000 of the new jobs were hypothetical jobs added by the CES Birth/Death Model . The unemployment rate remains at 4.7% because discouraged and part time workers are no longer counted as unemployed.

Yesterday's Treasury bond market closed below an important support for the rally yesterday. That means bonds are in full retreat for now. Bonds fell sharply again today, as the payroll numbers cast some doubt on how much the Fed will cut interest rates next week. The Labor Department added an estimated 94,000 new jobs in November, while revising the September and October statistics. Unfortunately, 51,000 of the new jobs were hypothetical jobs added by the CES Birth/Death Model . The unemployment rate remains at 4.7% because discouraged and part time workers are no longer counted as unemployed.

Can gold stay at $800?

Gold futures barely stayed above the $800 level, even though it took a beating earlier today from the payroll report. The precious metal was up this week on lackluster performance as investors are trying to cipher the direction of the next big move. The expectation of analysts is that gold will break higher after a period of consolidation. Right now I would say that the direction is anyone's guess.

Gold futures barely stayed above the $800 level, even though it took a beating earlier today from the payroll report. The precious metal was up this week on lackluster performance as investors are trying to cipher the direction of the next big move. The expectation of analysts is that gold will break higher after a period of consolidation. Right now I would say that the direction is anyone's guess.

Japan rallies, but not for long.

The Nikkei extended its rally this week, mirroring the U.S. markets. It finally clawed back to where it was one month ago. But there is limited room for more upside potential barring a strong recovery of the U.S. economy, Japan 's largest trading partner. The unfortunate question is not how strong, but how weak is the U.S. economy? We'll get more insight on that at the announcement following the next Fed meeting on Tuesday.

Do we hear bears growling in Shanghai ?

Being a bear on China has not brought anyone profits or fame in the past decade. The privatization of many industries has brought a transformation to China 's countryside, and its markets. However, what could be its greatest strength has become its weakness. The China Investment Fund, its $200 billion sovereign fund is still run by party hacks who place political expediency over profits. Instead of bringing China into the 21 st century, it is still trying to bury the last century's mistakes.

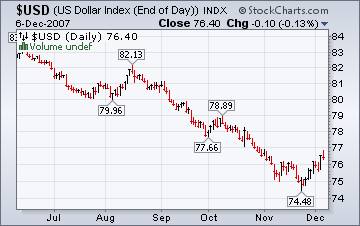

Houston , we have liftoff.

Today's Wall Street Journal Online reports on the Dollar dropping against the Euro based on today's employment report. The change was .1%, hardly a newsworthy event and barely attributable to anything like the employment report. But this supports the media bias that is slanted toward the previous trend long after it is over. The fact is, the downtrend is broken. There will be retests of the lows, but based on the length of the prior trend, the new one may last a while.

Today's Wall Street Journal Online reports on the Dollar dropping against the Euro based on today's employment report. The change was .1%, hardly a newsworthy event and barely attributable to anything like the employment report. But this supports the media bias that is slanted toward the previous trend long after it is over. The fact is, the downtrend is broken. There will be retests of the lows, but based on the length of the prior trend, the new one may last a while.

Will housing fall another 30%?

Moody's economy.com reports today that they see a drop in housing prices of another 30% or more before the crisis is over in 2010. The biggest problem is the growing inventory of unsold homes coupled with a weakening economy.

Just as China 's central planners are making all the wrong decisions on how to employ their wealth, Henry Paulson's proposal smacks of the same type of thinking. Trying to bury past mistakes only encourages the bad behavior that caused them in the first place. This is considered unfair to responsible borrowers.

No one is winning with higher gasoline prices.

The Energy Information's Weekly Report shows that domestic refiners' profit margins for the third quarter are 54% lower than they were a year ago. The U.S. average retail price for regular gasoline fell for the third consecutive week, losing 3.6 cents to settle at 306.1 cents per gallon as of December 3, 2007 , 76.4 cents above a year ago.

The Energy Information's Weekly Report shows that domestic refiners' profit margins for the third quarter are 54% lower than they were a year ago. The U.S. average retail price for regular gasoline fell for the third consecutive week, losing 3.6 cents to settle at 306.1 cents per gallon as of December 3, 2007 , 76.4 cents above a year ago.

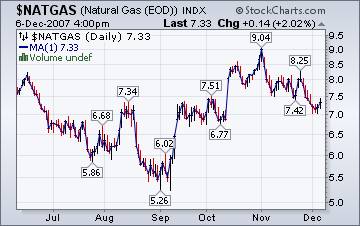

Winter's early arrival not a big deal.

The withdrawal rate of natural gas in storage was rose 45% higher than the 5-year averages, attributable to colder-than normal temperatures across the United States . Despite that, natural gas prices dropped in the last week. Meanwhile, alternate sources of natural gas are enjoying a comeback. Ever heard of gas from manure ? That's no B.S.

The withdrawal rate of natural gas in storage was rose 45% higher than the 5-year averages, attributable to colder-than normal temperatures across the United States . Despite that, natural gas prices dropped in the last week. Meanwhile, alternate sources of natural gas are enjoying a comeback. Ever heard of gas from manure ? That's no B.S.

The Mother of All Bad Ideas.

By Peter Schif f A “must read.” “Without question, the Bush administration's mortgage rescue plan will exacerbate, not alleviate, the problems in the housing market. As the plan will sharply reduce the ability of new buyers to make purchases, it really amounts to a stay of execution and not a pardon.”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. John may be gone this Friday, but Tim and I will attempt to give a summary of what we see in the markets. You may listen to our comments by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.