Credit Versus Equity The War Is Waged

Stock-Markets / Financial Markets 2011 Sep 11, 2011 - 06:52 AM GMTBy: Tony_Pallotta

Bull versus bear. Greed versus fear. Smart money versus dumb money. Depression versus transitory soft patch. Credit versus equity.

Bull versus bear. Greed versus fear. Smart money versus dumb money. Depression versus transitory soft patch. Credit versus equity.

In one corner is the credit market, a rather mighty opponent where $1 million defines an odd lot. Credit has spoken loudly. They have priced in a severe recession, depression whatever you want to call it.

In the other corner stands the equity market and although fierce is smaller than its opponent where 100 shares defines an odd lot (a mere $700 in the case of BAC). Also known as the contrarian equity has priced in a transitory soft patch, the opposite of credit.

Equity hopes to bounce back from a recent loss where they completely failed to price in the 2008 Great Recession. It was a horrible loss for equity as throughout the year they continued to try and price in economic growth only to be knocked back down by economic reality as GDP contracted larger with each passing quarter. Credit on the other hand has put together an amazing string of victories. They have priced in previous economic recession with the utmost precision.

We are now on the eve of yet another showdown. Both corners are far apart and yet only one can be proven correct. The other must accept defeat. The stakes are large and the reward to those on the right side even larger. History will be the judge and time is all it asks.

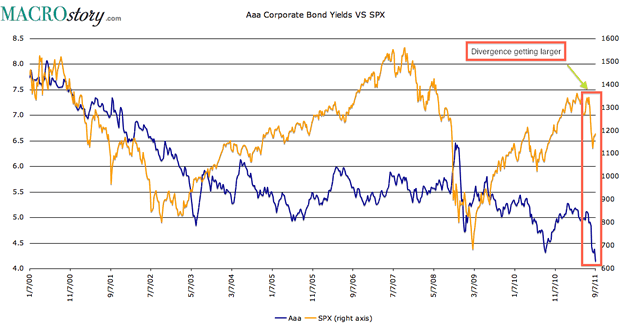

Aaa Corporate Bond Debt VS SPX - Yields are currently at multi year lows and moving lower each day. Meanwhile equity has begun turning higher. Equity markets would say Aaa rated debt should be yielding 6.5% whereas debt says the SPX fair value is 600.

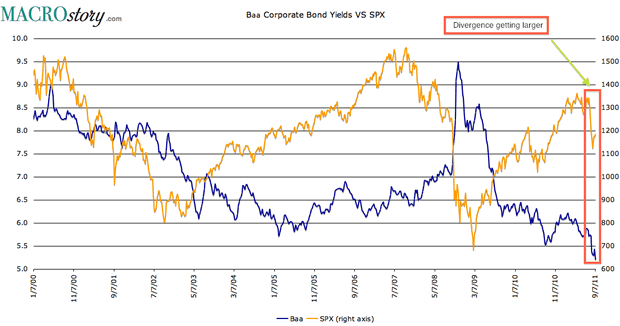

Baa Corporate Bond Debt - Similar to Aaa debt where rates are not only at decade lows but moving lower. Equity markets would say Baa rated debt should be yielding 8% whereas debt says SPX fair value is 600.

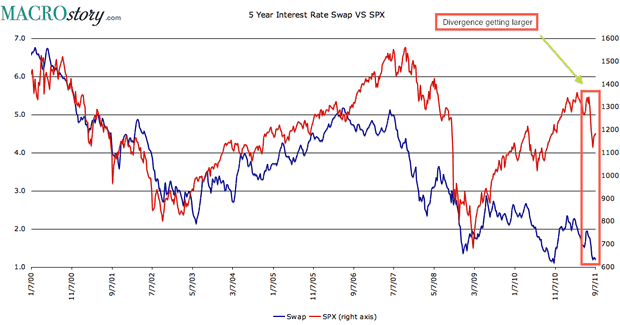

5 Year Interest Rate Swap Spreads - Similar to corporate debt not only is there a divergence but it is growing again.

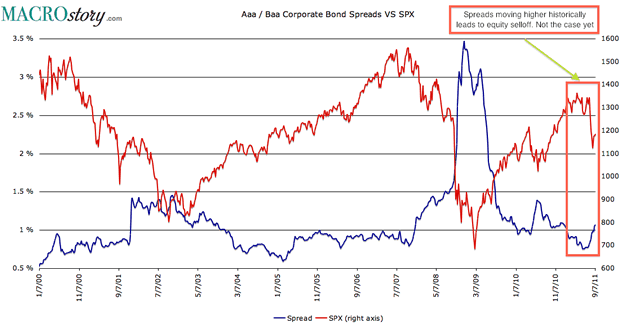

Corporate Bond Spreads (Aaa / Baa) - Spreads already at multi year lows have begun to turn higher as have equities contrary to their inverse relation. Considering the little room spreads have to move lower it would appear equities have it wrong here and going not only in the wrong direction but also a rather large gap to fill.

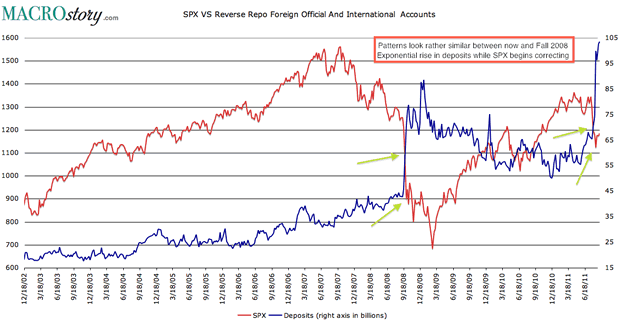

Foreign Reverse Repos

This is a chart that has been making the rounds of late. It shows the amount of reverse repurchase agreements among foreign official and international accounts. Notice the trend during this current exponential move higher in deposits versus that of September 2008. Additionally notice the eerily similar price action in equities during both times.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.