Stocks and Commodities May Get Hammered If U.S. Dollar Rallies

Stock-Markets / Financial Markets 2011 Sep 12, 2011 - 06:47 AM GMTBy: Chris_Ciovacco

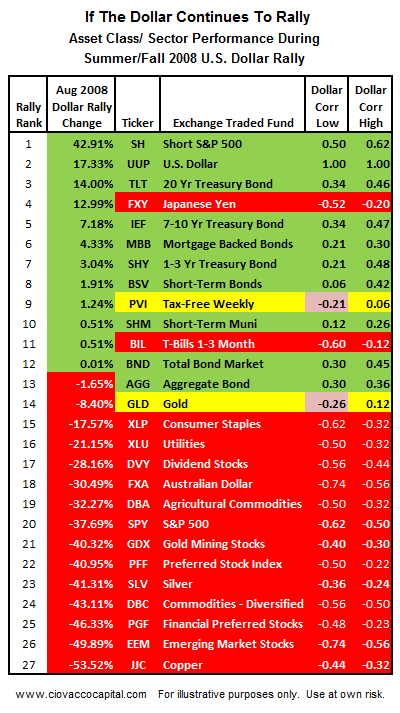

Saying an asset class may be “hammered” may seem like a colorful way to express an opinion, but the table below shows stocks and commodities were indeed hammered during a sharp U.S. dollar rally that occurred in the period August 2008 - November 2008.

Saying an asset class may be “hammered” may seem like a colorful way to express an opinion, but the table below shows stocks and commodities were indeed hammered during a sharp U.S. dollar rally that occurred in the period August 2008 - November 2008.

In the early stages of the last bear market, inflation-friendly assets, such as commodities (DBC) and emerging market stocks (EEM) held up relatively well as investors believed (a) the economy would avoid a recession, and/or (b) central bankers could create positive inflation via their printing presses. As the scope of the problems in the global financial system came to light, the markets shifted to a strong deflationary bias in the summer of 2008 as the U.S. Dollar Index spiked higher. The table below shows asset class/sector performance after the dollar flashed a deflationary signal in 2008.

The video below provides commentary on the table above, as well as ways to monitor the odds of continued strength in the dollar and weakness in stocks and commodities. The video explains inflationary and deflationary signals to look for in the Australian dollar (FXA) and agricultural commodities (DBA). Recent data on short positions leaves the door open to renewed selling pressure from hedge funds wanting to make bearish bets. The video is best viewed in full screen mode (use button lower right on video player).

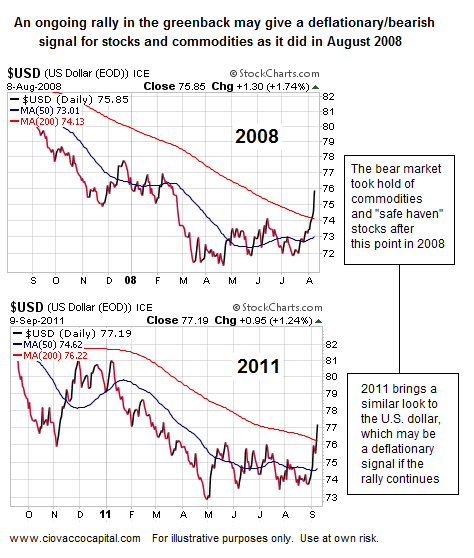

The charts below compare the look of the U.S. Dollar Index in August 2008 to the present day. From a fundamental perspective, how could the dollar possibly see a sharp rally? Unlike stocks, currency movements are all relative to other currencies. Roughly 60% of the movement in the U.S dollar is relative to the value of the euro. This week Moody’s is expected to downgrade several French banks, which may be the next nudge for the euro to move lower and the dollar to move higher.

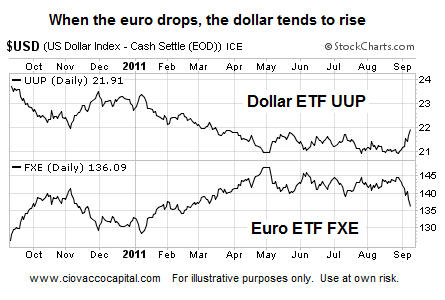

The negative correlation between the dollar and euro is easy to see in the charts below. Notice the euro broke out of a trading range in a bearish manner late last week as the markets began to sense the strong possibility of a default in Greece. If you are planning on the Fed killing the current dollar rally with ‘Operation Twist’, you may want to review these comments.

Bloomberg noted the term ‘bank run’ may be returning to a financial channel near you:

Nobel-prize winning economist Robert Mundell, whose research contributed to creation of the euro, said a Greek default would trigger a run on banks of “monstrous proportions.”

“This risk means that issues in Greece and the euro area are an international problem,” Mundell told reporters in Budapest today.

Th European Central Bank and the Federal Reserve should introduce a “very large” swap facility, in the range of $1 trillion, to tackle any potential dollar shortage, Mundell said.

As detailed in the video above, our bias this week will be to favor assets in green in the ETF performance table at the top of this article. If the euro takes another leg lower, the ‘big three’ ETFs may prove to be SH (S&P 500 short), UUP (U.S. Dollar), and TLT (Treasuries). We currently own all three and may add to our positions if the euro weakens and the S&P 500 closes below 1,146. As we noted on September 6, a logical case can be made for stocks to drop 49% from recent levels; nothing has changed yet to alter the bearish case. As always, we remain open to better than expected outcomes, but the bearish signals continue to pile up.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.