Germany Becomes an Appealing Investment

Stock-Markets / European Stock Markets Sep 13, 2011 - 10:33 AM GMTBy: Trader_Mark

While we've had a quite serious correction in domestic markets, Europe has been crushed the past few months - for obvious reason. As I was looking over the charts last night, it was stunning to see a country like Germany, the fourth largest economy in the world, mangled to the tune of a 33%+ loss in under two months. No matter the outcome of this crisis (and fact the Eurozone is probably headed for recession anew), this is a very dynamic economy which has probably melded the best parts of 'capitalism' and 'socialism' (I hate the labels) to create an export machine with a high standard of living.

I'd argue (frankly I don't see any solid counter argument) that these policies have created a much better recovery for 'Main Street' Germany than the 'recovery' in the U.S. the past few years. [May 13, 2011: German Economic 'Miracle' Continues as 5.2% GDP Growth Blasts Past U.S.] [Jan 13, 2011: Germany Puts Finishing Touches on Impressive 2010] [Oct 1, 2010: German Unemployment Rate Down to 7.2% after Peaking at 8.7%; Can We Learn Anything?] Of course Germany is being weighed down by the anchors in the region, but ironically as the euro finally gets hit, this will actually help their exports.

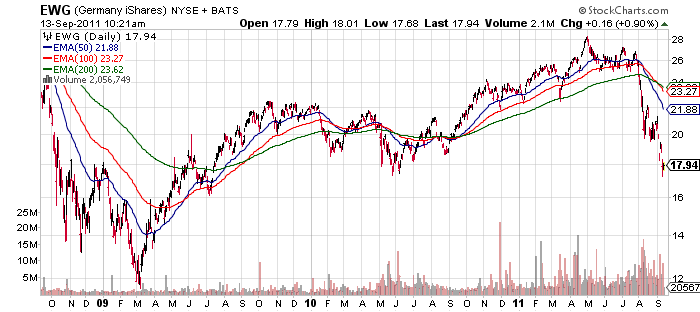

The DAX has now given back 2 years of gains, and now sits at levels last seen in summer 2009. Granted it could get 'worse', but at some point here this country full of multinationals (the elite standard in a globalized world), has to become a very appealing long term investment.

Here is the ETF for iShares Germany (EWG) - very top heavy with those multinationals; thankfully mostly industrial rather than 'financial':

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2011 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.