Did US Dollar Injection Alter the Dominent Crisis Market Trends?

Stock-Markets / Financial Markets 2011 Sep 16, 2011 - 01:50 AM GMTBy: Capital3X

This is part of the premium analysis for Captial3x subscribers. It was a tough trading day across desks as SNB/ECB combine once again caught almost every trader that I know off, napping by “injecting USD liquidity”. This is the second time SNB has found itself leading an operation involving non conventional methods and therefore reflects an increasing ability to preempt crisis. Left to the markets, dollar scarcity would have result the exact of not worse situation seen in 2008. Dollar liquidity was the first step in calming the markets but we need to understand how long will this last as Central banks do not have infinite resources. While there are many who will be increasingly vocal about the ethos of providing such operation instead of letting institutions/countries to fail, we disagree and believe if there is a problem we need to first treat the pain and then go to treat the real problem. If one has headache we do not think of cutting the head off, do we? Therefore CBs are in their right to deploy such measures if they see pain in the markets.

This is part of the premium analysis for Captial3x subscribers. It was a tough trading day across desks as SNB/ECB combine once again caught almost every trader that I know off, napping by “injecting USD liquidity”. This is the second time SNB has found itself leading an operation involving non conventional methods and therefore reflects an increasing ability to preempt crisis. Left to the markets, dollar scarcity would have result the exact of not worse situation seen in 2008. Dollar liquidity was the first step in calming the markets but we need to understand how long will this last as Central banks do not have infinite resources. While there are many who will be increasingly vocal about the ethos of providing such operation instead of letting institutions/countries to fail, we disagree and believe if there is a problem we need to first treat the pain and then go to treat the real problem. If one has headache we do not think of cutting the head off, do we? Therefore CBs are in their right to deploy such measures if they see pain in the markets.

Key Summary from yesterday operation:

The European Central Bank said on Thursday it would hold three fixed-rate operations between October and December to provide banks as many dollars as they needed, in order to ease any funding crunch over the year-end.

In addition: The British and Swiss central banks said they would conduct three-month dollar lending operations simultaneously with the ECB on Oct. 12, Nov. 9 and Dec. 7. The Bank of Japan, which already holds three-month dollar tenders, will add one on Oct.

18.The ECB already offers seven-day dollar loans every week. Two unidentified banks tapped this funding on Wednesday, borrowing a total of $575 million. It was the second time in a month that the facility was used; previously, it had not been tapped since February. Bank of France Governor Christian Noyer said this year’s three-month dollar operations would buy European banks time as they adjusted their dollar business, which he said was necessary because U.S. money market funds were “withdrawing from Europe”. A key warning of the things to come as US funds withdrew.

Did it really work?

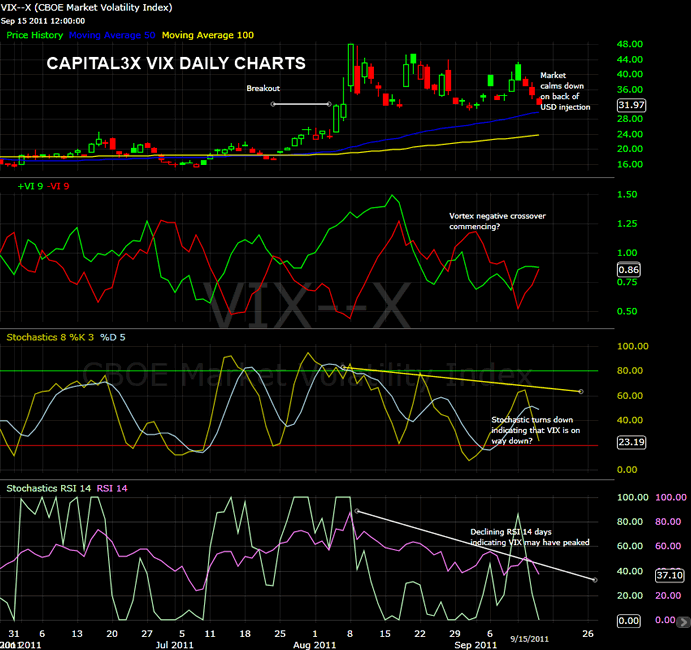

The VIX charts (daily) indicates that markets have calmed to a great extent.

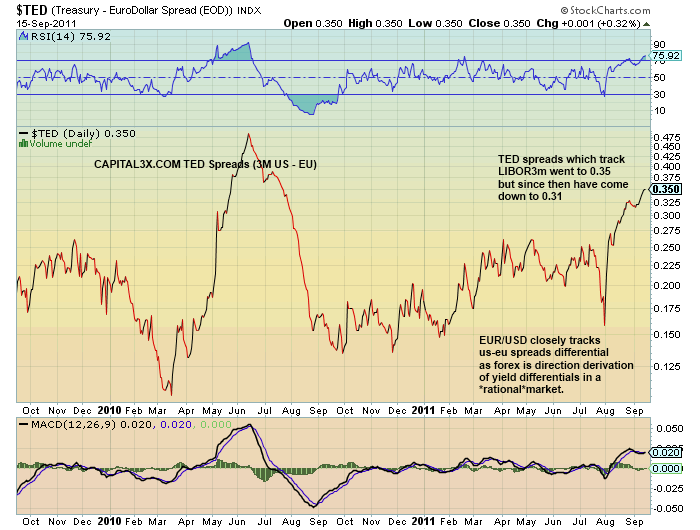

The TED spreads (tracking $LIBOR3m given that US yields are set to 0-0.25%) had risen to 0.35 but since the SNB intervention have dropped to 0.31 and thus reducing the crunch in the market.

Heightening credit crunch and market fear is first reflected in yield differential as flight to quality increases dollar demand and hence increasing dollar funding costs.

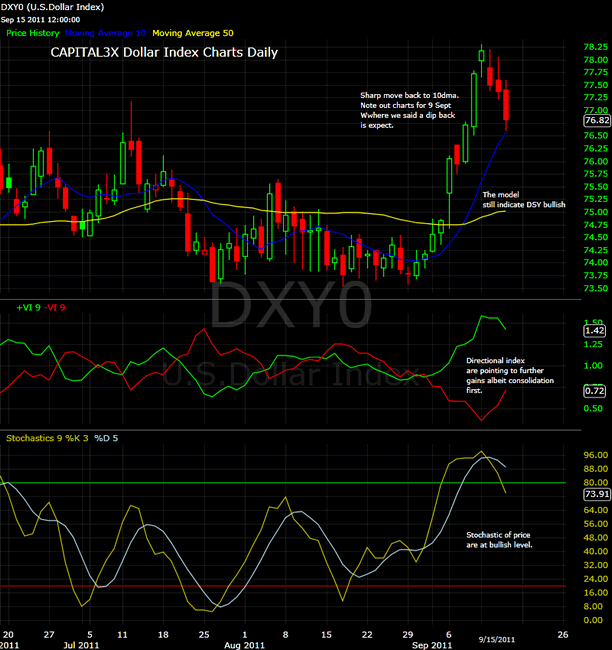

The dollar index dipped back towards to the 10 DMA(as warned by us on 9 Sept charts that the dollar index may dip back to test the breakout).

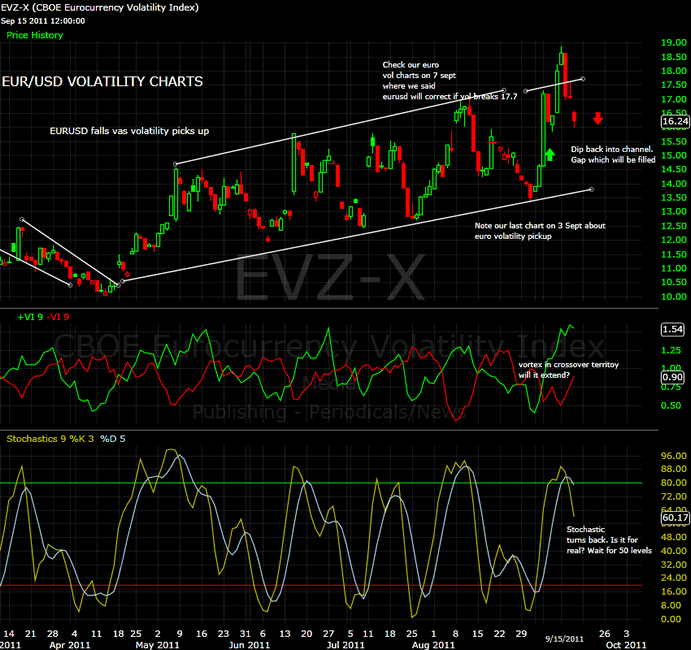

The EUR/USD 3 Month CBOE Volatility index dipped back into the uptrend.

The eurdollar volatility index broke back into the uptrend with *gap*. Gaps area lways filled and therefore expect another attempt at the 17.5 levels on the charts which will correspond with the EUR.USD making another attempt at 1.37 levels. If they hold, we can almost be sure that the dollar injection efforts by the global central banks have been successful and we should see neutralization of the downtrend.

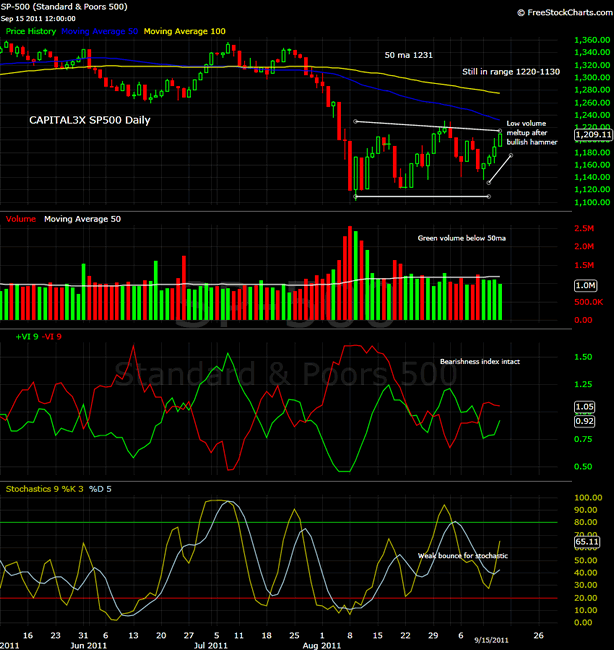

The equity markets reacted with sharp moves as the S&P tore through 100 WMA at 1189 but we need to see Friday close before we can make an honest assessment of the medium term trend.

While SP500 gets pulled toward 50ma at 1231, we need further confirmation of an uptrend in the medium term. Green volumes continue to be below 50 ma levels, while 9day Stochastic have rebounded. The vortex indicator have not budged from the negative crossover levels. Combined with VIX index charts and euro volatility charts, we need more confirmation of the price action before we can call an end to the medium term downtrend. We expect 1220-1230 to hold before a another wave of strong selling which will be line with our thoughts on the dollar index dipping back and then rebounding from 10ma at 76.5 (exact replica of 2008 when index dipped back initially on announcement of swap lines before a wave of dollar crunch overwhelmed markets in October 2008, November 2008. Central banks know the implication and are desperately trying to avoid the situation.

If you are not yet a premium subscriber you can do so now and be updated of trend and pattern analysis charts and daily and medium term trade portfolio. Premium Subscription.

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.