Why This Popular Investment Strategy Will Not Save Your Portfolio

Stock-Markets / Financial Markets 2011 Sep 17, 2011 - 12:23 PM GMTBy: EWI

So what is this popular investment approach?

So what is this popular investment approach?

You've heard the answer before: Diversification.

You probably know that the purpose of diversification is to spread risk across asset classes. The assumption is that if one asset goes down, the others will be stable or perhaps even move up.

But what if we're in a time when an "all the same market" scenario is unfolding in the financial world? What if the following description proves accurate:

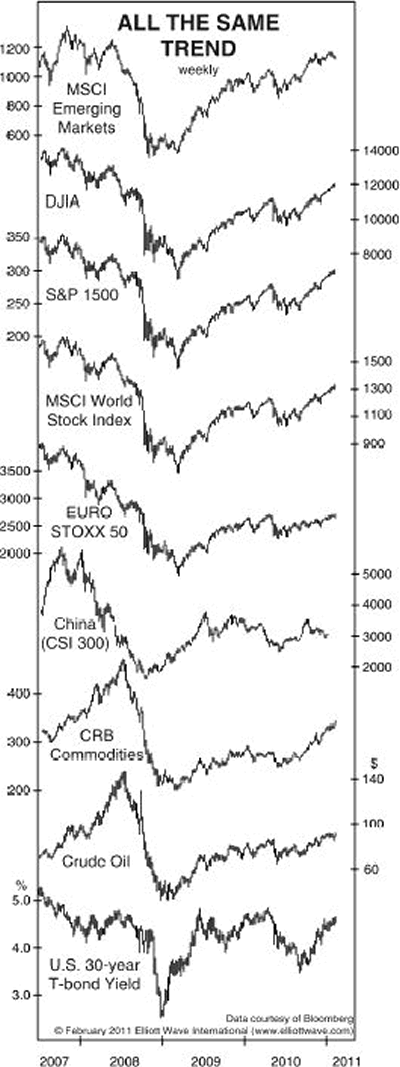

"In recent years the financial markets have turned roughly together. Although to date they have not topped and bottomed on precisely the same day or even the same month (that would be too easy), their correspondence is getting tighter and tighter." ~ Elliott Wave Theorist, May 2011

Please take a look at the chart below.

As noted in the quote above, not all financial markets are trending together exactly. Yet the chart speaks for itself: the correlation is becoming increasingly visible.

In the stocks category alone, diversifying between sectors can leave your portfolio beaten and tattered:

"More than ever on record, individual stocks in the Standard & Poor's 500 Index are moving in unison...

"'It's not just stocks. It's actually all asset classes,' said [Andrew] Lo, who is...the chairman and chief investment strategist of a hedge fund. 'The U.S. dollar relative to other currencies, gold, oil and hedge fund returns have now all become very highly correlated.'" ~ Huffingtonpost, (8/24)

No other investment approach has been more widely preached than "diversification." It's important to dispel the myth of diversification -- especially now.

Let me introduce you to a free report called "Death to Diversification: What It Means to Your Investment Strategy."

This publication's ten sections are packed with uncommon analysis which tells the truth about the too-common advice to diversify your investments. Moreover, the written analysis is accompanied by 18 fact-based charts.

You can instantly access your free report after joining Club EWI.

Club EWI is the world's largest Elliott Wave Community with more than 325,000 members. It's free to join with no strings attached

We look forward to welcoming you as a Club EWI member. "Death to Diversification: What It Means to Your Investment Strategy" can be on your computer screen in moments as you follow this link >>

This article was syndicated by Elliott Wave International and was originally published under the headline Why This Popular Investment Strategy Will Not Save Your Portfolio. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.