Has the FED Lost Control of Long End of the Yield Curve? We think so!

Interest-Rates / US Bonds Sep 21, 2011 - 08:13 AM GMTBy: Capital3X

There is nothing more scary for the FED than to look at the 30 year yield sticky and stubborn. The only reason why FED would need to do a QE is to take control of 30 year yield. The short end is near zero and there is very little that can be done at this end. The 20/30 year yield now is where the absolute need if for a QE. The problem now is not whether the QE is of few billions or more. The FED has no option but to do: QE ad infinitum.

There is nothing more scary for the FED than to look at the 30 year yield sticky and stubborn. The only reason why FED would need to do a QE is to take control of 30 year yield. The short end is near zero and there is very little that can be done at this end. The 20/30 year yield now is where the absolute need if for a QE. The problem now is not whether the QE is of few billions or more. The FED has no option but to do: QE ad infinitum.

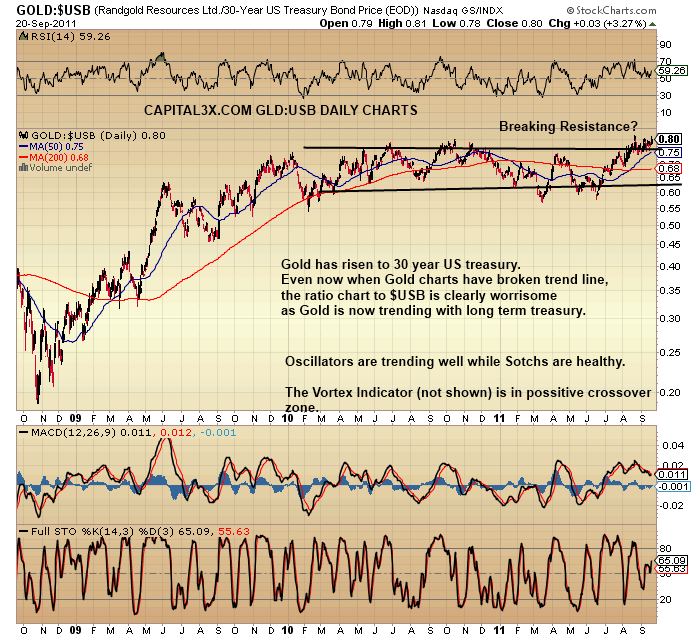

The GOLD:USB ration charts with 30 YEAR US treasury has been leading the way as Gold has been trending up since the last 18 months.

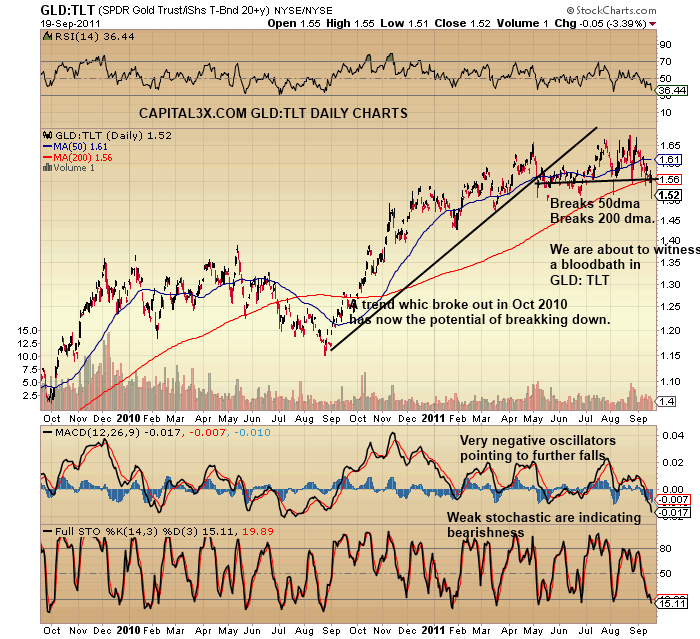

When you combine this chart with the Gold ratio with UST for 10 year, we get a remarkable chart where Gold:TLT is now at breaking point implying that TLT is about to have mad rush of race while Gold may plunge. Given the diametrically opposite charts, we believe that FED may continue with 10 year purchase.

In order for the Fed to keep long-term rates at a target rate they would need to target that rate explicitly and be willing to bid at that level no matter what. We are not yet sure that FED is ready to involve in such an issuance given the implications of sheer media bashing that may happen and the increasing call to prosecute the FED.

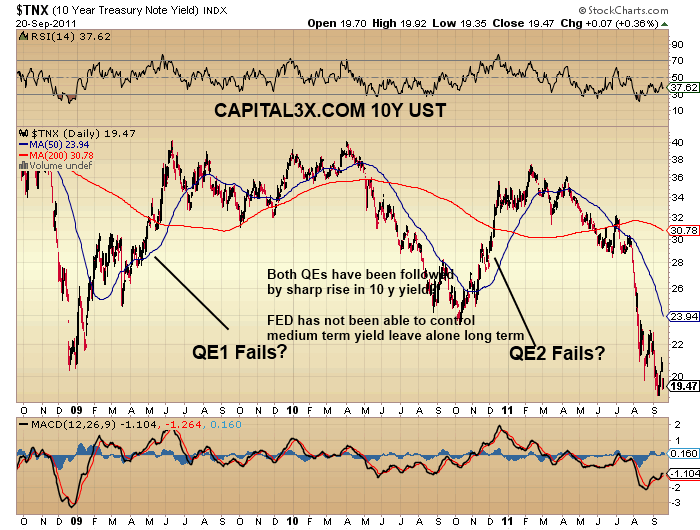

The 10 Y US Treasury will show us the reasons for our skepticism on FED ability to control long term and medium term yield. The crisis of 2008 was a mere consequence of rising yield in 10Y/20Y/30Y as US banks, leveraged to the hilt went bankrupt.

The FED then decided to take control of the US Treasury yield and unfortunately has not been able to reign in the medium/long term yield.

This is scary and once the initial euphoria of QE dies down (As and when it happens in Oct or Nov), we are sure that there is a watershed moment coming for bond markets world over and the focus of that will not be Greece defaulting but US bond markets.

If you are not yet a premium subscriber you can do so now and be updated of trend and pattern analysis charts and daily and medium term trade portfolio. Premium Subscription.

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.