Technical Analysis of Stocks, Currencies, Bonds and Gold

Stock-Markets / Financial Markets 2011 Oct 17, 2011 - 03:06 AM GMT -- When I last discussed the VIX two weeks ago, I had mentioned that the VIX was getting quite a bit of attention in the popular media. I should have suspected that it was the "kiss of death" for the continuation of the rally at that time. Although the formation appeared to be ready for an upside breakout, it was due for a Master Cycle low, first. It now appears that the low may be in, or nearly so. The VIX cycle turn date occurred on Saturday, so I am allowing one more trading day for the turn to happen.

-- When I last discussed the VIX two weeks ago, I had mentioned that the VIX was getting quite a bit of attention in the popular media. I should have suspected that it was the "kiss of death" for the continuation of the rally at that time. Although the formation appeared to be ready for an upside breakout, it was due for a Master Cycle low, first. It now appears that the low may be in, or nearly so. The VIX cycle turn date occurred on Saturday, so I am allowing one more trading day for the turn to happen.

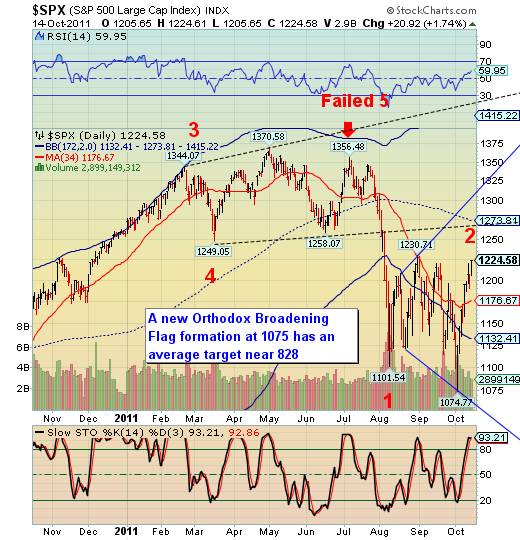

-- Broadening formations often appear capricious and maddening in their design, but the outcome is very predictable once the pattern is complete. They are pre-crash formations. The first Broadening Wedge formation (March through July) anticipated a 20% drop in the SPX. This new formation, known as an Orthodox Broadening formation, anticipates a decline over 30%. Monday, October 17 is the next cyclical turn date for the SPX. This decline may be complete in less than three weeks.

Zero Hedge correctly identified this nine-day rally as a low volume short squeeze. This weekend a follow-up article describes how this algo-driven short squeeze was engineered. The explanation for the “surge in the past 9 days is not driven by any latent "optimism" that Europe will fix itself, but simply due to the previously discussed wholesale asset liquidations (as none other than the FT already noted), which on the margin are explicitly EUR positive due to FX repatriation, courtesy of the post-sale conversion of USDs to EURs.”

-- From a technical view the Euro was due for a bounce by early October. In early September it violated violated its first

violated its Head and Shoulders neckline, but fell short of its target of 128.60.

The new impulse low at 131.64 may be the locus of a new Head and Shoulders neckline with a much lower target at 113.88. It appears that the prior neckline at 139.00 may provide resistance for this rally.

You can see that there is a very high correlation between the Euro and the SPX since early May. This coupling of the Euro and the SPX will likely continue for the next six months or more.

-- The dollar has completed a 46.6% retracement from its first impulse high off the May 4 low of 72.70 72.70

72.70. The retracement appears complete, although it may search for the bottom at 76.27, its 50% retracement. Friday happens to be a cycle turn date, so there'll be no surprises if the dollar resumes its upward trend on Monday.

-- Gold may have made its cycle high and a 41% retracement high last Wednesday, October 12. If so, it appears ready to decline through the lower half of its cyclical trading range and possibly hit its Orthodox Broadening Top target of 1230.00 in the process. The cycle pattern suggests that the next significant turn date will be at the end of October. Whether it reaches its target by then remains to be seen.

The cycles suggest a significant low for gold in 2012. If it can remain above 750 at its 2012 low, the secular uptrend in gold may continue. However, should a decline below 750, there may be yet another four years of decline in gold.

-- By all appearances, USB may have completed an impulsive rally from its February low. So far, however, both the declining pattern and the cycle do not appear to be complete, leaving USB in no man's land. Should the rally resumed while stocks decline we may see a parabolic blowoff in bonds. On the other hand, should USB immediately join equities in their decline, we may see an end to a 30 year uptrend in bonds.

The cyclical picture suggests, but does not require, approximately 2 more months in this secular uptrend. I remain cautious that the trend in bonds is due for a change.

--West Texas Crude has made a new Head and Shoulders pattern that lends meaning to the phrase, "When it first you don't succeed try, try again." I find it amusing that the second Head and Shoulders pattern has a target almost identical to the first. If the Head and Shoulders pattern holds, crude may be about to finish its rally and begin the next "crash phase" down in the next day or so.

Those of you following my work may remember that the initial Broadening Wedge formation anticipated a possible low near 74.00. The August low was a near miss. The new broadening flag formation anticipates a low near 57.75. I would not ignore that warning.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.