Realpolitik

Stock-Markets / Financial Markets 2011 Oct 19, 2011 - 05:02 AM GMTBy: HRA_Advisory

Go Angela!

Go Angela!

More mayhem, debt downgrades and a bank failure in Europe finally concentrated the minds of EU politicians, something the market has been waiting a year for. German Chancellor Merkel and French President Sarkozy are promising a plan for bank recapitalization. If we get one and it makes sense then we should see further gains.

It's too early to say with assurance that the bottom is in until the EU delivers but it's time to be looking hard at undervalued stocks on the list. Economic stats have also largely cooperated. Barring another policy error it doesn't look like there is a recession in the cards near term.

All that said, the technical damage to many stocks has been serious and we're heading into tax loss season. Stick with names that have resources in the ground they are growing. They should react best and see less tax loss selling. Earlier stage companies will find loss selling harder to avoid unless they are delivering good news and promising more to come. Others should be waited on to see if better prices are available in November.

If you're not comfortable yet, early November is worth waiting for. If the EU delivers a weak plan for the banks there could still be another pullback.

The rollercoaster ride continues as markets gyrate daily based on rumour and innuendo. This is going to continue until there is some sort of formal agreement between EU members, and palpable action by the core countries.

While the Greek situation still makes headlines, Greece itself is no longer the core issue. This has always been about debt write offs and the impact they would have on the European, and by extension, world financial system. We're not saying that Greece is not the cause (or today's version at least) of the problems. But it's also a symptom of broader political sclerosis that has kept cures from being implemented.

When the world teetered on the financial chaos three years ago, Europe and the US took different approaches to the problem. In the US, enormous sums of money were thrown at the problem. Many think too much money was expended on the issue and that "bankers" didn't deserve the help. Perhaps, but it was the right approach. Major liquidity crises need major liquidity to quell them. When the markets doubt the solvency of financial institutions and depositors start lining up to take their money out it's not the time for half measures.

The US went for financial shock and awe. The numbers were enormous both in terms of guarantees to underwrite potential losses and direct investments in failing companies to keep them afloat.

There is still debate over those measures but few disagree they were necessary at the time. The world's financial system very nearly collapsed. Lehman was a test case and the market's response was a total vaporization of liquidity and a frozen interbank lending system. No one thinks the solution was perfect, but the list of US based banks traders are worried about now is not long.

Europeans had their own problems at the time. Some were dealt with and the ECB also undertook major liquidity operations but the EU went much easier on the banks than the US and other jurisdictions. Discomfort with expending more money than absolutely necessary on what was viewed as an American problem meant solutions were minimalist.

That is what is coming back to haunt the markets now. Like the US, the EU ran stress tests on its major banks, but few outside the bureaucracy took those tests seriously. The number of banks judged failures and the capital additions required were suspiciously low. The tests did not include a sovereign default as a possible scenario, even though four EU member countries are on fiscal life support. The tests were viewed as a PR exercise that failed woefully.

That fact was brought home when Dexia, a French-Belgian municipal bank, saw its credit lines dry up and had to be rescued. Dexia was "rescued" in 2008 too, and judged to have adequate capital, if only barely. The market and other banks thought differently.

Dexia is now being broken up and nationalized but its demise may be a blessing in disguise. We're not sure its failure qualifies as a "Lehman moment" but it definitely made the stakes clear for a large number of European politicians.

Market pressure has led to emergency meetings between the leaders of France and Germany which culminated with pledges that a plan to recapitalize Europe's banks would be in place by month end. Signs of some decisiveness have cheered the markets but this isn't over yet.

Most major decisions and new initiatives at the EU level require backing by all 17 voting members. Simple or even super majorities are not enough. This system was designed to comfort smaller member countries that feared larger core countries would dominate the agenda. Admirable perhaps, but many would say unrealistic since the larger countries that foot most of the bill will always be the most important decision makers.

The drawback of this system is highlighted by the machinations involved in trying to create the European Financial Stability Facility (EFSF). Creating the fund involves pro rata financial contributions from member countries based on their size. That in turn requires a legislative vote to approve the contribution.

Sixteen counties voted for the EFSF. The last vote was held in Slovakia and the first vote went against the ESFS. In truth, the vote wasn't really about the stability fund by the time it was made. The first ESFS vote was appended to a non-confidence motion on the assumption this would get the vote through. This gave one of the minority parties in the ruling coalition an opportunity to bring down the government which it proceeded to do. Coalition members are still tussling over terms of a vote that would pass the EFSF as this is written.

Slovakia is the second poorest nation in the EU, accounting for 0.5% of the Eurozone's GDP. Its contribution to the ESFS will be nominal. Whatever the reasons for its no vote, letting decisions on something as serious as a banking crisis be hijacked points to the EU's major weakness. Giving everyone a vote is laudable but Europe needs some realpolitik. Those paying the bills need to be able to make their decisions stick.

The markets took the Slovakian vote with surprising equanimity. This reflects the comfort markets are getting from renewed seriousness and focus on bank solvency by France and Germany. Recent comments by Sarkozy and Merkel indicate they will hammer out a plan for bank recapitalization before next month's G20 meeting.

Germany wants to see capital infusions come first from investors, then the bank's home country if necessary and the EFSF only as a last resort. This seems like the right order, though its likely to be tough to get investors to step up at this point. The plan being devised may also include recommendations to start talking about tighter integration of the EU financial system. Many counties are still unsure about this but some sort of central agency is clearly needed. The current system simply can't react quickly or forcefully enough during a crisis.

Things could still go wrong, but the markets have reacted positively to recent announcements. The EU has a history of big promises followed by small actions. That pattern will have to be broken this time. Stickhandling recapitalization of multiple banks in different jurisdictions won't be easy but it can be done.

It has to be done so that the EU can follow through with a Greek default. It will be a managed default. Capital injections for banks will be the carrot; enforced larger write-downs of Greek debt will be the stick. The EU may try and stall this too but it's inevitable. The market has already priced this in assuming a much larger write down for bondholders than the 21% agreed to in July. As long as the EU acts forcefully enough to prevent contagion the effects of a default should not be major negative event. Everyone knows it's coming.

While Europe was going through this drama, the US was setting up for another season of political inertia. The Jobs Bill has been voted down and the wrangling will begin again. It's very possible there will be no substantive action on anything for the next year in Washington. The market would not be pleased if Democrats and Republican can't at least agree on budget cuts.

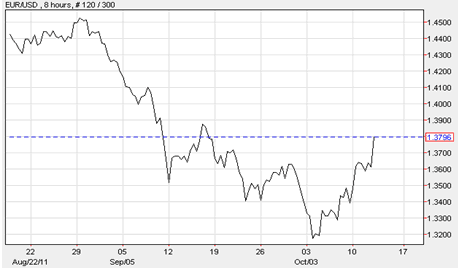

The chart above depicts the value of the Euro in UD Dollar terms for the past two months. The twists and turns in the political drama are obvious on the chart. As Greek default looked increasingly likely and the EU response weak the Euro fell by close to 10% during the month of September. The move was magnified by flight to safety trades that moved money into US Treasuries.

Since Europe's core countries acknowledged the depth of the problems and started working on the bank recapitalizations everyone wants the Euro has been climbing at an impressive rate. Its moved up close to 5% against the $US in the past two weeks and is still climbing as this is written. The Euro/$US exchange rates is one of the most direct measures of the fear levels in the markets

Metal Markets

The Euro chart on the previous page goes a long way in explaining the gyrations in the gold price in the past month. The fear trade generated both profit taking and margin calls across all markets and precious metals were not exempted.

When markets fall hard and the margin calls go out traders usually sell their winners first and hope for the best with losers. As a winning trade, gold and silver were obvious choices for selling. The downshift was exacerbated by increases in margin requirements of 21% for gold and 16% for silver put in place by Comex. That would have simply made the selling decision that much easier.

The fear trade also saw the return of the Dollar Bulls, but we suspect their day in the sun will be brief. With high odds of legislative gridlock in the US and continued slow growth the Dollar should move back to its recent trading range as long as the EU continues to advance solutions to its debt crisis.

Copper and other base metals saw even more dramatic price falls. The red metal dropped 30% in the space of a few weeks, returning to price levels last seen in early 2010.

We were not surprised the copper price fell; we've been predicting for months that such a move was coming. Even so, the speed of the move was impressive. To us, that implied there were some significant speculative positions being unwound. Margin requirements were also increased for copper which would have sped the selling.

Most base metals appear have found price bases as equities rise. Copper inventories in both London and Shanghai have been falling. The drop isn't dramatic yet but this is the pattern you want to see when looking for a price bottom. We don't know if this is end users consuming copper or buyers stockpiling it for later but it's still a good sign.

Bulk and agricultural minerals are still holding up well Iron ore has seen its price drop a few percent and potash is maintaining the price increases from the summer. Base and bulk mineral prices are all about China. Recent data show a flat manufacturing sector and shrinking trade surpluses. Beijing has kept monetary conditions tight all year to quell its growing inflate on rate. Inflation may have peaked but hasn't fallen back much. China isn't likely to loosen monetary conditions until it falls further.

Outlook

Virtually all of the world's major bourses fell into bear market territory before the recent bounce. Traders are discounting a recession in most regions.

Although analysts have predicted each month's data would be worse than the last, that hasn't been the case yet. While weak, Purchasing Managers Indices in most of the G8 were better than predicted this month. They are still at levels that imply continued growth, if only barely.

Likewise, retail sales in most regions continued to be positive. September retail sales in the US beat expectations by a wide margin and the formerly flat August number was revised upward. Employment growth in the US exceeded low expectations and the prior two month's numbers were also revised upwards. Current economic readings imply growth near 2% for Q3, higher than recent predictions.

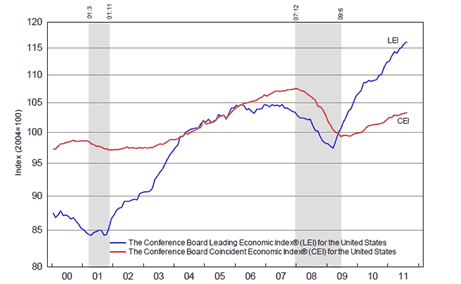

The chart above shows the Conference Board's Leading (blue) and Coincident (red) economic indicators going back 10 years. The Coincident indicator continues to move up as does the Leading. This measure isn't perfect but it does indicate conditions are still expansionary. The Leading Indicator doesn't mean there can't be or won't be a recession but it's not showing in the data yet.

Earnings season is upon us again. Early reports will be dominated by the financial sector and most of those won't be great. Overall however, growth in earnings of 10%+ is still expected. This could help markets continue to heal -- if Eurozone politicians get the job done right this time.

The situation is still shaky but things look far better than they did last month.

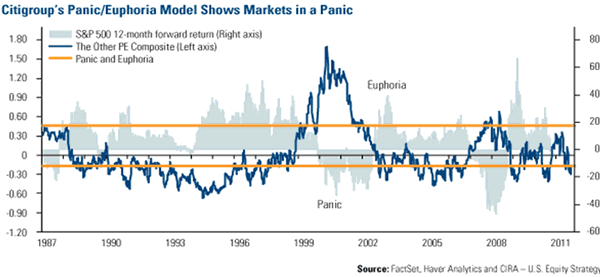

We'll leave you with an interesting chart by Citigroup. The chart compared expected returns (solid blue line) with actual returns over the following 12 months (light blue shading). The chart shows that the higher the expected returns get the less likely it is they will be realized. It's a concrete representation of the contrarian idea. The more euphoric traders are the more likely it is their hopes will be dashed.

The "good" news is that the markets are not euphoric at all right now and are actually just coming out of "panic" territory. This model doesn't predict tops and bottoms. The fact it's in panic territory doesn't mean the market can't go lower. It does imply 12 month forward returns should be positive, perhaps quite positive. Something you can look forward to after several months of ugly markets.

To view Eric Coffin's latest interview on the Money & Wealth Show [October 1] please click here. Eric Coffin discusses with Victor Adair the current market volatility, when to get back into resource stocks and the Yukon area play.

Ω

Sign up to receive HRA commentary, interviews and our latest free special report on Iron Ore & Potash, including a new HRA recommended company! www.hraadvisory.com

By David Coffin and Eric Coffin

http://www.hraadvisory.com

David Coffin and Eric Coffin are the editors of the HRA Journal, HRA Dispatch and HRA Special Delivery; a family of publications that are focused on metals exploration, development and production companies. Combined mining industry and market experience of over 50 years has made them among the most trusted independent analysts in the sector since they began publication of The Hard Rock Analyst in 1995. They were among the first to draw attention to the current commodities super cycle and the disastrous effects of massive forward gold hedging backed up by low grade mining in the 1990's. They have generated one of the best track records in the business thanks to decades of experience and contacts throughout the industry that help them get the story to their readers first. Please visit their website at www.hraadvisory.com for more information.

© 2011 Copyright HRA Advisory - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

HRA Advisory Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.