Stocks, Bonds, Dollar Cycles Crossroad

Stock-Markets / Financial Markets 2011 Nov 08, 2011 - 01:57 AM GMT The VIX reached what appeared to be its combined Master Cycle and Primary Cycle low on October 17. The two cycles appeared to agree and the VIX made its low at 28.08 that day.

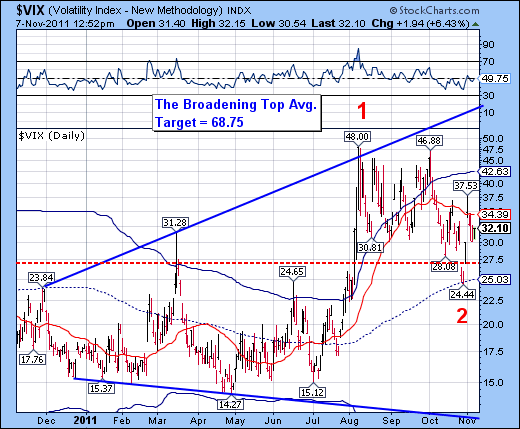

The VIX reached what appeared to be its combined Master Cycle and Primary Cycle low on October 17. The two cycles appeared to agree and the VIX made its low at 28.08 that day.

However, another zig zag lower appeared on October 28, corresponding with a lesser Trading Cycle low. This extended the Master Cycle low another 13 days beyond what was normally expected and allowed the equities indexes to go beyond their usual 50-61.8% retracements.

Bottom line: From the Master Cycle low the VIX has the capability of a minimum 6-week rally into mid-December. The next possible low in the VIX will occur between Christmas and New Year’s day.

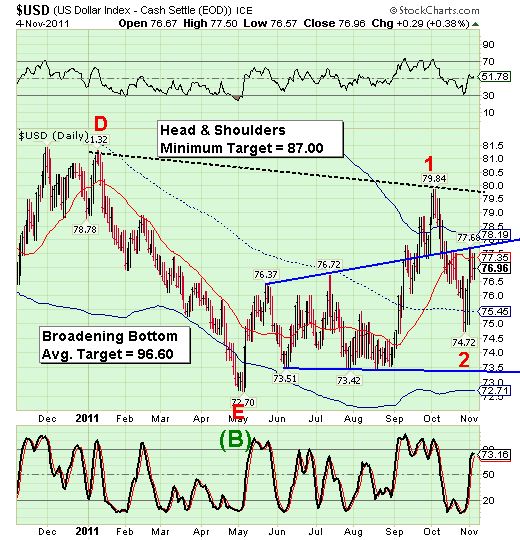

The US Dollar was also due for a Master Cycle low on October 17th. However, its Primary Cycle low was due on October 23, while its Trading Cycle low was due on November 1. In this case, the Master Cycle low extended to October 27 and split the difference between the two lesser cycles.

Bottom Line: The $USD also has the capability of an extended rally for the next 5-6 weeks and the subsequent low (if it occurs) will also be between Christmas and New Year’s day.

The SPX is due for a Master Cycle low in the next 5-9 days. In this case there is no conflict with lesser cycles. A Master Cycle low is a major low that occurs approximately every 8 months and one of them must be the low for the calendar year. The last two Master Cycle lows were March 16, 2011 and July 1, 2010. That is why I believe that a Flash Crash may be due at this time.

There is one possible alternative. That is, the Master Cycle low may hyper-extend until December 7, when the next Trading Cycle is due. That is my second choice at this time, because Options Week takes place next week and there may be an attempt to “save the market” at that time.

The VIX and the Dollar cycles both support a possible continuous decline through early-mid December. Regardless of which date it will be, the low for 2011 has not yet arrived in equities.

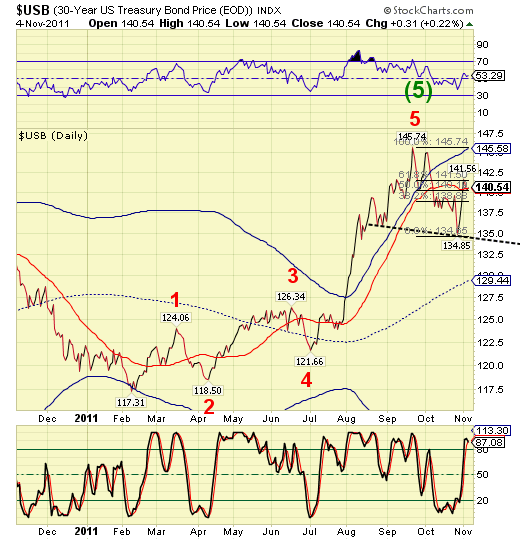

The primary holders of US Bonds are the world’s banks. In effect, the banking crisis has already begun, witnessed by the sell-off in the US Treasuries. Until recently, the sell-off in bonds has resulted in “risk on” trades being encouraged. That may be an anomaly of the computer trading, which may anticipate a probable inverse relationship between bonds and equities.

Bonds are at a cross-roads in which a decoupling may be forced in that relationship. Although TLT has rallied today, it has not broken out to a new high, which would be necessary to consider this move to be more than a retracement. $USB also had a Master Cycle low on October 27. A failure to rally from here would be absolutely devastating for the bond market, as it anticipates a decline in bonds until the end of June 2012. I am currently neutral in US Treasuries.

I suggest you read Alan Newman’s latest edition of Cross-Currents.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.