Stock and Financial Markets Thanksgiving Thoughts

Stock-Markets / Financial Markets 2011 Nov 24, 2011 - 09:49 AM GMTBy: PhilStockWorld

What an ugly finish November is having!

What an ugly finish November is having!

We’ve been trying to get bullish with little success and, if we are not reversing tomorrow, I will be regretting the wasted time poking at bullish plays when we could have been going "wheeeee" on the slide.

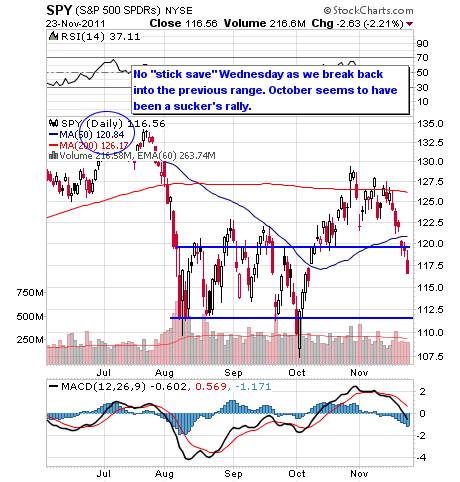

I thought that blue line on Dave Fry’s chart was going to hold, it’s about 2.5% down from our Must Hold level for the S&P on the Big Chart (1,235) and that would have been a reasonable (and slight) overshoot of the 10% drop we were expecting so we played for the bounce but now we’ve blown our -5% line at 1,173 and our next support level is -10% at 1,112 – a very sad level to revisit if we do.

I thought that blue line on Dave Fry’s chart was going to hold, it’s about 2.5% down from our Must Hold level for the S&P on the Big Chart (1,235) and that would have been a reasonable (and slight) overshoot of the 10% drop we were expecting so we played for the bounce but now we’ve blown our -5% line at 1,173 and our next support level is -10% at 1,112 – a very sad level to revisit if we do.

Technically, of course, we’re breaking down. Fundamentally, I’m not so sure. The fear is palpable as Europe looks terrible and clearly all these austerity measures are taking a toll on the Global economy but it’s simply NOT showing up in the data yet. PMI’s are dropping across the Globe but the Purchasing Manager’s index is a SENTIMENT indicator that reflects the OPINION of the buyers about business prospects.

As I have been pointing out (yes, there was a point) in my recent series of articles about market and media manipulation – there is a protracted campaign underway to push sentiment down – to chase retail buyers out of the markets.

As I have been pointing out (yes, there was a point) in my recent series of articles about market and media manipulation – there is a protracted campaign underway to push sentiment down – to chase retail buyers out of the markets.

Who is doing this? Perhaps it is the IBanks, who want to bottom out the market ahead of QE3, when we’ll be off to the races again. Perhaps it is the Fed and Treasury, who want to chase people into the $140Bn worth of bonds they have to sell each month. Perhaps it is the Republicans, who want to campaign against the worst possible economy next year to prove that Obama has blown his handling of the economy almost as bad as Bush did – so we may as well try one of their idiots again since it seems to make no difference. Don’t laugh – I have a button for Romney that says that…

Whatever and whoever is behind the negativity (and let’s not forget Germany, who are angling to take control of the EU and will be able to do so if things deteriorate further) – our job as investors is not to particularly care – but to figure out how far negative SENTIMENT can push the markets down before DATA pushes it back up.

As I pointed out on Tuesday with WHR, we’re now at the point (with the high VIX and low prices) where we can create spreads on stocks that give us built-in discounts of 25-30%. This is an improvement of our usual Buy/Write Strategy (see "How to Buy Stocks for a 15-20% Discount") that comes along with the happy (for Fundamental Investors) combination of an oversold market and overactive volatility.

While we are ready, willing, able and anxious to execute on Warren Buffett’s advice to "Be greedy when others are fearful" – we also must take the advice of William Wallace and "hold, Hold, HOLD" until we are confident (as opposed to hopeful) that we have found a proper bottom to invest in.

It’s fine to do a little bottom fishing if you are sitting on a lot of cash but PLEASE let us not forget the lessons of 2008 – that there is no bottom in a Global liquidity panic. So it’s here that we want to exercise a little game theory – what are our various possible outcomes going forward?

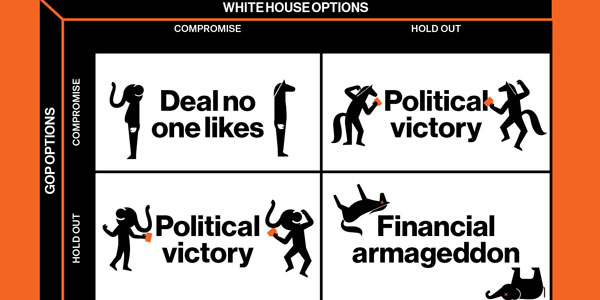

It’s fine to do a little bottom fishing if you are sitting on a lot of cash but PLEASE let us not forget the lessons of 2008 – that there is no bottom in a Global liquidity panic. So it’s here that we want to exercise a little game theory – what are our various possible outcomes going forward?

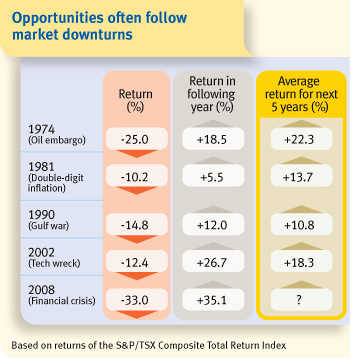

Since we have gone to cash in our short-term portfolios and hedged our our long-term portfolios as best we can (also half cash anyway) – the BEST thing that can happen right now is a devastating crash. As you can see from the chart on the left, there’s a very good chance of that happening since it is both political party’s self interests to hold out – just as it is the interests of individual countries and various Central Banks to do the same – even though their action invites the possibility of a total catastrophe. That’s essentially what we’re playing for from a cash position, which is why we speculate to the upside while we wait – we KNOW we will do well in a collapse, it would just be a shame to miss an unexpected rally so upside bets are now our hedge against our cash position.

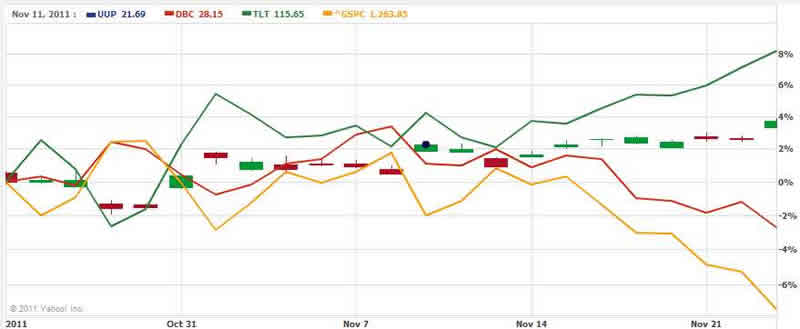

Cash is betting the Dollar is more valuable than stocks or bonds or commodities. Since we went to cash two weeks ago, that has certainly been the case for stocks and commodities but not so much for TBills – which have gone flying up in PRICE (not VALUE) as people panic into the Dollar. Of course, we also need to keep in mind the huge advantage of cash that’s a bit harder to quantify – it gives us the ability to very quickly move into new positions once their PRICE is sufficiently below their VALUE to the point where we are once again WILLING (because we are already READY and ABLE) to invest our cash,

In game theory, our choices are hold cash or invest. The market (ignoring a flatline) will go up or down. If the market goes up and we hold cash – bad outcome. if the market goes down and we hold cash – good outcome. So we guard against the market going up with some small bets that are, hopefully, offset by that 4% increase in the value of our Dollars, as well as the deeper and deeper discounts offered on the bullish positions we will ultimately buy.

Oh yes, perhaps this is a good time to make the point that this is NOT an investing strategy for people who think the World Economy will completely collapse and we will all go back to living in caves while Ron Paul divvies up the gold and ammo. For that, I am told an FN FS2000 Bullpup ($2,000) or an M1A ($1,500) are both excellent weapons for the post apocalyptic shopper.

Hopefully, we’re reading stock market newsletters because we believe there is a future for the Global Economy (and, if you don’t believe me, try reading "The Worst-Case Scenario: Getting Real With Global GDP") so we will focus here on looking for and preparing to take advantage of opportunities to bet ON the future – not against it.

Arnold Rothstein was a famous gambler in the 1900s (he was supposedly involved in fixing the World Series of 1919) and here’s a scene from Boardwalk Empire where he gives a little advice on betting and PATIENCE:

"Some days I make 20 bets, some day’s I make none. There are weeks, sometimes months, in fact when I don’t make a bet at all because there simply is no play. So I wait, plan, marshal my resources. And, when I finally see an opportunity, and there is a bet to make – I bet it all."

Now keep in mind that Rothstein is a fixer, he’s not talking about a 50/50 bet – he’s talking about when he’s already set things up so he KNOWS he’s going to win. For those of us not working at Goldman Sachs or JP Morgan – we may not have already set the markets up so we can be 100% sure of the outcome so it is prudent of us not to "bet it all" but it is certainly great advice to remember that sometimes, as the great and powerful WOPR reminds us – "the only winning move is not to play."

Now keep in mind that Rothstein is a fixer, he’s not talking about a 50/50 bet – he’s talking about when he’s already set things up so he KNOWS he’s going to win. For those of us not working at Goldman Sachs or JP Morgan – we may not have already set the markets up so we can be 100% sure of the outcome so it is prudent of us not to "bet it all" but it is certainly great advice to remember that sometimes, as the great and powerful WOPR reminds us – "the only winning move is not to play."

What we can do is marshal those resources (have cash ready and able to deploy) and wait PATIENTLY for the right opportunity to deploy it. As I said, we made a mistake (several, actually) in 2008 of trying to guess the bottom but there was not bottom. Sure we can look back now and say of course BA is worth more than $27, of course IBM was worth more than $70, of course AAPL was worth more than $78 and we were not wrong when we bought BA at $40 and IBM at $85 and AAPL at $90 but IT WAS STILL TOO EARLY and we suffered that last drop and some people stopped out right at the bottom – only to see, just a month later, those "too high" entry prices retaken and passed by.

Obviously, no timing system is going to be perfect but the key is to have cash available and not to over-commit. In September of 2009, I reviewed the collapse of 2008-9 with a series of 3 articles. In the 3rd post, we discussed the day, on March 6th of 2009, when I was on TV while the market was in absolute free-fall, telling people to BUYBUYBUY. During a 3-hour live broadcast, I came up with 13 trade ideas that made an average of 469% in 6 months but opportunities like that don’t do you any good if you blew all your reserves trying to guess a bottom on the way down.

There is great money to be made if we are patient. If we end up being wrong and the markets turn back up faster than we thought, then all we have lost is a little time but we still know dozens of ways to make really good money in a flat or up market BUT, on the off chance things do collapse, the smartest play we can make is to wait out that collapse and THEN, when the panic gets to ridiculous levels – as it was in March of 2009 – THEN we can buy our Blue Chip stocks at irrationally low prices and Mr. Buffett will be very, very proud of us.

There is great money to be made if we are patient. If we end up being wrong and the markets turn back up faster than we thought, then all we have lost is a little time but we still know dozens of ways to make really good money in a flat or up market BUT, on the off chance things do collapse, the smartest play we can make is to wait out that collapse and THEN, when the panic gets to ridiculous levels – as it was in March of 2009 – THEN we can buy our Blue Chip stocks at irrationally low prices and Mr. Buffett will be very, very proud of us.

Game theory suggests it is currently wiser for us to have cash and POSSIBLY miss a sudden move up in the markets than to tie up our cash and miss another huge opportunity to buy stocks cheap, like we did in 2009. The upside to catching a knife here for a move back up to the October highs is what? 5%, 10%? The upside to being in cash and buying those same stocks another 30% down from here is 35%, 40% – patience pays better than gambling!

Of course, if we though it was only 25% or less likely that the economy would suffer another shock, then we’d be less inclined to wait but, manipulated or not, we have some SERIOUS issues yet to resolve before we can get comfortably bullish again. Until then, we will continue to take a few upside pokes but will remain "Cashy and Cautious" for the duration.

Speaking of caution, our EDZ plays (our primary hedges) are getting deep in the money so it’s time to look at another layer of protection. In this series, we began with my 11/3 morning Alert to Members, where I said:

EDZ is still the best hedge against a Global meltdown and you can play the Dec $19/25 bull call spread at $1.30 and that can be offset with the sale of CHL Jan $45 puts at $1 for net .30 on the $6 spread or the now silly-low RIMM Nov $18 puts that can be sold for $1 or the Dec $17.50 puts that can be sold for $1.75 to make a credit spread with a net entry on RIMM at $17.15.

ISM numbers were not good and I still like my USO puts (Nov $35 puts are .90) as well as DIA Nov $116 puts at $2. Let’s do 10 of the DIA puts in the WCP with a stop at $1.75.

Notice in this trade we were NOT sure we were going down so we hedged EDZ with CHL to neutralize the cost, in case the markets did not drop. For an offset, you want to pick a stock you REALLY want to own, even while the markets are selling off – because that’s the bet you are making. As it stands at the moment, EDZ is at $25.36 and the Dec $19/25 bull call spread is now $3.50 and CHL is at $47.22 and the Jan $45 put is still $1 for net $2.50 – up 733% so far. The RIMM Nov $18 puts expired worthless so an even better play there but I was wrong about the longer Dec $17.50 puts, now $2.25 for net $1.25 off the original .45 credit but still up a nice 377% so far. Our next EDZ hedge was from my early morning Alert to Members on 11/9 with my comment:

EDZ remains the best hedge if you feel you’ve been caught not short enough. Any time they are below $18 we like them and you can sell Dec $16 puts for $1.50 to fund the purchase of the $16/22 bull call spread for about net even. Even if it’s a blown trade, you can roll the short puts and end up owning EDZ as a permanent hedge at $12 or less and then it’s just going to be great to sell calls against long-term.

This was a MUCH more aggressive hedge as we’re selling the EDZ puts to offset the cost of the bull call spread so doubly bearish less than a week after we first became cautious. I’m glad we did this because it’s a great example of the difference between a cautious offset and an aggressive one. The Dec $16/22 bull call spread is now $4.50 and deep in the money but those $16 short puts are now .05 so this trade, is already up $4.45, that’s 4,450%, even if the net of the trade was a dime!

This was a MUCH more aggressive hedge as we’re selling the EDZ puts to offset the cost of the bull call spread so doubly bearish less than a week after we first became cautious. I’m glad we did this because it’s a great example of the difference between a cautious offset and an aggressive one. The Dec $16/22 bull call spread is now $4.50 and deep in the money but those $16 short puts are now .05 so this trade, is already up $4.45, that’s 4,450%, even if the net of the trade was a dime!

Another week later, on the 17th, we went back to the well again and I think you can already see why EDZ is my favorite aggressive hedge for a global meltdown. My increasingly bearish comments to Members in that morning’s Alert were:

Somebody’d better do something or this whole thing is going to blow at this point. I have been expecting some form of Government intervention (but not Yentervention, which would be BAD) for a month now and they are missing their window of opportunity as Black Friday approaches fast (cue Steely Dan).

Obviously anything less than 1,235 on the S&P is BIG TROUBLE for the market so it’s an easy day to stay bearish as we have a clear indicator to cover. As I said early this morning (and please look over the news of the day from 3:33am Chat) this is just getting depressing and it’s certainly not something we want to be buying the dips on until we see definitive measures taken to forestall this growing crisis in the EU.

EDZ is still miles below where it could be in a panic at $20 and so it’s still my favorite hedge. The Dec $19/24 bull call spread is $1.40 and you can offset that with the sale of the $17 puts for $1.10 for net .20 on the $5 spread that’s $1 in the money to start. Owning EDZ at $17 is not a terrible hedge long-term either (and rollable, of course).

Another offset to the above is CHL, who I consider to be like buying AT&T in the 60s, short March $42.50 puts for $1.40 for a free spread and a crack at buying CHL for 17% off. The June $40 puts can be sold for $1.20 if you want a 20% discount on that entry.

I know, it’s boring. I make the same picks over and over again, don’t I? THAT’S BECAUSE THEY WORK!!! The Dec $19/24 spread is now $3.10 and the short $17 puts are .20 for net $2.90 (up 1,450%) and the CHL March $42.50 puts are down to $1.10 so looking good there despite the China melt-down (so great pick with CHL!) and the June $40 puts are higher, at $1.45 but that’s still net $1.65, which is still up over 800% – not too shabby for a week’s protection!

I know, it’s boring. I make the same picks over and over again, don’t I? THAT’S BECAUSE THEY WORK!!! The Dec $19/24 spread is now $3.10 and the short $17 puts are .20 for net $2.90 (up 1,450%) and the CHL March $42.50 puts are down to $1.10 so looking good there despite the China melt-down (so great pick with CHL!) and the June $40 puts are higher, at $1.45 but that’s still net $1.65, which is still up over 800% – not too shabby for a week’s protection!

The next week, on this Monday, we were already way ahead on our EDZ hedges and, since we had gone to cash and were now generally very bearish – it was time to layer these hedges and begin just a little bit of bottom fishing. My comment from Monday morning’s Alert to Members was:

So, if we get another breakdown here (and, with the news-flow, we likely will), then it’s just going to be another buying opportunity once we find a bottom. For now though, let’s not assume anything. Mostly let’s watch the Dow, as long as they hold the Must Hold line (11,590), there is hope. As we noted last week – we liked the DXD shorts because the Dow had a lot of catching up to do and it’s right about a 1.5% drop for the day so hopefully we hold there, down right at about 5% for the week and hopefully stopping there.

If it doesn’t hold – the next hope for the Dow is the 50 dma at 11,535 but, failing that and we’re very bearish until it’s re-taken. EDZ is flying now ($24) and we can add the Jan $22/26 bull call spread for $1 in preparation of stopping out all or part of the Dec spread. If we pull the Dec calls we bought (the $18s are now $6) and leave the $24s (now $3) naked, covered by the new Jan hedge, we have all the way up to $29 before it becomes a problem and, as we’ve seen – they don’t move that fast. Keep in mind though it’s a STOP out on the Dec calls, not a roll now so we are, at the moment – adding more protection and not cancelling our original position until we clearly have a reversal of fortune.

Oil is still stubbornly high and, in a real meltdown, it should fall back to the $80s. SCO Dec $40/46 bull call spread is $2 and you can offset that with the sale of XOM Jan $70 puts at $1.60 or RIG (who have more spill issues) 2013 $35 puts at $5. RIG is a bit risky but, long-term, they should come back and currently $45 means there’s a long drop before the $35 puts worry you. You can sell 5 of those for $2,500 and buy 10 of the SCO spreads for $2,000 with a stop at $1,000 for a net $500 credit that could bring back $6,500 if all goes well.

At the moment, I’m hoping the Dollar stops at 78.80 (now 78.64) and pulls back to give the markets a chance to recover but this is no place to be catching falling knives – we are really getting to the point where there is the possibility of a 2008-style meltdown if confidence erodes any further.

What we are doing here is walking a fine line between fear and greed. We are layering our EDZ play but doing so in PREPARATION for getting stopped out of our earlier, successful trades. This allows us, hopefully, to maximize our gains off the calls we bought without having to ride them back down on a reversal. If there is no reversal (and there hasn’t been one so far this week), then we simply have a new layer of hedges as the markets decline further. Notice we also added SCO to our primary hedges because our indexes fell 6-8% while oil stayed stubbornly high so either oil is indicating that our indexes are oversold (hence our preparation to take EDZ profits and run) or the indexes are right and oil is going to collapse along with them on the next leg down.

Fitch downgraded Portugal to junk this morning while that country is shut down by a Nationwide strike as citizens reject the harsh austerity measures forced on them by the EU. Meanwhile, EU leaders are talking about amending their Constitution to enable them to further crack down on the PIIGS while, at the same time, backing away from committing to playing a greater role in back-stopping the slide.

We don’t know when this merry-go-round is going to stop so we will just have to play it by ear. Having a well-hedged, well-balanced portfolio with plenty of cash on the side is, by far, the best way to enjoy the ride!

May you and all your family have a very Happy Thanksgiving,

- Phil

Click here for a free trial to Stock World Weekly.

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.