Stock Market Stalls at Broadening Wedge Trendline

Stock-Markets / Financial Markets 2011 Nov 28, 2011 - 12:47 PM GMT SPX appears to have stalled at the Broadening Wedge trendline. This trendline may be challenged, since 17% of all Broadening Wedges see either a challenge of the lower trendline or a throwback into the wedge itself. The obvious second target is the 50-day moving average at 1206.57.

SPX appears to have stalled at the Broadening Wedge trendline. This trendline may be challenged, since 17% of all Broadening Wedges see either a challenge of the lower trendline or a throwback into the wedge itself. The obvious second target is the 50-day moving average at 1206.57.

Should the bounce fail sometime today, there is an alternate view that the decline may extend to December 8. Otherwise, the standard view is that the reversal may happen tomorrow, with the next cycle bottom coming in on December 7.

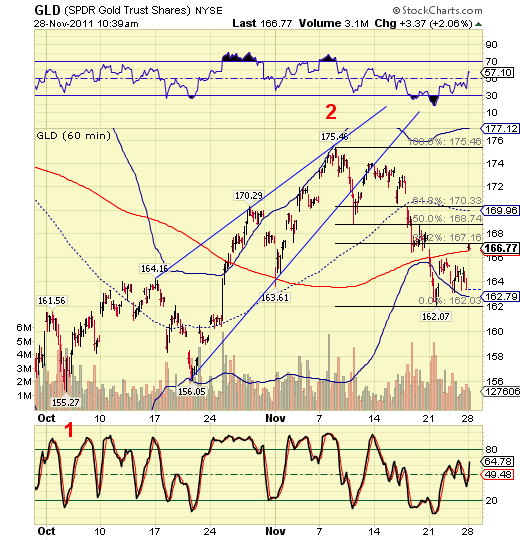

Last week I suggested that the cycle in GLD may invert and attempt to challenge intermediate-term trend resistance at 166.50. Although the cycle model projected the turn date to be last Friday, we may have seen the holiday weekend delay the move. In any event, we must treat this move as a counter-trend bounce that has only achieved a 38.2% retracement. The rally may extend to the end of today with a possible move to the 50% retracement, but the chances are only 50-50 of that taking place. I remain short GLD.

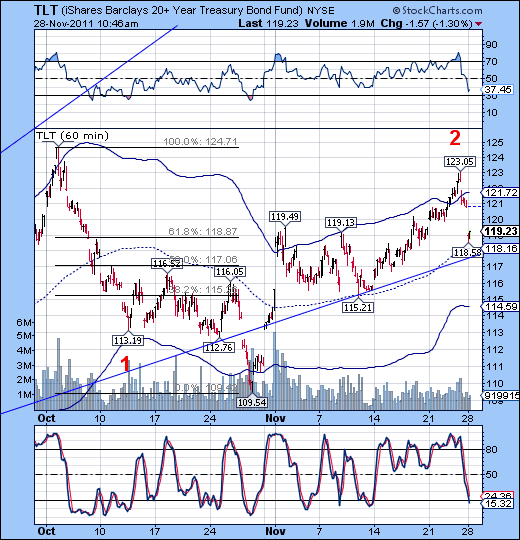

TLT continues its decline to the hourly mid-cycle support at 118.16. The proof of a true change of trend depends on a decline below mid-cycle support and the Broadening Top trendline just below it. The cycle model suggests the decline will continue through the end of December, which may confirm the absolute top in the 30-year rally in Treasury Bonds.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.