Financial Markets Head and Shoulder Patterns

Stock-Markets / Financial Markets 2011 Nov 30, 2011 - 03:29 AM GMT Believe it or not, the Euro is the index to watch over the next week or so. The reason is simple. Its master cycle low began on October 3, one day earlier than the equities cycle low. This gives us a one day notice on will happen with the SPX and commodities, for example. It should also give us a one-day notice of the dollar and the VIX top as well.

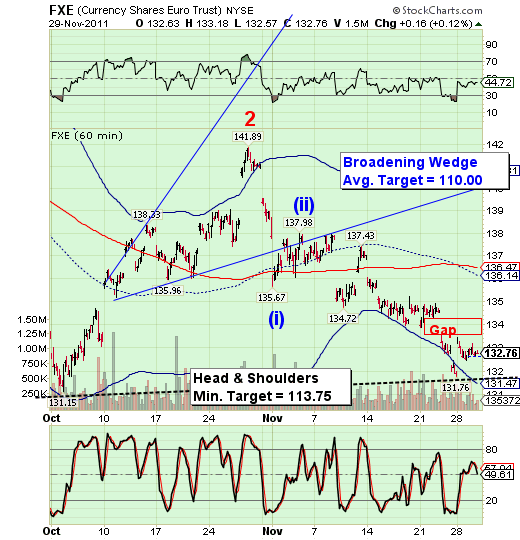

Believe it or not, the Euro is the index to watch over the next week or so. The reason is simple. Its master cycle low began on October 3, one day earlier than the equities cycle low. This gives us a one day notice on will happen with the SPX and commodities, for example. It should also give us a one-day notice of the dollar and the VIX top as well.

You can see that FXE made a Spike reversal high on Monday, with a lower reversal high today, signaling a continuation of the decline. Today was the reversal date for equities, also suggesting the bottom is not yet in.

What we're looking at is a very bearish head and shoulders neckline at 131.76, only 100 basis points lower. All it takes is a Through the neckline to trigger another 14% minimum decline.

Not to be outdone, SPY has also formed a complex head and shoulders neckline at 116.32. Its minimum target is 103.02, below the October 4 low. This decline could easily be accomplished in the next week.

As mentioned above, today is the reversal day for equities. SPY appears to have reversed at the 50 day moving average. The after- hours market seems to confirm this.

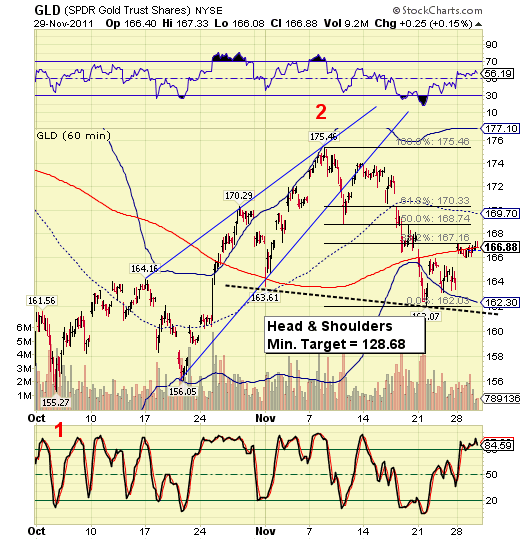

GLD appears to have made its trading cycle high today, four days beyond the normal date. The amazing thing is that it only made a 38.2 % retracement. It, too, has a head and shoulders neckline just below at 162.00. This, in effect, may double the decline already made from the November 8 high, at a minimum.

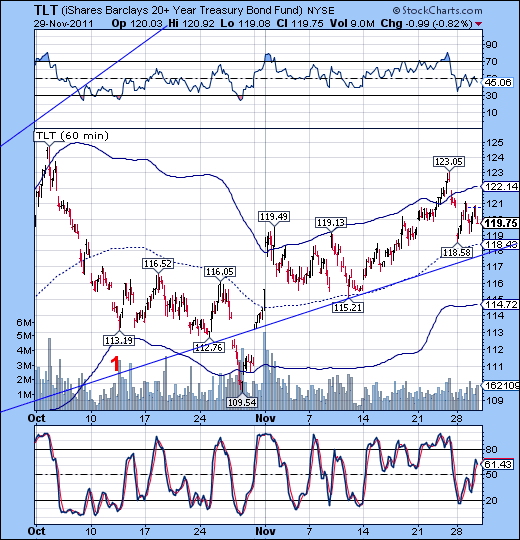

TLT remains above its trendline and appears capable of bettering last week's high of 123.05. However it may fall short of the October 4 high at 124.71. I am keeping a close eye on the broadening wedge trendline currently at 118.00. A break of that trendline would bring TLT back into double-digit territory in short order.

I'll keep you posted as new developments occur.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.