UK Economy GDP Growth Forecast for 2008 - NO Recession

Economics / UK Economy Dec 24, 2007 - 12:43 AM GMTBy: Nadeem_Walayat

The UK economy is being hit hard by the ongoing credit crunch with its sizable financial sector under strain and the UK housing market finally showing signs of the long anticipated downturn after one of the biggest bull runs in history. These and much other bad news will undoubtedly hit the UK economy hard during 2008, and in advance of this the media has finally turned decidedly bearish with much speculation of a recession during 2008.

The UK economy is being hit hard by the ongoing credit crunch with its sizable financial sector under strain and the UK housing market finally showing signs of the long anticipated downturn after one of the biggest bull runs in history. These and much other bad news will undoubtedly hit the UK economy hard during 2008, and in advance of this the media has finally turned decidedly bearish with much speculation of a recession during 2008.

In the Telegraph last week - David Owen, chief European economist at Dresdner Kleinwort Investment Bank, gave the odds of a recession in the UK during 2008 at 50%.

In The Independent today, Stephen King, the managing director of economics at HSBC warns that the Chancellors luck has run out and of the risks of a bust in the UK during 2008.

The opinion of my recent articles has been to expect growth of some 1.5% for the UK during 2008, therefore this technical analysis of GDP growth is to see if the economy is still on target for growth of 1.5% growth or if the increasingly bearish opinions of a recession are the more probable outcome.

Analysis of UK GDP Growth for 2008

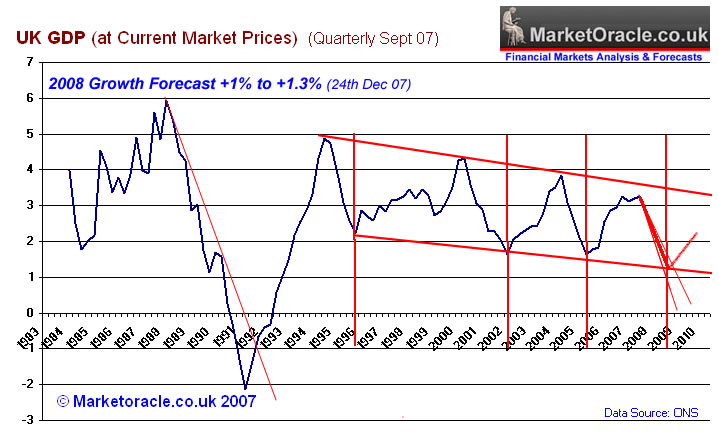

Key points which stand out from the GDP chart are :

1. That Britain has enjoyed a remarkably stable growth trend during the last 13 years, oscillating between +4% and +1.5% growth with-in a clearly defined channel and easily recognizable cycles.

2. That third quarter GDP failed to reach the upper boundary of the growth channel which implies weakness.

3. That the GDP growth cycle is clearly signaling a downtrend with previous downtrend cycles converging to a target low in the third or fourth quarter of 2008.

4. That the first half of the trend tends to be the severest, therefore expect a sharp drop in the GDP growth rate during 1st quarter of 2008 (4th quarter 2007 - Christmas boost), then subsequent quarters.

5. That GDP Trend is targeting a downtrend to between +1.3 and +1.6%

The risks to the trend picture is that there will be a breakout to the downside, and therefore develop a new much weaker trend pattern than the chart suggests. This is possible given the UK housing bear market and the credit crisis. However whilst implying weaker growth, it does not mean that the UK will go into recession.

Conclusion

The forecast for UK GDP growth by the end of 2008 is for a an annualised growth rate of between 1% and 1.3%. This is marginally below the original expectation of growth of 1.5%. But does confirm that despite much bad news on the economic front, the UK looks set to not only avoid a recession during 2008, but seems likely to grow at a comfortable rate given the recession expectation circumstances. Also that the first half of the year will be much tougher in growth terms then the second half, which now allows me to complete the next analysis with more confidence on the prospects for the UK stock market.

Summary of Forecasts for 2008 |

Forecasts for 2007 |

| UK House prices to fall by 7% - (22nd August 07) , Buy to Let Sector April 08 Crash | UK house prices to rise by 3.5% (Dec 06) |

| UK Interest rates to fall to 5% from 5.75% by Sept 08 (18th Sept 07) | Peak at 5.75% between Aug and Oct 07 (Dec 06 - 5%) |

| UK Inflation - Fall to below 3% RPI from January 08 4.4% RPI peak (26th Nov 07) | None |

| US Economy 2008 - NO Recession - GDP Growth of 1.5% to 3% (11th Dec 07) | None |

| UK Economy 2008 - NO Recession - GDP Growth of 1%-1.3% (24th Dec 07) | None |

| UK Stock Market - Pending | FTSE 100 to End 2007 at 6900 - (Dec 06 - 6220) |

| US Stock Market - Pending | Dow Jones End 2007 at marginally higher new high then Dec 06 - 12,600 (Dec 06 - 12340) |

| Gold 2008 - Pending | Gold to end 2007 at $920 (Jan 07 - $636) |

| British Pound 2008 - Pending | British Pound to Break above £/$2.00 (4th Jan 07 - 1.95) |

| Emerging Markets Outlook 2008 - Pending | China & Eastern European stocks to outperform India and other stock markets (Dec 06) |

| Stock Picks for 2008 - Pending | Suggested portfolio - (Dec 06) |

Your analyst thinking about how rare and brief GDP contractions tend to be, compared to the amount of speculation in anticipation thereof.

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Johnny Onith

03 Feb 09, 06:00 |

Embaressed

I hope, Nadeem, that you're truely embarressed with yourself after this piece of 'analysis' which not only suffered from a complete lack of logic or rational basis at the time, but has now been prooved to be utterlly and totally wrong. I can only believe that your 20 years of experience has been 20 years of errors and mistakes. |

|

Nadeem_Walayat

03 Feb 09, 06:47 |

Recession Forecasting

1. The mainstream forecating organisation, OECD, IMF, treasury, IMF etc were forecasting growth for 2008 of between 2% and 2.7% 2. My ongoing analysis concluded in April 2008, that the UK was heading for an imminent recession, long before the mainstream press and forecasting organisations caught on. Therefore contrary to your above assertion, if you actually took the time to check the facts as of Dec 07, you will see that I was and remain AHEAD of the CURVE and therefore beat the OECD, IMF, UK Treasury and many other in terms of being closer to the eventual outcome then they were at the time. All forecasts are best guesses that need to be reappraised in response to real-time events, especially black swan events such as Financial Armageddon during Sept / Oct 2008. |

|

David Hatchman

04 Mar 09, 00:30 |

Your Forecast 08

Nadeem, Your classic mistake is that you have used official statistics to try and grapple with constructing economic forecasts. You have been either too engrossed in this or blind to what has actually been happening in the UK economy since 2000, the writing, writ very large was on the wall then. Governments ignored it economist ignored it – at least classically trained ones did and commentators tended to spin massive spurious positives out of alarming FACTS. Some of us anticipated, dare I say forecast, very accurately the current situation at a range of 4 years and have been able to benefit greatly from it. |

|

Nadeem_Walayat

07 Mar 09, 13:57 |

UK GDP Forecast 2008 - 2009

2000 ? The country boomed economically from 2000 to 2007, so that statement resembles that of a perma bear / doom variety that tend to miss the booms but eventually prove right, given enough time. UK GDP 2008 - The Facts 2008 ended with GDP at +0.71% The forecast as of Dec 07 was for between +1% and +1.3% This is against the majority of forecasts at the time which were for 2008 GDP of between +2% and +2.7%. Therefore forecast made in Deceber 2007 proved highly accurate, however it has prompted me to undertake far more indepth analysis for all future forecasts with a view to improving on the accuracy as evidenced by subsquent forecasts, such as that of Febuary 2009 http://www.marketoracle.co.uk/Article8926.html The Feb 2009 forecast for GDP contraction of 6.3% for the recession and -4.75% for 2009 year. This is far in excess of mainstream forecasts that range from -1% by the government to -3% IMF / OECD. Whilst a 100% hit is highly improbable, however as 2008 proved far more accurate than that of forecasting institutions that recieve funding in the hundreds of millions, so will my forecast for 2009 by year end prove far more accurate than that of the likes of the Treasury, IMF or OECD which as far as my analysis concludes have failed to comprehend the degree to which the UK economy has fallen off the edge of a cliff. Regards Nadeem Walayat |