Europe's Debt Crisis and Solutions

Stock-Markets / Eurozone Debt Crisis Dec 06, 2011 - 04:14 PM GMTBy: Bloomberg

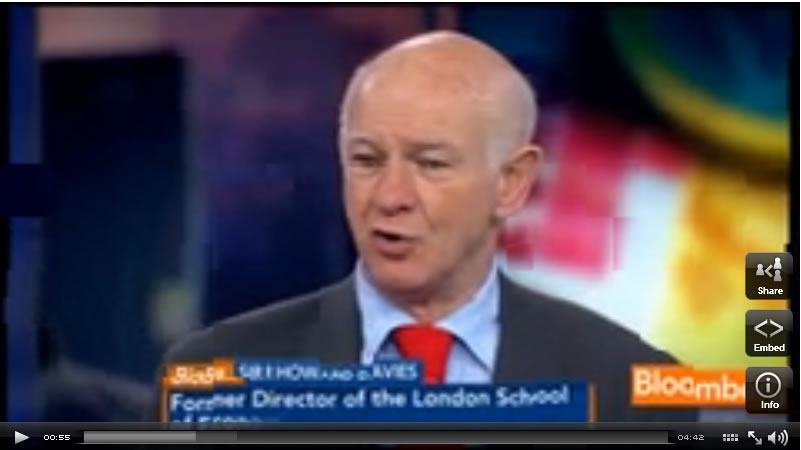

Sir Howard Davies, former deputy governor of the Bank of England and former director of the London School of Economics, spoke to Bloomberg TV's Erik Schatzker and Sara Eisen this morning and said that it is will not “make a huge amount of difference” if the S&P downgrade the Eurozone. He also said that there needs to be a European finance minister.

Sir Howard Davies, former deputy governor of the Bank of England and former director of the London School of Economics, spoke to Bloomberg TV's Erik Schatzker and Sara Eisen this morning and said that it is will not “make a huge amount of difference” if the S&P downgrade the Eurozone. He also said that there needs to be a European finance minister.

On Merkel and Sarkozy's latest proposals to resolve the EU debt crisis:

"They've still not got there. There has been a lot more lunches than concrete agreements…It's a huge gastronomic investment going on in France."

"I think yesterday's package is about trying to persuade German politicians and German voters that they have done enough on the fiscal tightness in discipline and on the austerity front - Germans love austerity as you know - in order to unblock the political resistance to the ECB acting to help countries whose debt is still very difficult to sell in the market."

On Germany's attitude towards the EU:

"The German attitude is that if they bail out people, what's to stop them doing the same thing again? That is the moral hazard argument."

"The ECB problem is a slightly different one. It would be fine for the European Central Bank to say, ok, we'll go and buy Italian debt, but at the moment we know that would just stack up losses on the balance sheet of the ECB. Who would pay for those? Ultimately there has to be a European finance minister. Ultimately it comes back to us taxpayers to fill in a hole if they buy stuff for more than it's worth."

On whether it's a good idea for banks to get bailed out and not take losses on European debt:

"I think it probably is. I know it sticks in the craw somewhat to say, Let's bail the bankers out of this. The difficulty is regulators and the central banks did actually tell the banks that these were safe assets. The regulators told the banks that they ought to be holding more sovereign debt and that was counted as AAA and solid liquidity."

"I think it's wrong to try to deal with the sovereign debt problem via the banking system. I think you have to deal with it direct, rather than telling the banks that they have to take all these write-offs and load themselves up with new capital."

On what would happen if S&P downgrades the eurozone:

"There is still one AAA credit and I used to represent it officially because the UK is not on this list. I don't quite know why, to be frank."

"As we saw in the S&P case in the United States, it doesn't necessarily make that much difference if a AAA goes down. It didn't disturb the markets a great deal in this country, I don't think. If they do it to everybody and they simply say there is just greater uncertainty about sovereigns in the rest of the world, I'm not sure that will make a huge amount of difference."

Copyright © 2011 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.