Currencies Favor Stock Market Bears Longer-Term

Stock-Markets / Stocks Bear Market Dec 12, 2011 - 12:23 PM GMTBy: Chris_Ciovacco

The correlation between the S&P 500 and the euro has been running extremely high in recent months. Therefore, if the euro can mount a sustained charge higher, stocks could do the same.

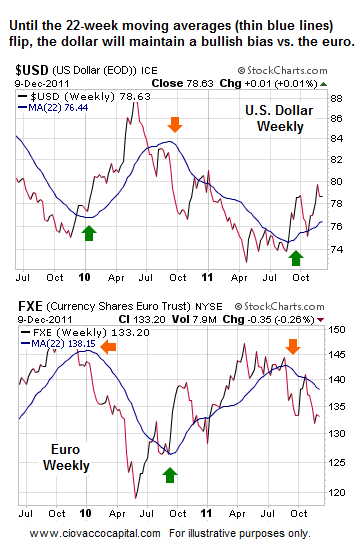

As we mentioned on December 9, the 22-week moving average is a good way to get a 30,000 ft view of many markets. When the slope of the 22-week is positive, a market tends to be healthy. When the slope of the 22-week is negative, further weakness may be in the cards.

When examining the 22-week moving averages for the U.S. Dollar Index and the euro, we see a “lesser of the two evils” advantage in the dollar’s favor. Based on what we know today, over the longer-term the odds favor (a) higher highs in the dollar, (b) lower lows in the euro, (c) and renewed weakness in stock prices.

It is common for markets to correct back to their 22-week, which means the dollar could weaken in the short-term, while keeping the longer-term trend intact. Similarly, the euro could experience a countertrend rally back to its 200-week, which would also allow for stocks to push higher for a time. If the euro can recapture its 22-week and the slope of the 22-week turns positive, it would be a good sign for both the euro and stocks. Until that happens, we will remain cautious with stocks and commodities.

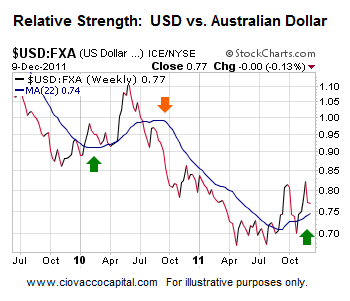

Another way to monitor the “risk-off” vs. “risk-on” tone of the markets is to monitor the strength of the U.S. dollar relative to the Australian dollar. As the world’s reserve currency, the U.S. dollar tends to attract capital during periods of fear and/or uncertainty about the future. The Australian economy relies heavily on commodities. When investors feel confident about future economic outcomes, they become more attracted to economically-sensitive commodities, such as copper. When commodities are performing well, the Australian economy tends to perform well with capital being attracted to the Australian dollar.

On the chart below, when the slope of the 22-week is negative (orange arrow), the “risk off” trade is in favor longer-term. When the slope of the 22-week turns positive (green arrows), the “risk on” trade tends to impact markets over the longer-term. Given the current state of affairs, the “risk off” trade still carries an edge, looking out several weeks, relative to the “risk on” trade. Countertrend rallies are to be expected, which means stocks could still make another push higher as we noted last week.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.