Breaking Stock and Financial Market Supports

Stock-Markets / Financial Markets 2011 Dec 12, 2011 - 12:31 PM GMT There seems to be quite a bit of complacency in the VIX this morning. That is not unusual since the VIX had already completed a reversal pattern as of Friday. Therefore the VIX is already on its cyclical buy signal and that buy signal may be confirmed by crossing intermediate-term trend resistance at 30.49. The patterns suggest that the VIX has quite a distance to go in this next move so hang tight.

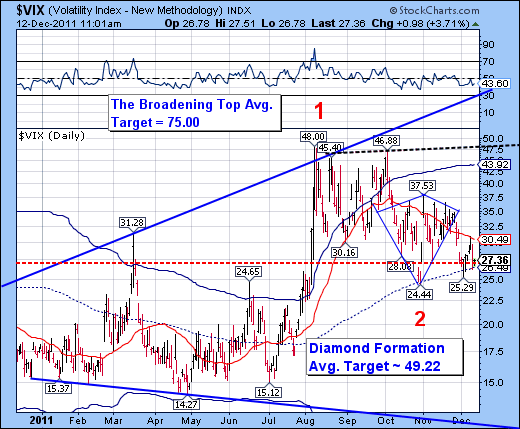

There seems to be quite a bit of complacency in the VIX this morning. That is not unusual since the VIX had already completed a reversal pattern as of Friday. Therefore the VIX is already on its cyclical buy signal and that buy signal may be confirmed by crossing intermediate-term trend resistance at 30.49. The patterns suggest that the VIX has quite a distance to go in this next move so hang tight.

The SPX has been repelled by mid-cycle resistance at 1255.24, giving it a cyclical sell signal. That sell signal is now confirmed by crossing intermediate-term trend support/resistance at 1238.00. The 50 day moving average is at 1221.92. Many traders look at that has the last bastion of the bull market, so we may expect acceleration once below that level. My cycles model suggests that current decline may last until the last week of December. If so, it is quite possible that the SPX may hit its initial target between 980 and 1024 by the end of this year. Although there may be a bounce into the New Year in the SPX, the initial trading cycle low is not expected to last week of January.

The NDX has crossed quadruple supports this morning. It is now below intermediate-term trend support at 2306.56 it has also crossed the 50 day moving average at 2297.26 and the 200 day moving average at 2290.91 and has now crossed mid-cycle support at 2280.62.

Folks, there is nothing holding up the NASDAQ. This is prime territory for flash crash, regardless of options expiration is Friday. In fact, having a decline through options expiration is like adding accelerant to the fire.

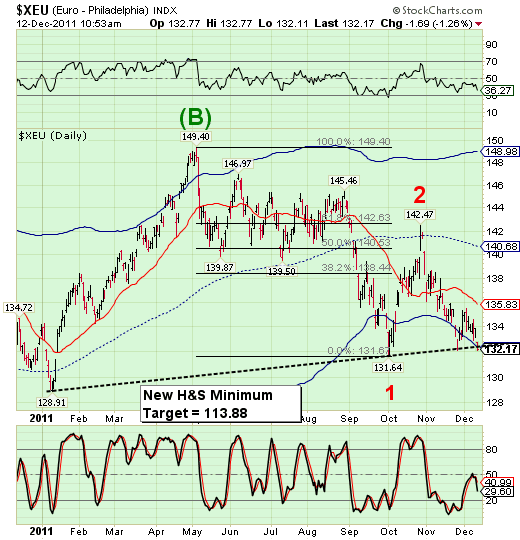

As reported earlier, the euro has not broken its Head and Shoulders neckline. The new minimum target is 113.88, but keep in mind that this is a minimum decline. The cycles model backs this up with the Primary Cycle low due on December 28.

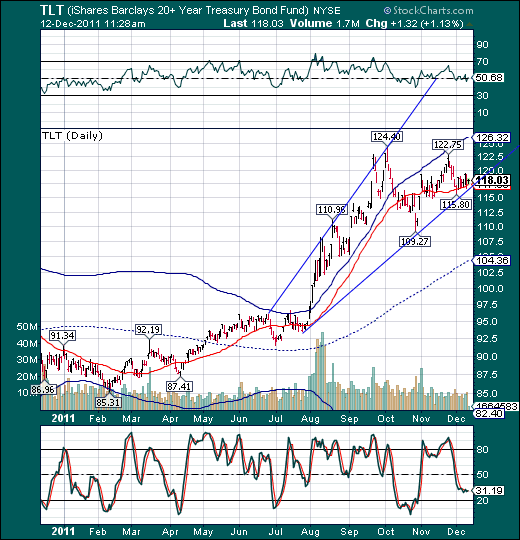

TLT has maintained itself above intermediate-term trend support at 117.37. It also remains above an important trendline, suggesting at least one more surge in price.

This may be a good entry point for new long positions, for those of you who cannot take an inverse position in the market. A stop loss may be put at 117.00 or slightly lower, since this is may not have additional confirmation until TLT breaks out above 124.40.

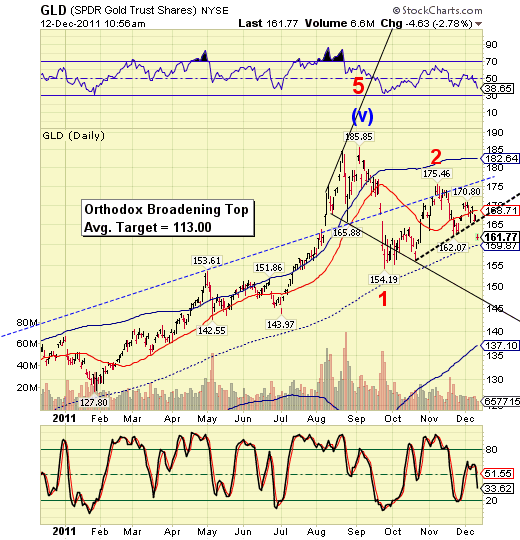

GLD has broken its head and shoulders neckline with a minimum potential target of 148.60. As you can see, but is not quite far enough to trigger the Orthodox Broadening Top at 145.00.

However, a rule of thumb is that once midcycle support at 159.87 is broken, there is a strong likelihood that the ETF will fall to cycle bottom support at 137.10.

Good luck and good trading!

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.