Global Stock Markets Heading for Lower Lows

Stock-Markets / Stocks Bear Market Dec 13, 2011 - 06:13 AM GMTBy: Adam_Brochert

As someone in the USA who tends to read more US-centric commentary, I continue to see analysts look almost exclusively at the US markets. Because US stock markets have been relatively strong recently, a frequently read conclusion is that the US economy is holding up well and terms like "de-coupling" are making their way back into the financial lingo. This is a ridiculous concept in the current global economy, but people want to believe good times are just ahead just like when "green shoots" and "goldilocks" were bandied about in prior cycles.

As someone in the USA who tends to read more US-centric commentary, I continue to see analysts look almost exclusively at the US markets. Because US stock markets have been relatively strong recently, a frequently read conclusion is that the US economy is holding up well and terms like "de-coupling" are making their way back into the financial lingo. This is a ridiculous concept in the current global economy, but people want to believe good times are just ahead just like when "green shoots" and "goldilocks" were bandied about in prior cycles.

The US is not decoupling, it is lagging. Just as emerging (and other) markets topped later than the USA in the 2007-2009 bear market, so the US is the laggard this time. It doesn't mean the USA will avoid the pain or another nasty bear market (one has already begun in my opinion, but the "slope of hope" is alive and well). I am continuing to document the signs of this bear market for those interested in preserving their wealth through what promises to be turbulent times, indeed.

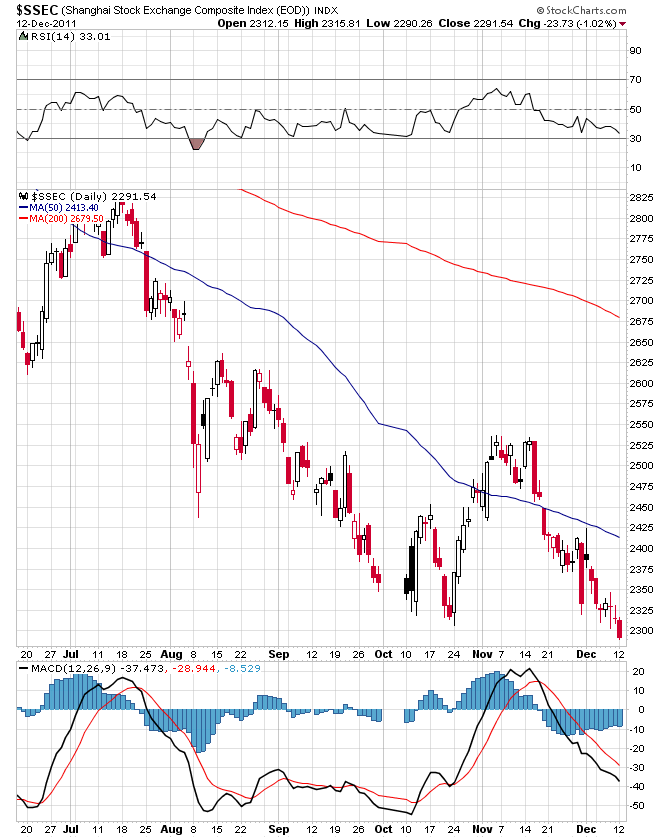

I previously pointed out markets making lower lows below their October lows in a previous post. Continuing along that theme are some very important additions to the list. First up, China, using the Shanghai Index ($SSEC). Here's a 6 month daily chart thru today's close:

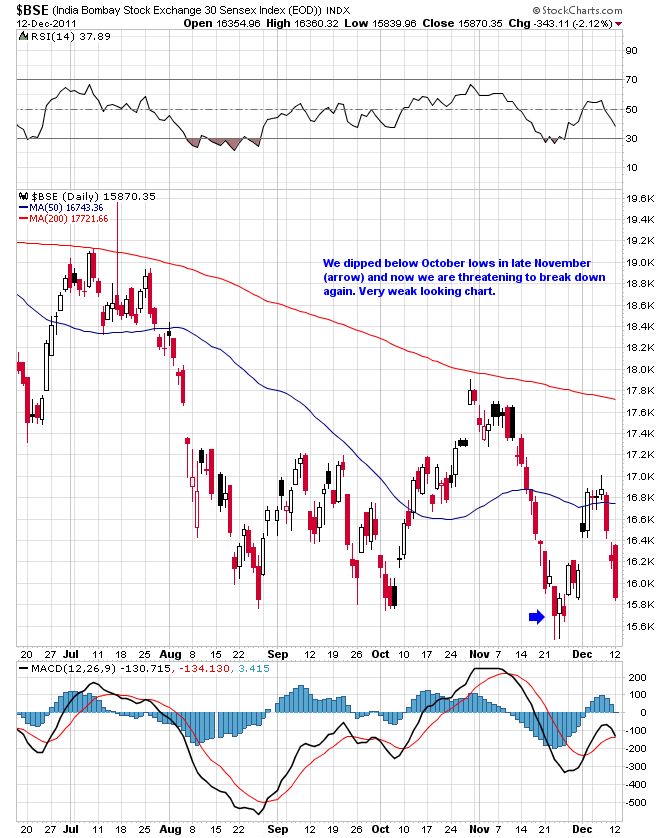

Next up, India ($BSE):

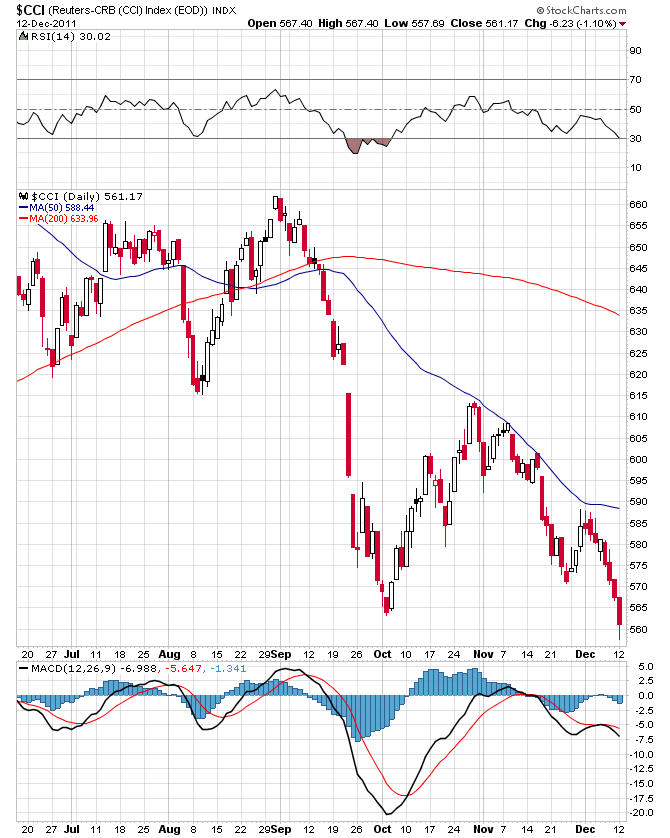

For commodity bulls, are you paying attention to the CCI Commodity Index ($CCI), which is more balanced and less oil-weighted than the $CRB Index?

Here are the so-called BRIC nation returns since their cyclical bull market peaks thru today's close:

Brazil: Down 21.6% since Nov. 2010 peak

Russia: Down 36.5% since April 2011 peak

India: Down 24.6% since Nov. 2010 peak

China: Down 34% since Aug. 2009 peak

The engine of global growth has been gummed up with bad debtor paper and declining demand. The global recession has already begun and the exact timing of each market making its biggest declines is the only game worth playing in my opinion. Meanwhile, the precious metals (PM) and PM stocks continue to decline. A very important buying opportunity is approaching in my opinion in the PM sector, but I don't think we're there yet.

My subscribers and I are currently short emerging markets while waiting to go long in the PM sector. If you're crazy enough to try trading in these markets, consider my low cost subscription service. Otherwise, just keep buying physical Gold on price dips and sleep well at night knowing you own the world's oldest and most reliable currency.

For those crazy enough to speculate in this environment, consider my low cost subscription service. My subscribers and I are currently short emerging markets and waiting for a bottom in the precious metals sector to start speculating in Gold stocks from the bull side.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.