How Important is North Korea's Leadership Change?

Politics / North Korea Dec 20, 2011 - 05:01 AM GMTBy: James_Pressler

This weekend, North Korean officials announced the passing of Supreme Leader Kim Jong-il, supposedly from a heart attack. Not too surprisingly, the next day Pyongyang heralded Kim's youngest son, Kim Jong-un, as the new head of state along with the title of "Great Successor." While it is widely known that the elder Kim was in poor health and rushing the grooming process for his son's succession, the Supreme Leader's sudden death leaves plenty of reasons to speculate as to just how the transition will impact North Korea and its relations with the world.

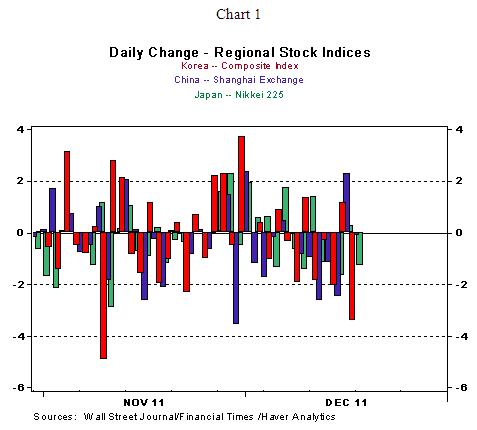

The first stop would obviously be a quick view from South Korea. On the first trading day after the announcement, the Korean exchanges dropped by 3.4%, while the Chinese and Japanese bourses - the two other neighboring countries of interest - fell to lesser extents. While Korea's market reaction is notable, the one-day fall does not even mark its biggest drop in the past two months, much less for 2011. This suggests that while the passing of the torch does add a little uncertainty to South Korea's outlook, it is hardly a game-changer. If anything, some may take the Pollyannaish view of this transition creating a clean slate for future negotiations between the Hermit Kingdom and the outside world.

As much as we would like to believe that, the situation calls for more practical thinking. First, the Great Successor in all likelihood did not finish his full set of dictator training courses. Kim Jong-un's father went through a considerably longer grooming process then waited in the wings for 14 years before assuming power at the age of 55. At 27, the Great Successor now ranks among the youngest heads of state in the world, and is charged with running a country that has been on the edge of collapse since the Clinton administration. From this perspective, the markets in South Korea and Japan should have fallen much further.

The reason we offer for short-term ease but longer-term uncertainty is that the former Supreme Leader was not the only power structure in North Korea even though the political cult of personality was attached specifically to him. Rather, different factions and power bases within the government - the Central Military Commission, the so-called Workers' Party, etc. - will maintain their own fiefdoms and tend to their own realms. It has been accepted over the past three years (if never confirmed) that after having had a stroke, Kim Jong-il ceded some control of government to these interests. If this is true, they will likely retain those powers while the younger Kim adjusts to the job. But within Pyongyang there is at least the chance of these interests angling to expand themselves into a perceived power vacuum, which suggests even more unpredictability from a government that has never been too consistent in the first place.

We took the news of Kim Jong-il's passing much the same as did North Korea's other neighbors - not expected but not surprising. We feel confident that the next few days will not bring any earthshaking news out of Pyongyang and that we need not change our regional forecasts in the slightest. But we also accept that North Korea is now in a state of transition, which is rarely ever painless. Combining that with the North's tendency to splash the diplomatic waters now and then, the only thing we feel sure about is that this change of leadership does not suggest calmer seas ahead.

James Pressler — Associate International Economist

http://www.northerntrust.com James Pressler is an Associate International Economist at The Northern Trust Company, Chicago. He currently monitors emerging markets in sub-Saharan Africa, as well as several European and Asian countries.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.