Stocks Bear Market Focus Point: Complacency Still Rules and China Stalls

Stock-Markets / Stocks Bear Market Jan 15, 2012 - 10:30 AM GMTBy: Garry_Abeshouse

It’s my view that the reluctance to believe you are in a prolonged bear market slowly decreases over time until the final bottom is reached and closure is realised. The recent sharp 52%fall in the Baltic Dry Index, together with the low levels currently experienced by the $VIX and the ProShares Ultra Short S&P500 ETF (SDS) and the comparative high levels of the equity markets, clearly show that complacency is still well entrenched in the market place.

It’s my view that the reluctance to believe you are in a prolonged bear market slowly decreases over time until the final bottom is reached and closure is realised. The recent sharp 52%fall in the Baltic Dry Index, together with the low levels currently experienced by the $VIX and the ProShares Ultra Short S&P500 ETF (SDS) and the comparative high levels of the equity markets, clearly show that complacency is still well entrenched in the market place.

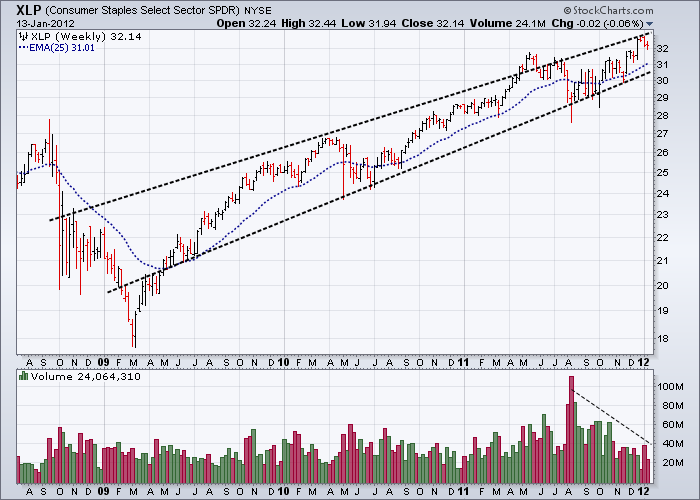

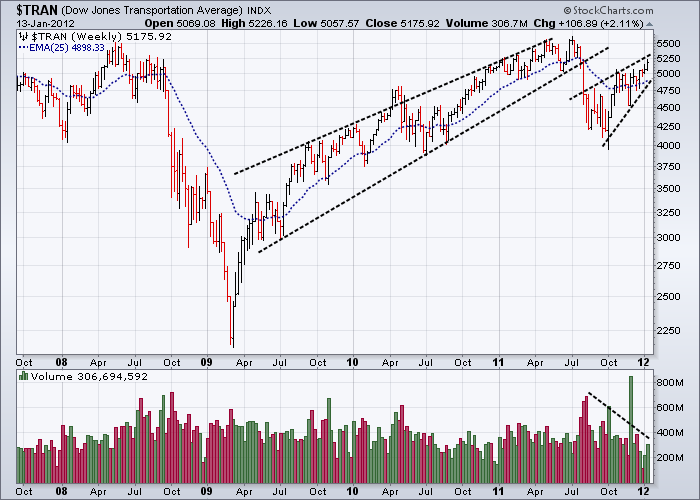

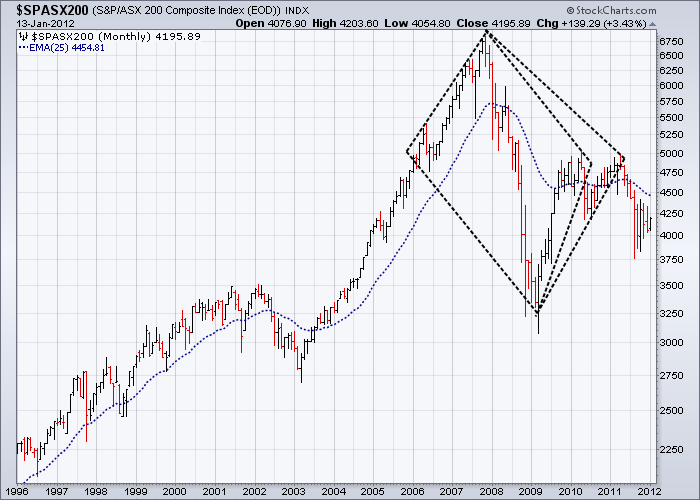

Over the last three years I have repeatedly mentioned that chart patterns such as upward wedges, descending triangles, broadening tops and head & shoulders tops appearing after an extended rise are and continue to be bearish portents, rather than signs of the beginning of a new bullish trend. These patterns still predominate in most markets, with the USD Index and US T-Bonds being the two most blatant exceptions. Interestingly the Gold price looks less like a safe haven and more like the equity markets at the moment - a further sign we are heading for deflationary times, where Mr Cash will always be king.

In the light of the downgrading this weekend of nine countries in the Eurozone, we all should be watching the charts on China very closely, as the patterns shown across a broad cross-section of Chinese Indices suggest that it is more likely that spurred on by the world-wide economic slowdown weakness here will continue. This begs the question of how far the Chinese government will allow their stock market to fall before they pull the plug and stop trading on their exchange. Of course they can’t stop the trading of Chinese companies listed on US exchanges or the repercussions elsewhere and there lies their dilemma. Accordingly, those markets such as Australia, who depend upon their exports to China also bear watching.

Till next time.

Garry Abeshouse

Technical Analyst.

Sydney

Australia

I have been practicing Technical Analysis since 1969, learning the hard way during the Australian Mining Boom. I was Head Chartist with Bain & Co, (now Deutsch Bank) in the mid 1970's and am now working freelance. I am currently writing a series of articles for the international "Your Trading Edge" magazine entitled "Market Cycles and Technical Analysis".

I specialise in medium to long term market strategies.

© Copyright Garry Abeshouse 2012

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.