Stock, Commodity, Bond and Forex Markets Breakout or Breakaway?

Stock-Markets / Financial Markets 2012 Jan 16, 2012 - 06:55 AM GMTBy: FNN24

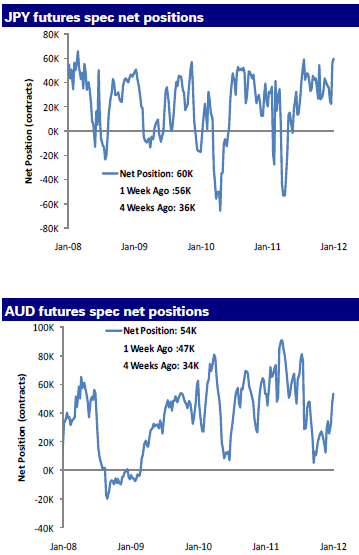

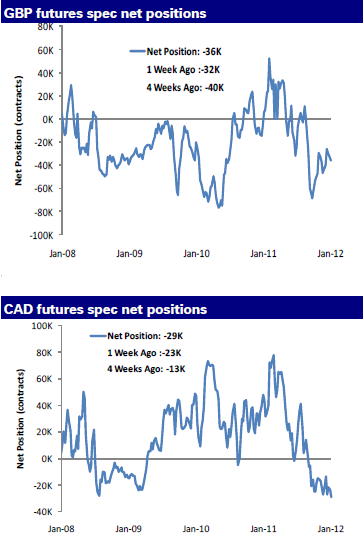

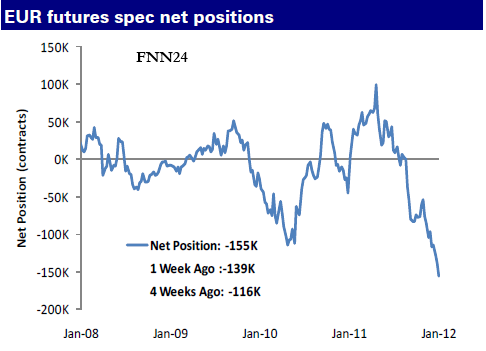

We begin this week weekly analysis by looking back at the week COT data which show increasing spec shorts on key currencies.

We begin this week weekly analysis by looking back at the week COT data which show increasing spec shorts on key currencies.

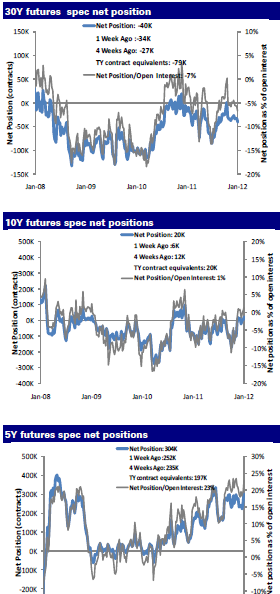

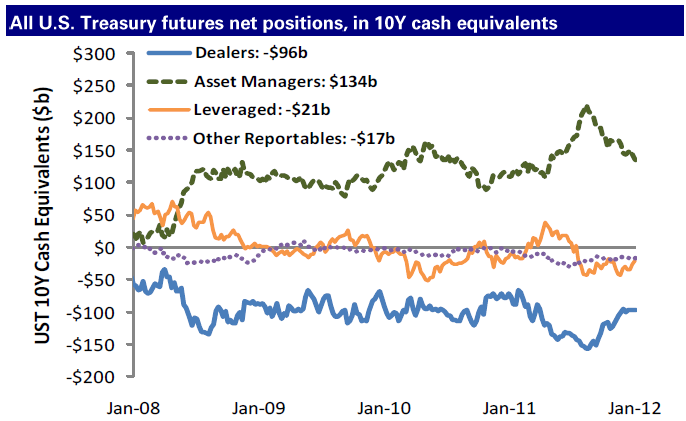

In Treasury futures, speculative investors have been getting longer in FV, increasing their net long positions to 304K contracts from 252K from the last week. Net spec positions in the charts below show the difference between gross long and short positions in each contact held by speculative traders, or non-hedgers, as reported by the U.S. Commodity Futures Trading Commission.

In FX futures, speculators again added to net short positions in euro. They are now the most net short since at least January 2006.

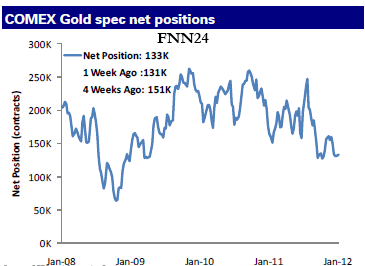

In commodities, silver and crude oil saw increases in net long positions, driven in part by managed funds. In equities, speculators pared their short positions in S&P 500 e-mini and reached a net short position of -150K contracts from -248k of the last week.

Macro Charts and analysis

Retail sales disappoint in December

Retail sales increased 0.1% in December, as we expected but below consensus expectations of a 0.3% gain. After netting out autos, gasoline and building materials, “core control” retail sales fell 0.2%. This wo;; push down US GDP for Q4. It also shows weaker momentum for the consumer heading into the new year. The Thursday’s weak retail sales report combined with the spike in jobless claims combats some of the bullish sentiment and reminds us that the economy is still struggling. This is the recovery of fits and starts.

Weak Trade deficit

The November trade deficit widened to -$47.8 billion after the October deficit was revised down slightly to -$43.3 billion from -$43.5 billion previously. Exports were down -0.9%, the second decline in a row and broadly consistent with the downshift in ISM new export orders, although the later is still indicating that US exports should be slightly positive. Weakness in Europe is weighing on exports.

EU Debt update

The ECB left the main interest rate unchanged yesterday at 1.0%, in line with the consensus and our forecast. The rate for the deposit facility and the marginal lending facility remained unchanged at 0.25% and 1.75% respectively. President Mario Draghi said that the interest rate decision was unanimous. He also made clear that the ECB would be ready to act to lower interest rates further if needed. In a TV interview this morning the Finnish Central Bank Governor Erkki Liikanen said that the views of the Governing Council members regarding the economy “converged strongly”. He stressed the downside risks to the economy and mentioned financial market developments as a “great risk” for the outlook. Comment: To us this suggests that if there are signs of a deeper recession and/or a clear undershooting of inflation below 2% in the medium term, the ECB will cut rates further. We expect the main refinancing rate to fall to 0.5%in 2Q, the deposit rate to decline to 0.1% and the rate for the marginal lending facility to 1.25%.

According to the FTD, ECB Executive Board Member Jörg Asmussen has criticised the latest draft of the fiscal compact. The paper reports that he regards the ability to have larger deficits in “extraordinary circumstances” as a watering down of the previous version and is trying to convince governments to take this clause away again. FTD also reports that Mr. Asmussen has proposed that the European Court of Auditors should control the compliance of the fiscal rules in the member countries.

The German government is leaning towards the introduction of a Financial Transaction Tax (FTT) in the euro area only. A tier-two representative of the junior coalition partner FDP said yesterday that she expects an introduction of a FTT even without the UK. So far, the FDP has been strictly against the introduction of a FTT in the euro area only.

Greek PSI – Officials from the IIF met with representatives of the Greek Government yesterday to discuss the details of the PSI. According to the Greek Government, a final outline on a voluntary debt swap deal could be reached within a week. However, the IIF officials who represent private sector holders of Greek bonds said that key issues to reach a deal on a voluntary debt exchange remain unresolved and that the time for a deal is “running short”. In the meantime, IMF officials have reiterated that any PSI deal will have to be in line with Greece achieving debt sustainability.

French presidential election polls: Le Monde reports that a new approach to continuous polling undertaken by IFOP revealed that National Front candidate Marine Le Pen would receive 21.5% of voting intentions at the first round of the presidential election, compared to 23.5% for President Nicolas Sarkozy and 27% for Socialist candidate Francois Hollande. In the second round, Hollande would obtain 57% of the polls versus 43% to Sarkozy. Another Opinion Way poll puts Hollande in the lead with 27%, ahead of Sarkozy at 25% and Le Pen at 17%. Centrist candidate Francois Bayrou comes in fourth place with 15%. For the 2nd round, Holland wins with a 10-point margin. Comment: this is the first time that a poll has suggested that National Front candidate Marine Le Pen could be a serious challenger and feature in the second round as did her father in 2002. The gap measured by an average of the five latest polls continued to shrink between Hollande and Sarkozy to just 2.9 points in the first round and 12 points in the second round.

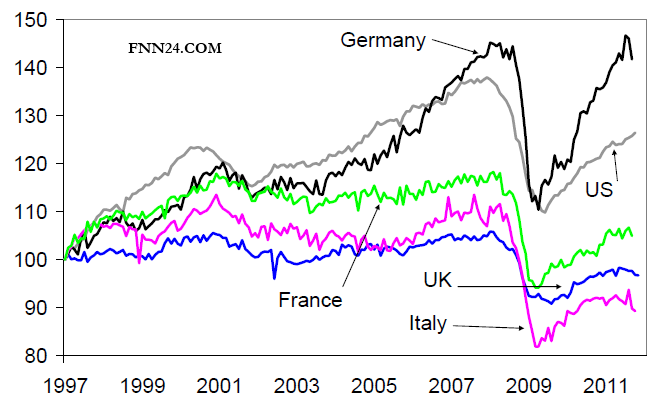

UK and US Manufacturing are slacking while Germany consolidates

The ONS report that industrial production fell 0.6% MoM in November, with manufacturing output down 0.2% MoM. The October reading was revised to minus 0.9% MoM from minus 0.7% MoM previously. Manufacturing output has now fallen in five of the last six months, with one unchanged reading. Manufacturing output is down 0.6% YoY, the first time that the YoY rate has turned negative since late-09.

These figures suggest that the initial release for Q4 GDP (to be released on 25 January) may well show negative QoQ growth. The average level of industrial production in October and November is 1.2% down from the Q3 average, and other ONS data show that services output in October fell 0.5% below the Q3 average. The ONS data on services output in November are used to construct the initial GDP figure and are released at the same time as the GDP data. But, unless services output rebounds really strongly in November, the initial GDP print will probably be negative. We suspect that the economy was held back by weakness in investment, government spending, and inventories. Surveys suggest that further declines in manufacturing

output are likely in coming months, raising the chance that the manufacturing sector is slipping back into recession (ie two consecutive quarters of negative growth).

All this while the German manufacturing index surprises on the upside as it consolidates at higher levels led by strong results from the Auto sector.

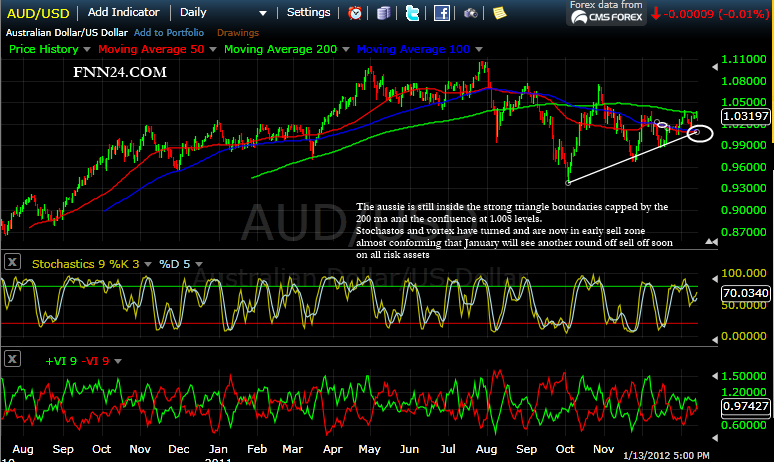

Key FX charts

Key risk currencies are showing signs of exhaustion and now pointing to a breakaway move for the dollar in January.

Bond markets Updates

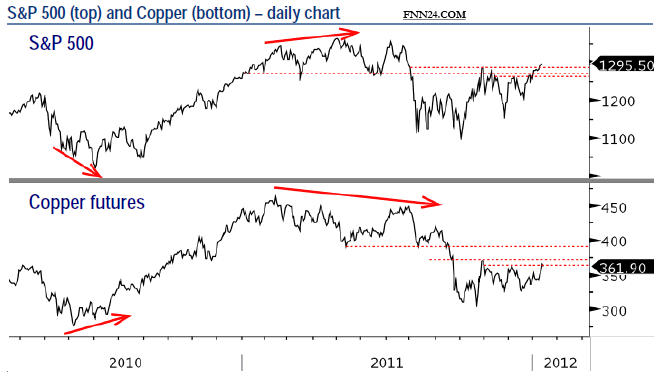

The S&P 500 has continued to rally and is attempting to breakout above its late October high. Dr. Copper is not confirming the rally and this is a potentially negative sign for the US equity market. Copper has been an important barometer for global growth. In mid 2010 copper bottomed out prior to the S&P 500 and in early 2011 copper topped out before the S&P 500. Moving into January 2012, neither the S&P 500 nor copper has a strong base or bottom in place and the pattern for copper is weaker than that of the S&P 500.

Conclusion

As we enter into 2012, there are key concerns which we highlight:

Six technical concerns entering 1Q12

•The S&P 500 is overbought based on the stochastic price momentum indicator for the daily and weekly model.

•The stocks’ only advance-decline line is not confirming this rally – it is still below its October peak.

•Complacency is building on sentiment – the AAII US Investor Sentiment model has moved to an overbought reading and Investors Intelligence is not far behind. The CBOE put/call ratio and VIX is also with complacency readings.

•Monthly price momentum models (5 vs. 15-month moving averages) remain on a sell signal.

•The euro breaks key support and China’s small cap index, the Shenzhen, also breaks key support – US dollar is king.

•European banks remain weak and risk getting weaker – see sidebar.

So given the macro fundamentals and charts from the FX and bond markets, the move on the risk assets seem to be break away more than breakout. Thus a false move.

Mark

Head of Research FNN24 Singapore, Mumbai, London, NY Home

URL: http://www.fnn24.com

FNN24 provides real time news bullets and economic indicators with sub second latency helping the retail trader with contextual mission critical information/data. Never miss another trade due to delayed data.

Bio: Head of Research, FNN24 a 24 hour news bullet service for the retail trader providing economic indicators with sub second latency. Never miss anothe trade due to delayed data.

© 2012 Copyright FNN24 - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.