Now More Bearish on the Stock Market Than 2007

Stock-Markets / Stocks Bear Market Jan 18, 2012 - 06:42 AM GMTBy: Paul_Lamont

While we were Hyper Bearish expecting an Asset Fire Sale in late 2007, we are more bearish now than at anytime in 2007 and 2008. Here is why...

While we were Hyper Bearish expecting an Asset Fire Sale in late 2007, we are more bearish now than at anytime in 2007 and 2008. Here is why...

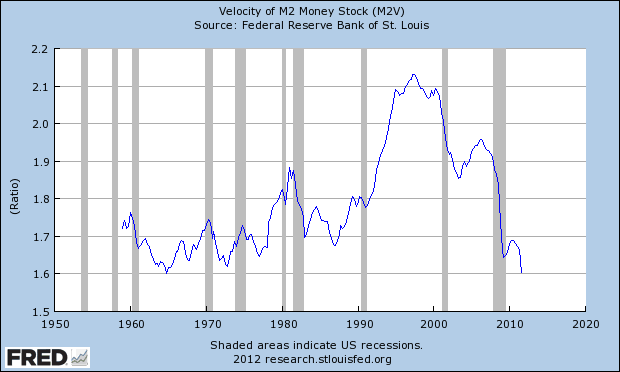

Money moving around the economy is slowing again in Europe and in the U.S. as the chart below shows. (We brought this same issue up in June and early September of 2008.) Remember this chart because we will come back to it.

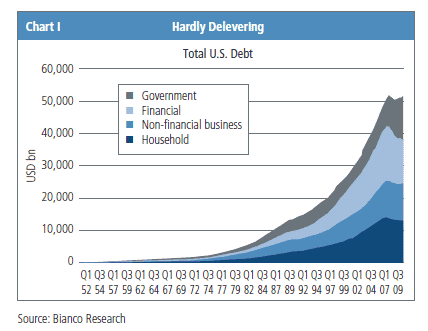

Basically, to keep prices up (and not have a full blown deflationary Depression) debt must continue to grow. Governments stepped in after the last crisis to fill the debt gap created by the shrinking financial sector (chart below). This prevented a deleveraging and the widespread forced selling of assets from occurring. But now, governments have reached their own borrowing limit dictated to them by the bond market (i.e. Greece) or their populace (i.e. Tea Party).

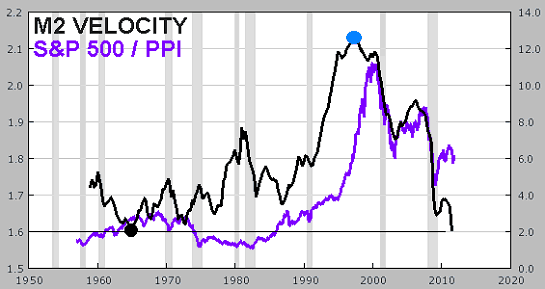

As Bill Gross, world's largest bond fund manager, states: "The financial markets are slowly imploding - delevering - because there's too much paper and too little trust." With little trust, money slows (the first chart we spoke about) and the financial system locks up again. Below is the first chart we presented with the inflation adjusted S&P500 overlaid.

So if we expect lower stock prices, it should be no surprise to see the following headline:

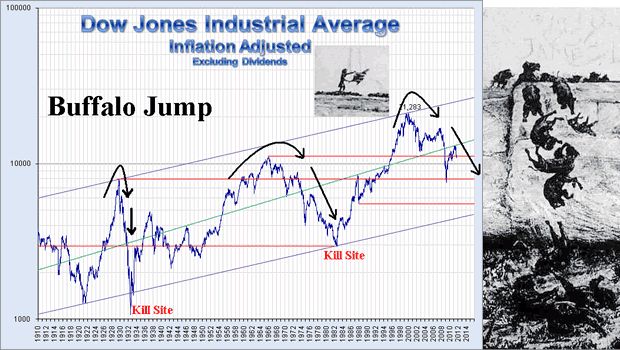

AAII Survey: Big Jump In Bullish Sentiment

Individual investors' bullish sentiment jumped to an 11- month high this week. The number of individual investors calling themselves bears also fell to a record low (i.e. they gave up). And since individual investors as a group are always wrong when it comes to the direction of the market, we can only suspect that the jump in sentiment will be over the cliff.

Hunting the Herd at Head-Smashed-In Buffalo Jump - Alberta, Canada

"The "jump" kill involved what seems like a simple plan. Hunters would frighten or spook a herd of buffalo off of a cliff or high bluff. But to make the plan work required strategy. The right site had to be located, the animals had to be directed to the spot, and they had to be stampeded over the edge." - Mass Kills. Texas Beyond History.

While there is no 'plan' to drive the investment herd over the cliff, financial markets regularly (in fact, almost always) blind investors to the dangers. Looking at the inflation-adjusted Dow Jones Industrial Average (chart below) and our progress so far in this secular bear market, we could not help but think of the Buffalo Jumps of the Great Plains. Head-Smashed-In being the best named.

We can only imagine the feast of cheap investments that await us at the bottom.

By Paul Lamont

www.LTAdvisors.net

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us . Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions. This newsletter should not be construed as personal investment advice. It is for informational purposes only.

Copyright © 2012 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama . Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.

Paul Lamont Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.