The Time is Right for Malaysia Investing

Stock-Markets / Emerging Markets Jan 24, 2012 - 02:23 AM GMT

I have been bullish on Malaysia long before the Southeast Asian nation became a fashionable investment destination. MY recommendation to buy into the country’s market via iShares MSCI Malaysia Index Fund (NYSE:EWM) has generated a 36.5 percent return since I added the exchange-traded fund (ETF) to Global Investment Strategist’s Long-Term Holdings Portfolio at the end of 2009.

I have been bullish on Malaysia long before the Southeast Asian nation became a fashionable investment destination. MY recommendation to buy into the country’s market via iShares MSCI Malaysia Index Fund (NYSE:EWM) has generated a 36.5 percent return since I added the exchange-traded fund (ETF) to Global Investment Strategist’s Long-Term Holdings Portfolio at the end of 2009.

By contrast, the MSCI World index has returned 15 percent and the S&P 500 has gained 20 percent during the same period. All returns include dividends. Malaysia was the second-best performing market in Asia in 2011, following Indonesia.

Although I’ve periodically recommended that investors take some profits off the table, Malaysia remains a relatively defensive market given the shortage of foreign investors and the assortment of government-linked companies that dominate its stock market. As such, investors should maintain a position in Malaysia in times of uncertainty.

The biggest development for Malaysia in 2012 should be the upcoming elections, slated to be held sometime between March and May. Prime Minister Najib Razak–who the markets view as a pro-growth reformer–is expected to win the majority. However, some observers are uncertain whether he can cling to the absolute majority that his government now enjoys. At present, the ruling coalition controls 62 percent of the seats in the parliament, and any number less than 50 percent would be viewed negatively by the markets.

The government has been in an election mode for months, as is clearly demonstrated by the budget delivered last October. The budget increased the compensation for civil service workers, reduced the operating costs for taxi owners and lowered the cost of living by pushing through price cuts at government-sponsored stores.

The budget also provided about USD160 to households that earn less than USD960 per month, as well as a 2 percent increase in the pensions of retired civil servants. The government also will spend about USD1.9 billion though a “Special Stimulus Package” to upgrade schools, hospitals, basic rural infrastructure and public houses.

In addition to those election-related hand outs, the budget also called for more services to be liberalized. In total, 17 services-subsectors will be liberalized in phases next year. These sectors include private hospital services, medical and dental specialist services; architectural services; engineering; accounting and taxation; legal services; courier services; education and training services; and telecommunication services. This liberalization will allow as much as 100 percent foreign equity participation in these sub-sectors.

These initiatives will surely spur domestic consumption, both by encouraging the development of infrastructure projects and by providing assistance to the needy who are struggling to cope with the rising cost of living.

Like I said in Malaysia: A Good Alternative Bet, Najib Razak has delivered on some reforms during his first term, especially via the Economic Transformation Programme (ETP). The ETP aims to attract USD444 billion in investments in 131 projects over the next 10 years and to double the country’s per capita standard of living. Thus far, USD60 billion worth of investments have been announced, the majority of which are privately funded.

Given these facts, it’s easy to understand why a clear majority for Najib Razak’s government is important to the markets. But regardless of what transpires in the parliamentary elections, it’s critical that Najib Razak remains at the helm, which is likely to occur. The Malaysian economy remains strong and a slight shift in domestic politics shouldn’t alter its course. I recommend investors buy into Malaysia on any dips.

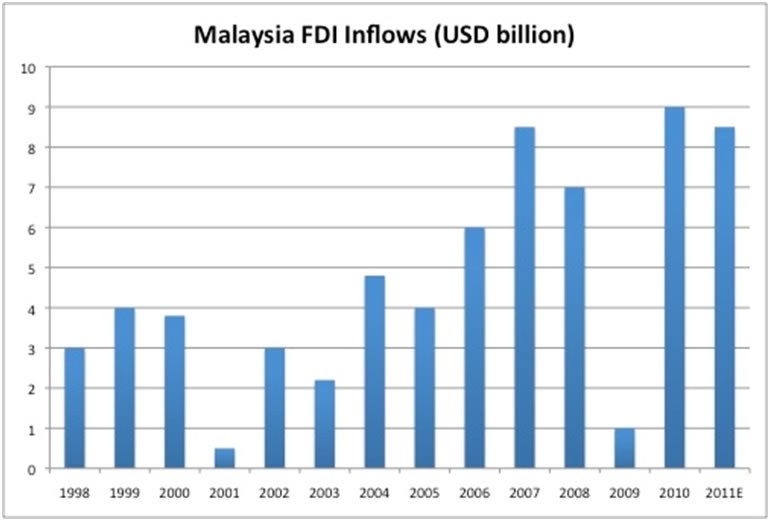

A good indication of the strength of the economy is the level of foreign direct investment (FDI) inflows, which has picked up strongly and will continue to do so, barring a complete collapse of the global economy.

Source: United Nations

Monetary policy remains stable, as does the currency. Given Malaysia’s relatively strong gross domestic product (GDP) growth, albeit below potential, the country shouldn’t ease monetary policy anytime soon–rates are currently at 3 percent. I expect GDP growth of about 3.5 percent in 2012 given the uncertain outlook for the global economy.

Inflation is about 3.3 percent and is expected to recede in 2012 as food prices continue to decline. But in the event of a total global economic collapse or a severe recession in the eurozone, the Malaysian central bank will be forced to cut rates. The bank’s first meeting is scheduled for the end of the month.

That being said, Malaysia has historically been fairly sensitive to global growth and remains vulnerable if the global downturn worsens. The most recent trade figures showed exports expanding by 15.8 percent, supported by commodities. Oil exports were up 87 percent, liquefied natural gas exports rose 82 percent and palm oil exports increased 54.3 percent. The strong growth in commodities more than offset the weakness in electronics.

Malaysian exports to India rose 77 percent, shipments to China rose 37 percent and exports to Japan rose 30 percent. However, exports to the US declined by 5.5 percent and exports to Hong Kong fell 2.5 percent. Meanwhile, import growth slowed to 4.6 percent, bringing the trade surplus to USD4.2 billion.

It’s very difficult for foreign investors to directly purchase shares of Malaysian companies, which is why I recommend investors gain exposure to this emerging market through an ETF like iShares MSCI Malaysia Index Fund

By Yiannis G. Mostrous

Editor: Silk Road Investor, Growth Engines

http://www.growthengines.com

Yiannis G. Mostrous is an associate editor of Personal Finance . He's editor of The Silk Road Investor , a financial advisory devoted to explaining the most profitable facets of emerging global economies, and Growth Engines , a free e-zine that provides regular updates on global markets. He's also an author of The Silk Road To Riches: How You Can Profit By Investing In Asia's Newfound Prosperity .

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.