Gold Stocks and U.S. Dollar What To Expect Next

Stock-Markets / Financial Markets 2012 Feb 28, 2012 - 03:09 AM GMTBy: Chris_Vermeulen

This morning we are seeing the US Dollar index move higher retesting a short term breakdown resistance level. What this means is that the dollar fell below support and is not slowing drifting back up to test the breakdown level. As we all know once a support level is broken it then becomes resistance. So if that holds true with the current move in the dollar we should see stocks and commodities find a short term bottom and continue higher today or tomorrow from the looks of things.

This morning we are seeing the US Dollar index move higher retesting a short term breakdown resistance level. What this means is that the dollar fell below support and is not slowing drifting back up to test the breakdown level. As we all know once a support level is broken it then becomes resistance. So if that holds true with the current move in the dollar we should see stocks and commodities find a short term bottom and continue higher today or tomorrow from the looks of things.

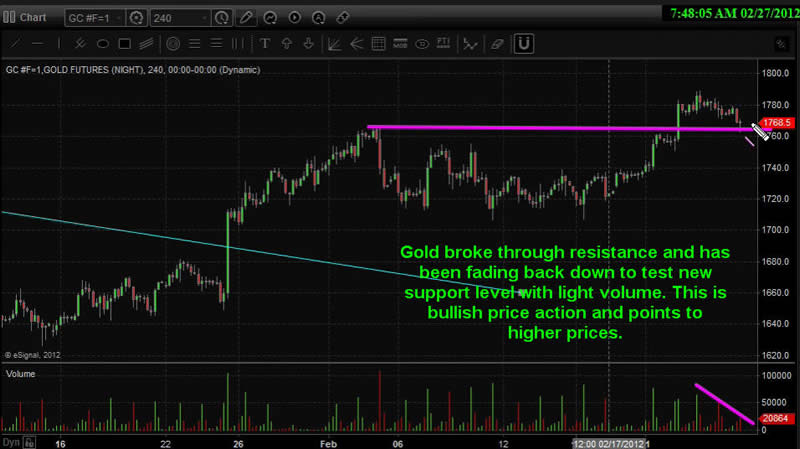

Gold has been pulling back the past couple trading session on light volume which healthy price action. It has done the opposite of what the dollar did above. Gold broke through a key resistance level and is slowly drifting back down to test the breakout level to see if it is support. If so then gold should continue higher in the coming days.

Both silver and gold miner stocks are lagging he price of gold. They have yet to break through their key resistance levels. That being said it could happen an day now as they have both been flirting with that level for a couple trading sessions now.

Crude oil continues to hold up strong and is headed straight for its key resistance levels without any real pullback. Chasing price action like this is not something do often because risk: reward is not in your favor. I am staying on the sidelines for oil until I see a setup that has more potential and less risk.

The equities market remains in a strong uptrend at this time. I do feel a 1-3 weeks pause/pullback could take place at any time but in the grand scheme of things we could be only half way through this runaway stock market rally as noted in the video.

The equities market is going to gap down this morning which is typical in a bull market. Remember. in an uptrend the stock market tends to gap lower at the open and close higher into the close. And it's the opposite in a down trend with stocks gapping higher and sell off through the trading session.

Get My FREE Weekly Newsletter Here: http://www.GoldAndOilGuy.com/

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.