Financial Markets Head Firmly In The Sand!

Stock-Markets / Financial Markets 2012 May 14, 2012 - 05:25 AM GMTBy: UnpuncturedCycle

We now see signs of deflation everywhere except of course in the news where they still insist in talking about the possibility of inflation. On Friday we saw that a drop in gasoline prices dragged producer prices down in April by the most in six months, according to data released by the government on Friday. The Labor Department said producer prices fell a seasonally adjusted 0.2% in April to mark the biggest decline since October. The unadjusted 12-month rise of 1.9% in the rate of wholesale-level inflation was the weakest since October 2009. Energy prices tumbled 1.4% on the month due to a reversal of a recent spike in oil prices as well as continued weakness in natural-gas prices. Prices of intermediate goods, which are partly processed items like flour or lumber, shrank 0.5%, which also was the largest drop since October. Prices of crude materials like raw cotton, grains and crude petroleum tumbled 4.4%. Besides energy, other notable drops came from corn, which dropped 5.6%, and scrap aluminum, which skidded 6.4%.

We now see signs of deflation everywhere except of course in the news where they still insist in talking about the possibility of inflation. On Friday we saw that a drop in gasoline prices dragged producer prices down in April by the most in six months, according to data released by the government on Friday. The Labor Department said producer prices fell a seasonally adjusted 0.2% in April to mark the biggest decline since October. The unadjusted 12-month rise of 1.9% in the rate of wholesale-level inflation was the weakest since October 2009. Energy prices tumbled 1.4% on the month due to a reversal of a recent spike in oil prices as well as continued weakness in natural-gas prices. Prices of intermediate goods, which are partly processed items like flour or lumber, shrank 0.5%, which also was the largest drop since October. Prices of crude materials like raw cotton, grains and crude petroleum tumbled 4.4%. Besides energy, other notable drops came from corn, which dropped 5.6%, and scrap aluminum, which skidded 6.4%.

According to the news services it’s unlikely that officials at the Federal Reserve will be worried by April’s PPI report, as they continue to see interest rates at ultra-low levels through the end of 2014. Then again rates are at historically low levels nominally and they’re already negative in real terms so what else can they do? Of course they could decide to live

within their means but that would drive the world economy into a deep dark depression, so they’ll opt for more printing. Quantitative easing is a euphemism for printing and we’ve already had several rounds of easing here in the US and now it is being tried in Europe and Japan. Even the IMF is getting into the act.

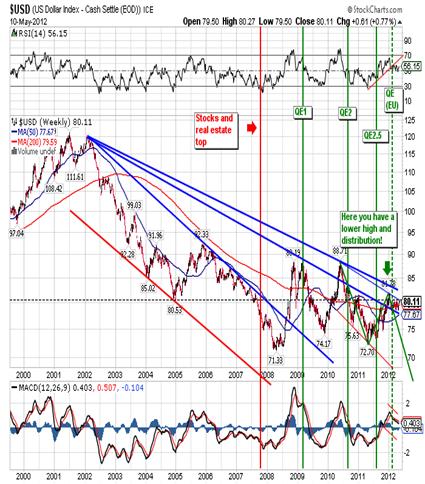

You would think that printing dollars would have a negative effect on the greenback, but that hasn’t necessarily been the case as you can see here:

The dollar has been trending sideways in part do to the residual effects of it being the world’s reserve currency for almost seven decades. The dollar is recognized even in the most extreme corners of this planet so over the short run people flock to it in times of stress. You can walk into any store in Latin America and pay in dollars, but try and do that with Yen, Euros or Yuan. The greenback is the epitome of liquidity.

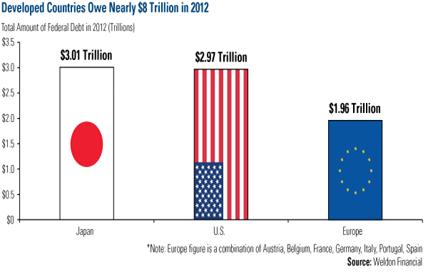

Of course the dollar is being supported by the complete inability of the Europeans and Japanese to solve their own problems. Better yet it would be more accurate to say that they choose to solve problems the American way, i.e. with the printing press. The fact that the Yen and Euro look less desirable makes the dollar look better by comparison, at least for the moment. Then there is the issue of debt. Take a look at the amount of debt coming due in Japan, the US and the EU:

This is for 2012 only and it doesn’t include unfunded obligation like social security or debt on a state or local level. The amounts are truly staggering and it would surely be cause for deep thought if it weren’t for the fact that we’ve been transformed into an ostrich society.

Debt is by far the single greatest issue that the world faces today, and it is the issue no one wants to deal with. Just this week along the Fed sold US $30 billion in three-year notes. Thirty billion dollars used to mean something but now its just another ripple in the pond. Unfortunately it has an affect that most people can’t grasp. The amount of debt and the money required to service that debt is so staggering, so difficult to comprehend, that it hard to know where to start. Supposedly we print in order to promote growth but credit for the average individual is almost non-existent. Small and medium-sized businesses do not have access to credit because sovereign nations are sucking it all up. This “crowding out” is fatal since it’s the investment by small and medium-sized businesses that lead to growth and consumption in the US.

Instead the Fed takes the fiat currency and gives it to the major money centers, almost for free and in return for garbage debt marked to face value. These banks then deposit that money with the Fed and earn interest. No growth is produced, no jobs are created, and no new exports are flowing out to international markets. What’s more the Fed allows people like J. P. Morgan’s Jamie Dimon to receive US $34 million in salary while his company loses US $2 billion in new bad investments! What’s going on in the US financial markets is so bizarre that you couldn’t make this stuff up if you tried.

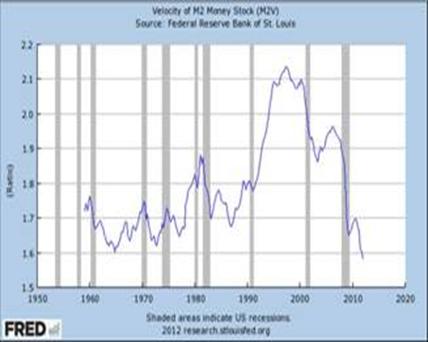

The world waits for inflation because the world is ignorant and believes everything it hears on Bloomberg. In very simple terms inflation comes about as you spend the same dollar at a faster and faster rate. Normally the faster you print the faster you spend because the public doesn’t want to hold on to them. That was the case in 1980 when inflation in the US hit almost 20%, but that is not the case today! In today’s world we spend that same dollar at a slower and slower rate because the new dollars never sees the light of day! That’s why the velocity of money, the economy’s speedometer, is at an all time low as you can see here:

You will never have inflation on the planet earth as long as the velocity of money is declining to all-time lows. Never!! Why is velocity at an all-time low? Because “you” never see one penny of all the fiat currency being printed!

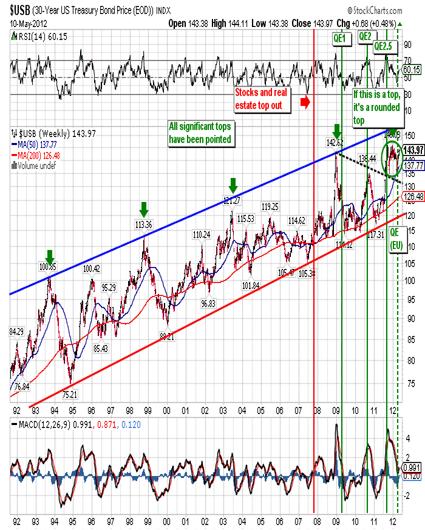

The effects of ‘quantitative easing’ have spilled over into the

the bond market as the Fed transforms itself into the buyer of last resort. It prints more and more money to buy back more and more of its own debt, old debt and new debt, and drive the price of the bond higher and the interest rate lower. Of course it’s an artificial application, a lot like offering an open bar on the Titanic after you hit the iceberg. The single malt goes down good, but in the end you drown.

Bond prices are at historic highs, interest rates at historic lows, but only marginally higher than they were before QE1. So you’ve spent trillions of dollars with little or nothing going into your pocket book, and bond prices have barely moved. If you have just half a brain, that’s got to be a tough pill to swallow! You’ve created huge amounts of debt and yet unemployment is little changed, growth is declining, interest rates are little changed, prices are declining, real wages are declining and forty-six million people are on food stamps. Finally, notice how every major top over the last two decades has been pointed. The only exception is the current top that smacks of distribution. If we are at the end of the road then what’s left for the Fed to do? The answer is nothing!

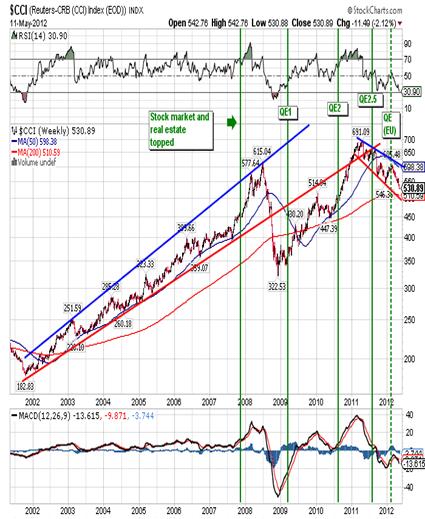

Everyday I receive e-mails telling me that QE3 will push commodities prices higher and every day I tell them that they are wrong. Commodities prices topped out five months after the stock market and once again we see that after trillions of dollars were spent, all we have to show for it are marginally higher highs! In fact these higher highs came months ago and the reality is that Operation Twist (QE2.5) and QE by the EU has done nothing to stop the decline as you can see here:

Recently the CRB Index broke below strong support at 545.00 and is now on its way to test strong support at 515.00. I don’t think the decline will stop there and I am convinced that QE3 will not right the ship. Deflation is now part of our life and I hope they chisel that on Bernanke’s tombstone.

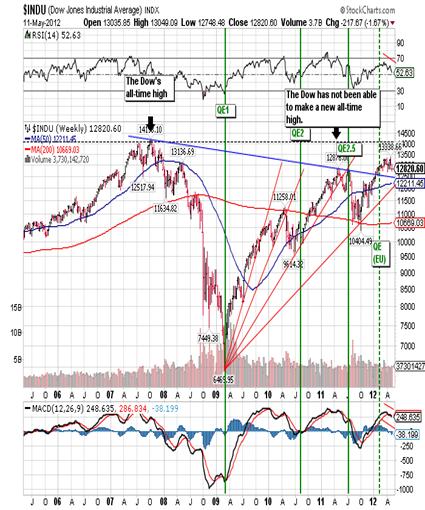

Then we have the strange case of the Dow. The Dow is the Fed’s economic yardstick. As long as they can point to a ris-

ing Dow all is right with the world. Strangely enough both commodities and bonds made marginally higher highs after the Fed spent trillions of dollars but the Dow didn’t! Lately we’ve seen the Dow make not one but four failed attempts to close above strong resistance at 13,232, just nine hundred

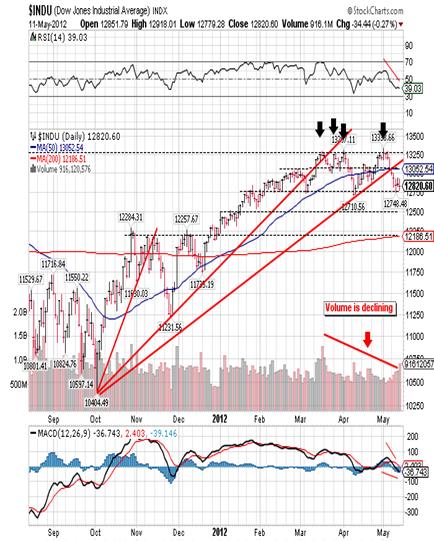

points below the all-time high from October 2007. The last attempt was just one week ago. Since then the Dow has turned down and on Friday it closed at 12,820, only sixty points above the March closing low.

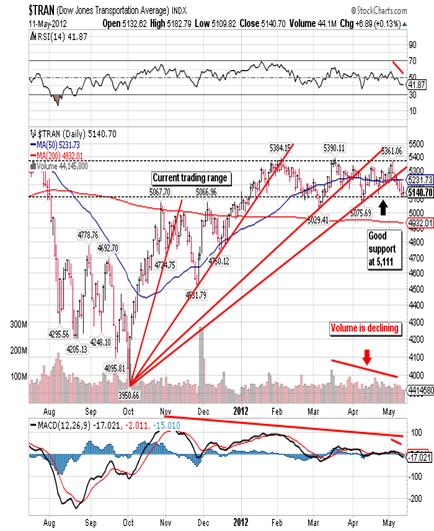

The Transports are a different story as they did manage to move to a new all-time closing high last year:

but the new closing high was not confirmed by the Dow. Now both indexes are struggling to stay above their March

INDEX DATE LOW CLOSE

Dow March 6 12,759.15

Transports March 6 5,047.25

closing lows. If both indexes do manage lower closes it would not mean the bear market rally is over, but it would be an indication that we’ll go on to see a test of the October 2011 lows. With respect to the Dow we see buying every time it approaches the March low but the buying is on low volume while the selling is on higher volume. Finally, I don't like what I see in the Lowry's statistics. Buying Power (demands) has been slipping, and Selling Pressure (supply) has been creeping higher. The negative spread between the two has widened from a recent to yesterday's new high of 151. All in all, it’s a stock market to avoid or possibly short.

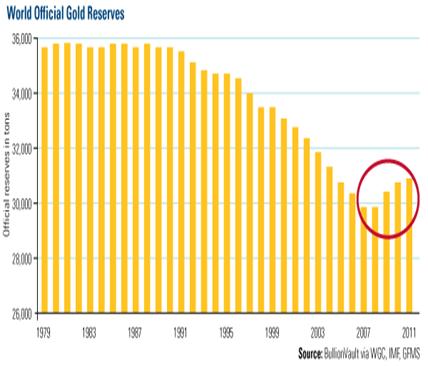

Gold continues to suffer even though emerging market central banks continued their gold buying spree in March. UBS Investment Research says that Mexico bought 16.8 tons, Russia bought 15.6 tons and Turkey added 11.5 tons. Additional small purchases were made by Tajikistan, Kazakhstan and Belarus. As I mentioned months ago central banks have begun accumulating gold reserves since the Federal Reserve cut interest rates in 2007, and HSBC Global Research expects this buying trend to continue for at least another five years:

In March, China’s gold shipments grew to 62.9 tons, which is the third largest volume of gold in a decade from Hong Kong to the mainland, according to UBS. With ongoing rising demand, it is expected that China may overtake India this year as the world’s largest gold buyer.

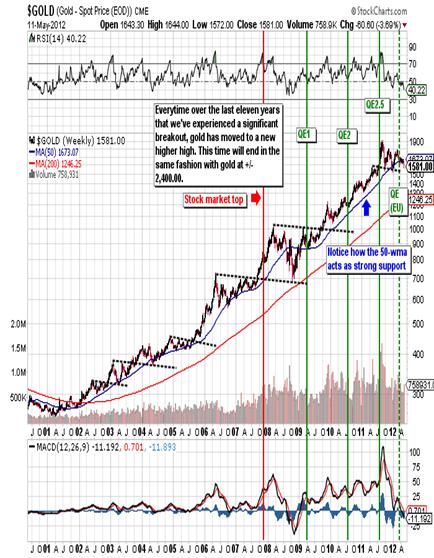

So why is the price of gold in decline? The truth is that it isn’t. It is simply a correction in an ongoing bull market as you can see in the following historic chart:

This is our sixth correction and they occur when the Fed feels the need to suppress the physical market by selling paper gold against it. In some respects it’s the opposite of the bond market where they print dollar to support bond prices. Here they print dollars and use them to sell paper gold thereby suppressing the price of physical gold. It’s all rather Machiavellian to say the least!

What has quantitative easing done for gold? Not a lot if you look at it rationally. Gold rallied from 250.00 to 1,000.00 before the easing began, and with a threefold expansion of the Fed’s balance sheet the price of gold has gone up another 58% to its current price of $1581.00. By comparison the Dow went from 6,600 to 12,800 so you didn’t get much bang for the buck with gold. How can that be? Again, the Fed suppresses the price of physical gold by selling paper gold against it. Why? In order to create the illusion that there are no viable alternatives to paper assets! Of course it helps when you have people out there like Berkshire Hathaway’s Charlie Munger telling everyone that only “Jews in 1939 and uncivilized people” buy gold.

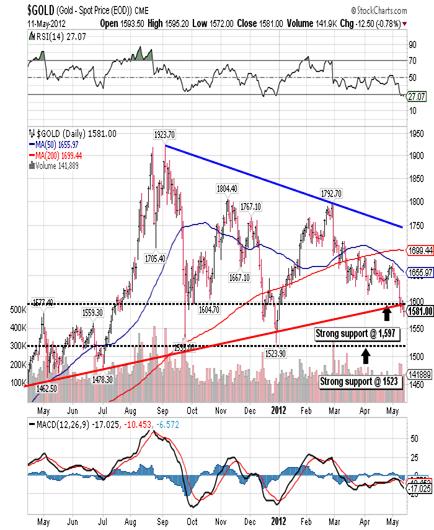

Right now gold appears to be on its way to a third test of strong support at 1,522.20 after the recent break of what was strong support at 1,596.90. That break has put gold into an extremely oversold condition and is the reason I covered my short position Friday morning. In spite of being extremely oversold gold has absolutely no friends and that is inversely very bullish. The last time gold was in a similar position was way back in 2008 and it is worth remembering that gold moved from 681.00 to 1,900.00 with very few stops in between. This time will be no different! Now take a look at the following daily chart:

You can see that the price of gold is below both the 50-dma and the 200-dma, broke support at 1,597.00, and is below the trend line (red line) that comes in at 1,599.00. Although it’s possible that gold could stop around 1,577.00 I would be surprised if it doesn’t test 1,522.20 one more time. That should really squeeze out the last of the longs and make gold absolutely ripe for the picking. I don’t usually like to scale down but I will start to accumulate gold at 1,575.00 and continue buying down to 1,522.00. Finally, I would not be the least bit surprised to see a bottom in gold coincide with the announcement of QE3 and/or some external shock.

CONCLUSION

Obviously you can see that the idea of quantitative easing being good for the economy is just so much bullshit. The Fed is destroying the capital market by pegging and manipulating the price of money and debt capital. Interest rates signal nothing anymore because they are zero. The yield curve signals nothing anymore because it is totally manipulated by the Fed. Capital markets are at the heart of capitalism and they are not working. Savers are being crushed when they desperately need savings. The federal government is borrowing when it is broke. Wall Street is arbitraging the Fed's monetary policy, with the Fed’s blessing, by borrowing overnight money at 10 basis points and investing it in 10-year treasuries at a yield of 200 basis points, all at your expense. The Fed has become a willing accomplice of the traders and robots on Wall Street.

I think the likely catalyst for a financial disaster is a breakdown of the U.S. government bond market. It is the heart of the fixed income market and, therefore, the world's financial market. Federal Reserve mismanagement and interest-rate pegging has produced a market that is artificially medicated. All of the rates and spreads are unreal. The yield curve is not market driven. Supply and demand for savings and investment, future inflation risk discounts by investors—none of these free market forces matter. The Fed dictates the price of money, and Wall Street merely attempts to front-run its next move.

As long as the hedge fund traders and fast-money boys believe the Fed can keep everything pegged, we may limp along. The minute they lose confidence, they will unwind their trades. If that happens, the massive repo structures—that is, debt owned by still more debt—will start to unwind and create a panic in the Treasury market. The question is: Will the central banks be able to avoid a panic given that they have already expanded their balance sheets? The Fed balance sheet was $900 billion (B) when Lehman crashed in September 2008. It took 93 years to build it to that level from when the Fed opened for business in November 1914. Bernanke then added another $900B in seven weeks and then he took it to $2.4 trillion in an orgy of money printing during the initial 13 weeks after Lehman. Today it is nearly $3 trillion. Can it triple again? I do not think so. Worldwide it's the same story: the top eight central banks had $5 trillion of footings shortly before the crisis; they have $15 trillion today. Overwhelmingly, this fantastic expansion of central bank footings has been used to buy or discount sovereign debt.

The U.S. Treasury needs to be in the market for an average of $20 billion in new issuances every week. When the day comes when there are all offers and no bids, the music will stop. Instead of being able to easily pawn off more borrowing on the markets—say 90 basis points for a 5-year note as at present—they may have to pay hundreds of basis points more. Once the bond market starts unraveling, all the other risk assets will start selling off like mad, too. If the bond market goes into a dislocation, it will spread like a contagion to all of the other asset markets. There will be a massive selloff.

I think everything in the world is overvalued—stocks, bonds, commodities, currencies. Too much money printing and debt expansion drove the prices of all asset classes to artificial, non-economic levels. The danger to the world is not classic inflation or deflation of goods and services; it's a drastic downward re-pricing of inflated financial assets. That of course will take commodities with it and leave gold as the only viable alternative. The Fed is now at the end of a $3 trillion limb and it has been taken hostage by the very markets the Federal Open Market Committee was trying to placate. People in the trading desks and hedge funds have been trained to front run the Fed so how does the Fed ever unwind its current lunatic balance sheet? If the smart traders conclude the Fed's next move will be to sell mortgage-backed securities, they will sell like mad in advance; soon there would be mayhem as all the boys and girls on Wall Street piled on. So the Fed is frozen; it is petrified by fear that if it begins contracting its balance sheet it will unleash the demons.

Giuseppe L. Borrelli

www.unpuncturedcycle.com

theunpuncturedcycle@gmail.com

Copyright © 2012 Giuseppe L. Borrelli

- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.