Fixed Savings Rates Near 7%, Despite Easing of Interbank Rates

Personal_Finance / Savings Accounts Jan 26, 2008 - 03:38 AM GMTBy: MoneyFacts

As fixed rate savings continue to fall, Rachel Thrussell head of savings at moneyfacts.co.uk looks at what this sector of the savings market still has to offer.

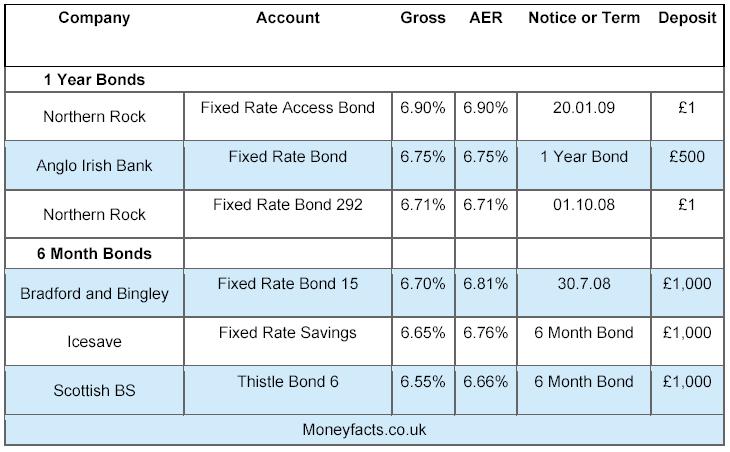

“Although we have seen a dramatic drop in some short term fixed rate savings over the last couple of weeks, with larger institutions such as Halifax dropping rates by up to 1%, there are still some really good deals to be found.”

“The best fixed rate deals don’t last for long, as the Alliance and Leicester 1 year bond paying 7% proved when it was withdrawn after only 5 days. If you are considering getting a fixed rate deal, it is advisable to act soon or risk missing out.”

“But no sooner did the Alliance and Leicester bond disappear, when up stepped Northern Rock with a cracking new deal at 6.9%.”

“Despite SWAP rates having dropped 0.46% this month, other influences such as the institutions’ liquidity seem to be keeping the rates comparatively high. Whatever the underlying reasons for providers keeping the rates high, it is good news for savers.”

“For anyone looking for a high interest paying account without the need for immediate access to the money, fixed rate bonds are paying by far the most competitive rates. With expectations of further base rate cuts in the pipeline, fixed rates are looking a lot more attractive and of course offer that extra stability.”

25.1.08

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.