US Treasury Bonds False Safe Haven, GOLD is the True Sanctuary

Interest-Rates / US Bonds Jul 26, 2012 - 02:11 AM GMTBy: Jim_Willie_CB

As preface, consider that the USTreasury 10-year yield went below 1.4% this week. Some unenlightened celebrate the asset appreciation and point to a successful asset in performance in an otherwise dismal financial market. The Jackass said in the June 6th public article "USTBonds: Black Hole Dynamics" that such a success is a marquee billboard message of economic meltdown and systemic failure. As the rally continues, possibly the onliest rally outside of corn and soybeans in yet another disaster, people should focus on whether the systemic collapse will occur before the 10-yield hits 1.0% in my warning. Focus on four major points:

As preface, consider that the USTreasury 10-year yield went below 1.4% this week. Some unenlightened celebrate the asset appreciation and point to a successful asset in performance in an otherwise dismal financial market. The Jackass said in the June 6th public article "USTBonds: Black Hole Dynamics" that such a success is a marquee billboard message of economic meltdown and systemic failure. As the rally continues, possibly the onliest rally outside of corn and soybeans in yet another disaster, people should focus on whether the systemic collapse will occur before the 10-yield hits 1.0% in my warning. Focus on four major points:

- The unspoken effect of ZIRP (0%) is the powerful ongoing destruction of capital, as the entire cost structure rises

- As equipment goes off line further, the USEconomy will weaken further, in a powerful vicious cycle

- The official Zero Percent Interest Policy is the calling card of the Gold Bull Market, powered by negative inflation adjusted returns on savings

- The USTBonds will fail from their own success, unleashing the Gold Price when the investment community and global creditors realize no further potential appreciation in the most massive asset bubble in modern history, supported by Interest Rate Swap derivative machinery. Money will eventually fly out of bonds and seek true safe haven.

Fear not. The USTBond 10-year yield (TNX) will not and cannot reach below 1.0% as all ponderings of a world with 0% on 10-year yield are divorced from reality. The Black Hole is working hard, gathering force, amplifying the gravitational field. It is happening right on schedule, no surprise here, a very easy correct forecast. The original supposed Flight to Safety in the USTBonds was totally fabricated and phony. As mentioned at least a dozen times by the Jackass, the last half of year 2010 saw the dutiful Wall Street outpost Morgan Stanley devote a fresh $8 trillion in interest rate derivatives, fully documented by the Office of the Comptroller to the Currency. Their reports never make the headlines, since they are so chock full of rancid fetid scum. As the TNX marches down the swirling pathways within the vast USGovt debt sewer-like cisterns, their energy will be derived from the massive recession that has engulfed the USEconomy. Not only is the flight to safety in the USTBond complex a total fabrication falsehood, but the USEconomic recovery is also a fiction written on political propaganda posters. The followon flight to the bubble ridden USTBond is based upon economic wreckage and broad disintegration of the entire periphery and surrounding core to the bond market. The great sucking sound can be heard, much like during the non-earthquake in Virginia in September 2011. Experienced traders are looking at each other, in full recognition that the TNX rally is indeed an endgame signal.

THE BRUSH FIRE PHENOMENON

The LIBOR scandal unleashed brush fires. They started in London but extend throughout the entire Western banking treeline. The scandal that started at Barclays and Lloyds has hit Deutsche Bank, as well as Citibank and JPMorgan. Many more pages will be written on the LIBOR brush fire, as the damages are delineated by those on the opposite side of the price rigging table. The USFed, Bank of England, and Euro Central Bank are directly implicated, casting corrupt light on the central bank franchise system. The clownish supposed economic expert Larry Kudlow actually attempted to claim the crime scene had no victims, as all benefit across the system. The naive Wall Street defender (carnival barker) must not be aware of the damages claimed by the mortgage underwriters in the lending industry, by corporations seeking stable bond yields, and by the swap recipients in countless state government agencies. A figure was put forth this week that caught my eye. For every single basis point in the LIBOR price rig, fully $50 billion in effects result. The market is huge, involving a staggering $370 trillion in worldwide debt. Expect hundreds of high profile lawsuits. Expect dozens of class action lawsuits. Expect well over $1 trillion in total declared damages from the legal attempts at remedy. LIBOR will not go away, since it is actually the heart & soul of the entire lending industry, and of the shadowy derivative market. LIBOR funds the vast derivative market, which is becoming frazzled in a slow disintegration. The brush fire will burn down the USTBond Tower and render useless its Interest Rate Swap buttress structural support, both of which are in an implosion mode.

This article is not about LIBOR and its inner workings, the damage suffered by mortgage underwriters, the short changing of corporations and state agencies involved in swaps. Instead, this article is about the serious jumps in the brush fire, jumps to new areas of scandal, which will take down the system. In no way is the list of potential new fire zones comprehensive. Perhaps a few more will result, since large burning tree branches have a way of being lifted by the high winds of controversy fanned by deep suspicion. The entire document discovery process will be exploited to the fullest, a vast crowbar. Once the lid is lifted via legal discovery of LIBOR criminal collusion, all is fair game to be viewed and pulled out of the vast sea of scum, filth, and rancid paper floating within the big bank balance sheets. It is all admissible evidence. Then there are the communications often shown to be highly revealing to establish motive and paint the pictures in more detail. No longer are those analysts like the Jackass considered biased, tilted, and off the mark when they cite financial corruption as an ongoing theme year after year. The corruption is coming to the surface, fully visible, in a manner to render perhaps fatal damage to the system. My theme has been systemic failure from the inefficiencies and corruption wrought by the Fascist Business Model. Witness it!

My focus is on jumps in the big brush fire that escalate the financial criminal exposures. Entirely new areas of criminal exposure, investigation, and prosecution will emerge. LIBOR was the center, and Barclays was the banker's bank, which owns sizeable equity shares of numerous global banks. Leave aside the difficult questions as to why and how the LIBOR fraud was revealed, and why and how the crime was not shoved under the rug as usual, and what higher power is controlling and orchestrating the maneuvers. LIBOR and Barclays lie at the heart of the Western banking cartel and power structure, labeled corrupt to the core. The big banker brush fire has begun. It is raging, but it will spread to create several other nasty brush fires. The jumps will occur easily, the process having already begun.

MONEY LAUNDERING & NARCOTICS DEPENDENCE

Just in the last ten days, the brush fire jumped into the drug money laundering forest. Permit an imagery jump as well, even though mixed imagery is a cardinal sin of composition. But since on the topic of jumping, a shift in the blaze of imagery might be appropriate. The money laundering of narotics funds is a vast industry. The United Nation task force identified the United States as being unduly reliant upon the benefits of drug money infusion into the banking system following the 2008 Lehman bust, sufficient to prevent a collapse. The UN document reports were published in 2009 and again in 2010. What better place to funnel the money than into the primary banking system from the USGovt agencies responsible for the vast clearing house functions. Representative Ron Paul has addressed this problem in direct accusations. Here is the imagery jump. The operations of money laundering are like a collection of wires without insulated coatings laid out on dark basement floors, one from each bank. The participating big banks do not always have full knowledge of the other and their activities. Many countries are involved, as the distribution rings are vast, like with Mexico in the recent incident. So the wires occasionally cross each other and cause troublesome sparks. The High Scandal in Bank Collusion has already caught fire in the money laundering rings. The bank in the spotlight has been encouraged to align its wires properly, according to the Cooperative Installation Alignment codes from the Underwriters Lab south of WashingtonDC. They will comply, or else resignations will be the least concern of the bank executives. Their lights might go out. This is a topic loaded with risk. The message to take away is that all the major US banks are deeply committed to narco money laundering, which tie in with defense contractors who serve as errand boys and delivery hosts.

INTEREST RATE SWAP & FALSE USTBOND SAFE HAVEN

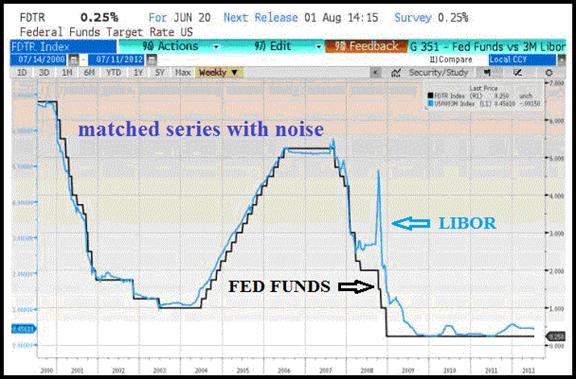

The next jump in the banker brush fire might be the revelation of the primary role played by the Interest Rate Swap derivative contract device. The JPMorgan chief investment office is tasked with fabricating the USTreasury Bond rally. They must maintain the near 0% bond climate despite chronic $1.5 trillion deficts to securitize and largely absent foreign creditors. They farm out the duty to their Morgan Stanley outpost. Hundreds of $billions in artificial USTBond demand can be produced, with trumpets blown by strumpets calling the flight to safety in toxic USTBonds. Recall that the cost of funding the IRSwap mechanical abuse is the ultra-cheap LIBOR rate. Notice the tight correlation between the US FedFunds official rate and the LIBOR rate. The price rigging in the LIBOR came about since the banks refused to lend at the absurd 0% rate dictated by the USFed, working in close concert with the Bank of England. The banks were willing to speculate at that rate, but not to lend at that rate. The target could not be sustained. So the participants to the consensus procedure lied to each other, complete with memos, adorned by winks. The practicality of the ZIRP could not extend into the real world without further collusion.

The scandal will hit the Interest Rate Swap devices and reveal the artificial nature of the entire flight to safety in the USTreasury Bonds. They will be more visible under document discovery amidst the LIBOR investigations. The heavy machinery of the IRSwaps has been exposed to some extent from the May losses suffered by JPMorgan, as reported by the Jackass and confirmed by CEO Dimon. They lied and gave blame to the European sovereign debt fluctuations, when they were actually stable during the focused period of six weeks. Big fluctuations were seen in the USTBond market though, identified in my past analysis. Expect further revelations and documented evidence of vast rigging process in the USTBond market, using the IRSwap devices. The flight to safety will be revealed as a sham. It is only natural in the brush fire jumps.

INSOLVENT BANK RECOGNITION & FASB ACCOUNTING

Another jump in the banker brush fire might be the revelation of the deep insolvency within the big US banks, managed and kept hidden by vast accounting fraud. Recall that in April 2009, the USCongress passed a law to bless FASB rules which allow for accounting fraud. The big banks were permitted to declare any value they wish for all manner of toxic and rancid assets lying within their balance sheet. So they went on course to choose the original book value for many imploded toxic assets like mortgage bonds, like worthless collateralized bond obligations, and many other wonders of financial engineering devised by the wrecking crew on Wall Street. Imagine a raft of memos from bank executives like the chief financial officers, admitting that they are all too aware that balance sheet items were being declared as having untrue values, during quarterly earnings reports. The Sarbanes Oxley violations are too numerous to count.

Imagine the stream of memos expressing concerns over revelation that the banks were aware of the false values disclosed. They will be more visible under document discovery amidst the LIBOR investigations. Imagine mention with relief that the officially sanctioned FASB accounting rules permitted the fraud, replete with fictional values set for assets to share holders in the legal exercise. The giant banks are almost all dead zombies, insolvent to the core. The scandal will likely hit the Financial Accounting Standards Board (FASB) methods and the coverup of deep insolvency. The banks are not performing their normal lending function, since they are insolvent, citing tighter borrower requirements. Tragically, both the borrower is impaired and the lender is insolvent. Expect further revelations and documented evidence of vast falsification of the accounting process in the legally required financial reporting, using phony FASB rules. It is only natural in the brush fire jumps.

NON-US$ TRADE SETTLEMENT & BANK RESERVES MGMT

Another jump in the banker brush fire might be the revelation that the big US banks are preparing for a Paradigm Shift. The Eastern nations are well along a path to settle trade outside the USDollar. The Chinese have arranged for bilateral currency swap agreements with a gaggle of nations, mostly from the East, but also Brazil in the West. Consider such agreements to be the foundation for barter systems coming into vogue. The key is their non-US$ nature. The entire loss of global trade settlement done in the US$ terms is being elevated in importance. Some day soon, it might become the majority of trade. The tipping point could come when over 50% in trade excluding crude oil is managed outside the US$ settlement. Later, like in a year or so, maybe a bigger tipping point could come with over 50% of all trade including crude oil being managed ouside the US$ sphere. The big banks must see the trend, unless they wear blinders, unless their arrogance is so thick, or unless they are so pre-occupied with other brush fires that they leave themselves vulnerable and unprepared.

A very important tenet of global trade and banking is that trade dictates banking activity, not the other way around. It used to be for decades that the USDollar global standard required all trade to be settled in its reserve currency. The banking structures must reflect the reality of trade settlement methods and practices. However, the mortgage bond crisis laden with banking fraud in mortgages and foreclosures rendered damage. The TARP Fund patch job with bait & switch in executive largesse rendered damage. The USFed bond monetization (called euphemistically Quantitative Easing) went out of control, causing a global rise in energy and food prices. The result was great damage rendered. The endless foreign wars on a credit card have caused deep resentment, replete with fraud among the service contractors, also rendered damage. The Iran sanctions, further distracting from the basic violation of Iranian oil sales outside the US$ sphere, have resulted in tremendous insurrection against the global reserve currency.

The major Paradigm Shift in trade has been the emergence of non-US$ trade settlement and the development of devices to facilitate the skirting end around process. Therefore, the banking system must adapt or be left isolated. The big US banks might soon be caught in revelations that they are preparing for shunning of the USDollar in trade payments and satisfaction. They might reveal processes already in place to dump USTreasury Bonds at their artificially lofty values, maintained by high powered Interest Rate Swap machinery during a falsely engineering flight to safety. Imagine open communications about demanded IRSwap usage to maintion artificially rigged high bond principal values. They will be more visible under document discovery amidst the LIBOR investigations. If the big US banks are shown to be diversifying out of USTBonds during the current crisis, it would indeed be devastating news against the Dollar Fortress. Expect further revelations and documented evidence of diversification away from the bubblicious overvalued USTBonds, as the trade settlement pathways avoid the US bull chits. It is only natural in the brush fire jumps.

ALLOCATED GOLD & 40 THOUSAND METRIC TONS SHORT

An assured jump in the banker brush fire will be the revelation of massive raids on Allocated Gold accounts done systematically over two decades. The big Western banks have been illegally grabbing the gold bars via unauthorized leasing, then selling them in the open market in order to maintain the artificially low Gold & Silver prices. The process of revelation is already well along, with important major lawsuits in Switzerland. The Matterhorn case where Von Greyerz pointed out the long delays for his fund investors to receive their gold bars from Allocated accounts has added to the controversy. The gold bars arrived with stamps and dates much younger than the original bars owned, lifting the veil of fraud. The scandal has not yet reached the public eye, but it will very soon. Some Gold experts call it The Mother of All Gold Scandals. Several class action lawsuits totaling several $billion are underway in the elite banker nation of Switzerland. So far, the coopted press has kept a lid on the story. The leaks will be natural, like an overflow of chocolate from the vat. The documents concerning the serious illegal activity will be more visible amidst document discovery during the LIBOR investigations.

My best source shared in 2010 that at least 20 thousand tons of Gold had improperly been taken, leased, and replaced with gold paper certificates in vaulted locations. The bullion bankers were dangerously short. In 2011, he admitted that the criminal activity had easily surpassed 40 thousand tons of Gold illegally leased, resulting in a massive short position for the bullion banks. In 2012, he increased his estimate to between 40 and 60 thousand metric tons of gold illegally seized from Allocated Gold accounts, the short position totally out of control and absolutely impossible to bring into balance with short covering. In the last week, he passed along a communication with a veteran Gold expert with decades of savvy experience. They concluded that remedy for the vast gigantic short position by the gold bullion bankers will send the Gold price well over $10,000 per ounce. They believe probably by the end of the criminal prosecution remedy, the resolution of the defrauded Allocated gold accounts, and the installation of the new trade system alternative, the Gold price will find a natural value at least twice that elevated value. Expect further revelations and documented evidence of vast Allocated Gold account raids, and improper raids to gut the Exchange Traded Funds (GLD, SLV). It is only natural in the brush fire jumps.

The Gold Bull will hit on all eight cylinders, and adopt another four cylinders, when the Allocated Gold account fraud is revealed and hits the news. Only then will public calls for broad criminal prosecution be accompanied by equal calls by the very wealthy. By then, speculation will extend to how high the Gold price can go, and to what limit. Think at that point, unlimited extensive money growth, a gaggle of futile bank aid packages, and currency debasement abuse from the hyper monetary inflation underway for over four years. The Gold price must match the abuse stride for stride, when at the same time react to forced bullion banker purchases of Gold in order to replace the raided Allocated accounts. A frenzy will come.

2011 BANK HEIST & DISPOSITION OF ASSETS

A potential disruptive jump in the banker brush fire would be the revelation of disposition of World Trade Center vaulted assets. Only a moron would believe they vanished. Refer to the enormous amount of purported missing gold bullion, the enormous amount of purported missing bearer bonds, the enormous amount of purported missing diamonds from the infamous 911 event. The political implications would be vast, far more damning than the smoking guns by scientists. They would eclipse any and all claims made by engineers and architects (see AE1000 Group) that undermine the official poppycock story. The documents concerning the flow of gold, bonds, and diamonds might be more visible under document discovery amidst the LIBOR investigations, if a bank heist were to be demonstrated. It is a difficult task to conceal the movement of $100 billion in gold bars, $100 billion in bearer bonds, and $100 billion in diamonds, if indeed it was a bank heist. The Jackass scientific background has consistently brought attention to the vast inconsistencies due to gravitation pull in freefall, to the inadequate burning temperature of jet fuel to alter structural steel, and the absence of aircraft debris on the Pentagon lawn. All official stories have seemed like music on the other side of logic and physics.

Only flag waving morons sporting red white and blue jockey shorts believe the official story, in addition to diehard types who hold scientific evidence in contempt, along with senile veterans well past the octagenarian mark. No disrespect is meant to veterans, who often seem incapable of sorting evidence or even identifying a financial fascist out of uniform. Even the 911 Commissioners admit they were coerced to omit widespread evidence, including testimony from the New York Police Dept captains. They could not voice their objection too loudly, or else lose their jobs and likely pensions too. Whereas in 2003 and 2004 the critics seemed like crackpots, no longer do they seem so wild-eyed and lunatic. Some very well informed people believe the 911 event was actually a bank heist. The odd new twist is the reports that many people at the World Trade Center who were eyewitnesses have died mysterious deaths. Harken back to the Grassy Knoll from that infamous November 1963 event in Dallas. By the 1990 decade, a few dozen people had died from mysterious deaths, many being violent deaths, to the point that no eyewitnesses had survived. A mission accomplished in the sordid history of the United States. The bond trails already cast extremely suspicious light on Cantor Fitzgerald, which curiously moved all its data storage backup facilities to New Jersey only a few months before the incident. Perhaps further potential revelations and documented evidence toward disposition of WTC site assets will surface during the never ending discovery process. It is only natural in the brush fire jumps. One can only wonder what George Washington, Thomas Jefferson, John Adams, and Benjamin Franklin would have to say about these events, or even Dwight Eisenhower and Douglas MacArthur. The notion of patriotism has been redefined by force. Many patriots prefer to think and use the brain stem, turning away from the goose step. Then again, perhaps several hundred discrepancies, inconsistencies, and contradictions to the official story are just a coincidence and the work of our enemies.

MUTUALLY ASSURED DESTRUCTION

A very unusual phenomenon is at work. The three banker camps from the United States, London, and Western Europe are naturally going to protect their own pillboxes. A well connected banker source from Central Europe has shared that Deutsche Bank has already begun to cooperate with the International Court of Hague, working with Interpol officers, bank examiners, experienced attorneys, and judges to assist the prosecution of London and New York bankers. But Deutsche Bank cannot stop the assault by USGovt officials and their army of legal prosecutors, who will tear D-Bank apart. The London bankers have been exposed, laid bare, for the entire world to attack them. The resignations will continue like a parade, soon to involve the privileged groups among the Anglo elite. Expect far more lawsuit effects than prosecutions, since the USGovt legal staff is loaded to the gills with Wall Street friendlies.

The CFTC and SEC and FDIC and FBI have to date been attack dogs and protectors to the Syndicate in the entire scandalous decade. They are the Fascist Business Model soldiers in the field. To be sure, each of the three camps will attack in round after round, bringing charges, seeking remedy, forcing executive sacks, levying fines, and more. They will each enable high ranking bank executives to turn state's evidence, to flip, but the lines of jurisdiction cannot be altered. Each region will protect its own, and attack the other two. A fight to the death might have begun. The banker attacks will not put each other's executives in jail, as much as wreck the Western banking structures. Witness the Competing Currency War in a late stage, as it has reached a new level of financial violence. The Wall Street marketing corps, and the noble financial press, have chosen to trumpet the message that European weakness translates to American advantage. It is like Al Capone competing with Bugsy Moran. It is like John Gotti pointing a finger at Michael Corleone. In the end, they will both succumb to the pressures and the light. Their ships at sea are listing and taking on water. They will all sink. The life boats are made of Gold with Silver linings

GOLD IS THE TRUE SANCTUARY

The concept of solutions for the global monetary system, the global currency system, and the global banking system, have become outright laughable and an insult to the intelligence of observers. The paper system has become weighed down by toxic assets to the point of rendering the entire system insolvent and sinking its future prospects. No new debt can repair and provide remedy for the fatally sick and current overly indebted dying system. The new trade settlement facilities are ready to put in place, based upon a Gold & Silver core. That word has come from a source directly involved in the preparation process for the Eastern Fortress. The trade notes will provide the lubrication to complete trade, which will have a hard asset core. The USDollar will gradually fade away from trade settlement, except for the United States, Canada, the United Kingdom, and possibly Southern Europe. The great tipping point approaches, whereby over half of global trade will be settled outside the domain of the crippled toxic USDollar. The foreign participants can no longer tolerate the bank bond fraud, the central bank debasement, and the usage of bank devices as weapons.

Major changes are coming. A return to a certain type of Gold Standard is right around the corner, awaiting the Western collapse that is in a late stage of pathogenesis. The jumping brush fires that the London, New York, and Western European bankers must contend with will eventually envelop them, doling out massive smoke inhalation. Worst of all, the jumps will expose new areas of corruption every few weeks, sufficient to bring down the system. After all, it is a fiat faith based system. The faith has long ago vanished. All that remains is power politics, arrogance, and corruption. The new system will force the Gold price above $5000 per ounce on a conservative basis. It is all part of the plan not yet revealed. The Gold/Silver Ratio will revert to 20:1 in time. That translates for the math impaired to a $250 per ounce Silver price. These are conservative figures.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"In my 40 plus years of business experience that includes stints in public and private companies as well as entrepreneurial ventures, I have read numerous newsletters in an effort to stay abreast of a rapidly changing world. In my opinion, you seem to be tying the pieces together better than any other source."

(BobT in Maine)

"Your monthly reports are at the top of my list for importance, nothing else coming close. You are the one resource I can NOT do without! You have helped me and countless others to successfully navigate the most treacherous times one can possibly imagine. Making life altering decisions during tough times means you must have all the information available with direct bearing on the decision. Jim Willie gives you ALL the needed information, a highly critical difference. You cant afford to be wrong in today's world."

(BrentT in North Carolina)

"You have warned over and over since Fall of 2009 that Europe would come apart and it sure looks like exactly that is happening. You have warned continually about the COMEX and now the entire CME seems to be unraveling. You must receive a lot of criticism regarding your analysis, trashing the man, without debate. Your work is appreciated. I do not care how politically incorrect or how impolite your style is. What is happening to our economy and financial system is neither politically correct or polite."

(DanC in Washington)

"The best money I spend. Your service is the biggest bang for the buck."

(DaveJ in Michigan)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

edward sealy

02 Aug 12, 23:31 |

Another Gold Pumping Goof

When the globe keeps imploding, investors flock to REAL ASSETS, US Treasuries.The smart money has made a fortune over the past couple of years. |