Significant Stock Market Top, Next Leg Down: Export led World Economic Collapse UNDERWAY

Stock-Markets / Stocks Bear Market Aug 21, 2012 - 03:37 AM GMTBy: Ty_Andros

- Italy: Time to put a fork in it. It’s done!

- 50 year lows equal 50 year highs in FEAR and MONEY printing!

- GRESHAMS LAW strikes AGAIN!

- Faces of CRONY Capitalism!

- Stock Market Top of significance?

- Next leg down: Export led world economic collapse UNDERWAY!

As the Developed World’s Currency, Financial systems and economies move towards their ultimate denouement the next 4 months are JAMMED packed with prospective catastrophes. A number of canaries in the coalmines are singing loudly signaling their COMING demise as the grim reaper continues its march to them. This era in mankind’s evolution will be written about and studied for centuries into the future. Illusions fostered by GOVERNMENT-controlled schools, the main stream media and a global banking cartel are set to FALL.

As something for nothing societies head for their demise as the search for something for nothing hits fever pitch levels in Developed World economies and as the cannibals they are turn on their own societies/wealth producers and anything which can FUND their unpayable expectations and perceived entitlements. Socialism is MISERY SPREAD WIDELY and the blast zone just keeps on GROWING in the centrally planned socialists economies of the west.

Growth in REAL terms is EXTINCT in the developed world but debt (unpayable and inextinguishable promises to pay of ALL TYPES: Sovereigns, pensions, entitlements and FIAT currencies printed endlessly out of THIN air) is GROWING and compounding RELENTLESSLY. UNLESS CENTRAL planners REPENT and repeal their choke hold on their respective economies and UNLEASH the entrepreneurs, and builders in their societies who PRODUCE REAL WEALTH there can be NO HOPE! Don’t hold your breath for this as you will DIE waiting. Prepare for it and thrive.

REAL WEALTH can ONLY be created by manufacturing, growing, or mining it combined with lots of SWEAT equity, risk taking and personal sacrifices. Capital and sweat MUST COMBINE to produce more than it consumes and create SAVINGS which can be used in the next endeavor to create MORE for less and MAKE the gains in productivity necessary for rising standards of living, thriving middles classes and the disinflation CRITICAL for fractional reserve banking to WORK properly.

REAL WEALTH can ONLY be created by SOLVING problems and creating MORE of EVERYTHING that people want for less money and being REWARDED for it as people make the RATIONAL choice of getting more for their families for less of their paychecks. They themselves get rich by providing more quality and quantity. This is VIRTUOS behavior as everyone is served MORE. Businesses are rewarded for providing more for less as are their employees who work for GROWING businesses, have good future prospects and create JOB security for themselves in doing so.

(Authors note: This is NOT Doom and GLOOM, it is the greatest opportunity in the HISTORY. Invest properly for this outcome and GROW RICH, invest looking in the REARVIEW mirror and your wealth will be irreparably DAMAGED. Volatility is opportunity for the prepared investor. As it is priced in and markets ZOOM higher or LOWER to price in collapsing economies and money printing huge opportunities are created. Is your portfolio structured to thrive? The greatest transfer of wealth from those that hold it in paper and financial assets to those that don’t is UNDERWAY. Restoring fiat currencies to sound money and absolute return alternative investments with the potential to thrive in all market (up, down and sideways) conditions is what I do. If you have an interest in learning more and working with Ty: CLICK HERE).

This is why PEOPLE always spend their money better than government as they try and MAXIMIZE the benefits from their PAYCHECKS to themselves and their families. The very IDEA that a faceless bureaurat at any level of government can know what is best for you is OBSCENE and FALSE. As we shall soon see when OBAM@C@RE is implemented their decisions can HASTEN your demise. The main parts of which were intentionally POSTPONED past this presidential election, as its Pandora’s box of evil is UNLEASHED on the public would have destroyed the chosen’s ones reelection chances when they BECAME KNOWN.

The formulas for Economic success are quite SIMPLE (see Germany below), but unknown to the socialist progressives and their leviathan government partners known as BANKSTERS, elites, crony capitalists and the public serpents…er...servants who WORK for THEM rather than their constituents. These are the predators on the public through a variety of ways assisted by the ignorance they have fostered though public schools.

You must understand this is not doom and gloom, it is HISTORY REPEATING on a scale never seen in history and the GREATEST OPPORTUNITY in history for those investors that play it correctly, and the demise of those that don’t. Huge transfers of wealth LOOM from those that store their wealth in PAPER promises to those that DON’T. As incomes collapse so will the bombs…er…bonds that RELY on that income to service the debt they have issued. The deleveraging and FORCED liquidations are still in their EARLY STAGES.

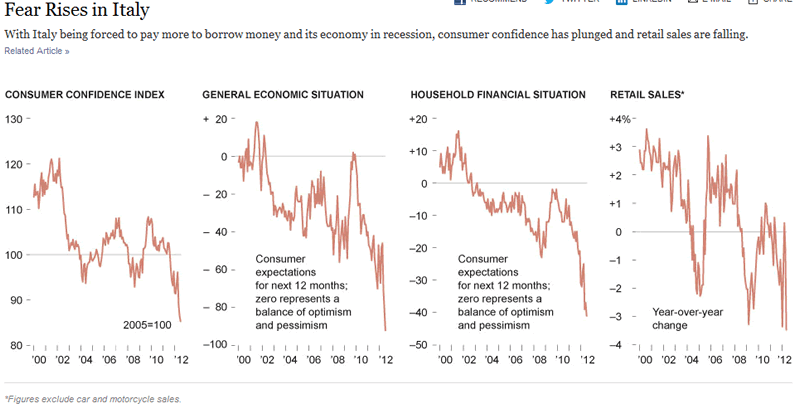

Look no further than NEXT poster boy in the Dominoes game of insolvency known as ITALY. It is now on the DOWN elevator to that place we now see Spain and its economy is imploding in a SIMULAR manner. We are only waiting for the announcements of depression, despair and BAILOUTS. The denials are the confirmation of the unfolding conflagration. First let’s look at sentiment and retail sales (courtesy of the www.NYTimes.com) in the land of great food and wine:

Consumer confidence is at multi decade ALL time lows set in April 1993. Retail sales, household financial situations and expectations are at decade lows, far below lows set at the DEPTHS of the 2008 Global financial crisis and the 2001 recession. These are BLEAK Black numbers from which there will be NO QUICK RECOVERY. NOW let’s look at CREDIT demand in Italy and throughout the Eurozone:

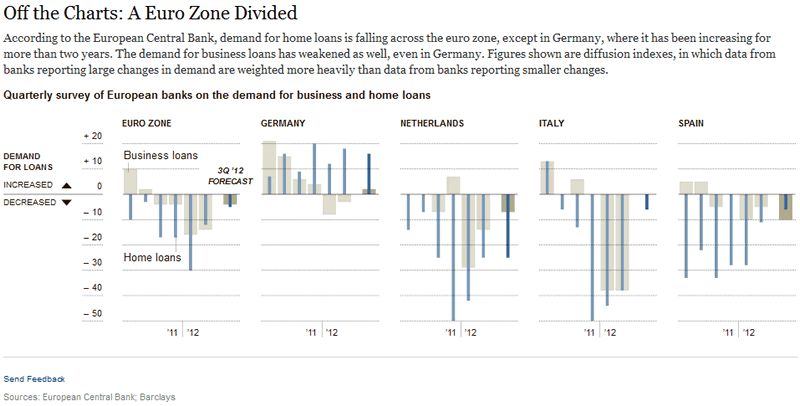

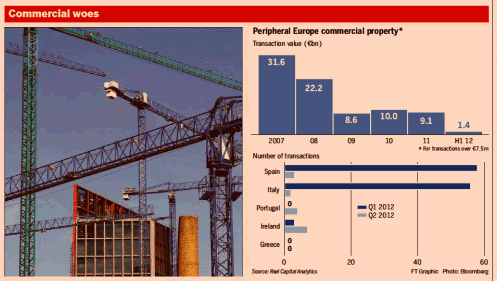

These are disaster numbers for ITALY, SPAIN and the Eurozone in general. CREDIT is COLLAPSING inside credit based monetary and financial systems. Actually Spain paints a better picture than its larger neighbor Italy, both racing to see whose GOVERNMENT policies can lead to economic collapse in the most expeditious manner. This can also be seen in a Collapse in commercial real estate in both markets courtesy of the www.ft.com:

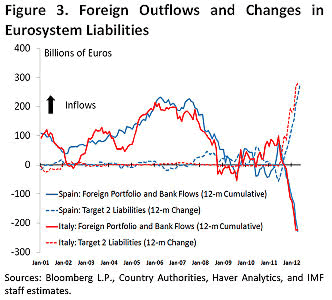

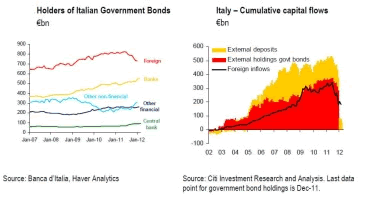

OFF 90%! This is a picture of an UNFOLDING commercial real estate COLLAPSE. It also signals the next wave of defaults looming on HUNDREDS of BILLIONS of commercial estate loans in BOTH countries and deepening insolvencies (not yet reported or REALIZED) in the respective BANKING systems. CAN YOU SAY FORCED LIQUIDATION LOOMS? The sovereign bond markets HAVE BEEN abandoned by international investors and the ITALIAN SOVEREIGN insolvency have been transferred to the DOMESTIC banking system and their holding are DEEPLY UNPROFITABLE as is the case in Spain as well.

These are PICTURES of Collapsing BANKING systems and SOVEREIGN funding. Who are the LENDERS to cover these bank (target 2) outflows? Mostly Germany, France and northern European economies CENTRAL BANKS who loan the outflow back to the banking system that is suffering the run on the banks. This money is LOST and will never return in my opinion, only the announcement of such waits sometime in the future along with the central banks which did the back door lending. ITALY IS AS COOKED as SPAIN, only the coming announcements of the collapse are waiting to surface! PUT A FORK IN IT!

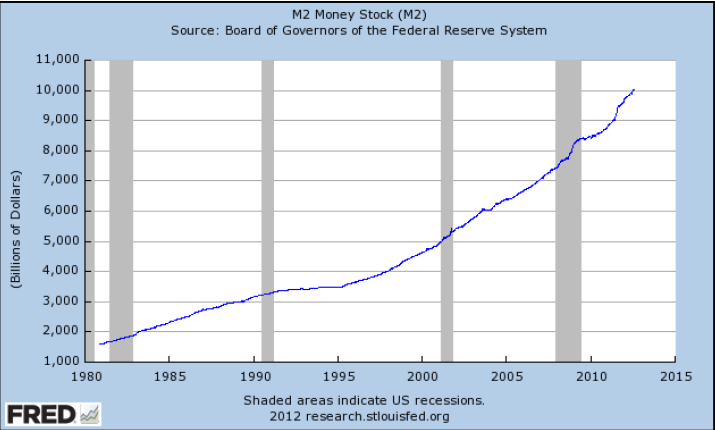

Moving on to the United States here are two charts that should scare the heck out of you. The first is a picture of M2 money supply back to 1980 illustrating an approximate 900% increase and it is a MOONSHOT of MONETARY expansion and is a TRUE measure of base money stock:

Do you think the US economy GREW almost 900% since 1980? No this is the mechanism for ponzinomics and asset backed economies masked the destruction of the REAL economy through assets repricing to reflect the lower purchasing power of the currency they are denominated (In this case it is the US dollar).

“The best way to destroy the capitalist system is to debauch the currency. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million can diagnose.”

- John Maynard Keynes, 1920

The adjusted monetary base (NOT SHOWN) is a politically correct ILLUSION to mask the horror of the money printing to MONETIZE TREASURY and MORTGAGE debt. M2 just breached $10 Trillion dollars and this is the face of DEBAUCHING the currency as Keynes speaks about…

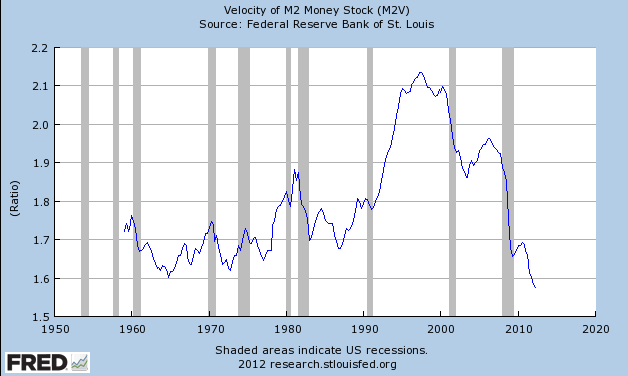

The SECOND chart is a fifty year look of M2 velocity of money which has been CRASHING and is at all-time lows going back to 1958:

Talk about wind shear, when will this picture CLEAR? When that CONTRADICTION is RESOLVED>>> WOW, that is a looming INFLATIONARY DISASTER when VELOCITY TURNS UP. Notice the crash in velocity since the chosen one and his progressives took TOTAL control in 2008? THIS IS THE FACE OF FEAR: fear of GOVERNMENT and the policies they are IMPLEMENTING. That is the result of the corrupt socialist/progressive supermajorities elected in 2008. These are pictures of why the economy can’t GROW and WON”T grow.

In their two years in ABSOLUTE control they passed OB@MACARE, DODD FRANK Financial reform and the stimulus bill which was nothing of the sort. They were the EXTENTION of centrally planned political control and unending corruption being put in place. These laws will be sold over and over to the highest PAYING special interests. Just like the tax code today they will GROW and GROW and be defined by the most recent back room deal. It is the Chicago way, learned in the most POLITICALLY corrupt state and city in the United States.

The stimulus bill was a PERMANENT EXPANSION of GOVERNMENT from 19% of GDP historically to over 24% of GDP (does not include state and municipal spending which will send it over 40%) today.

SUCKING the life out of the private sectors sails as government EXPROPRIATES capital from the PRIVATE sector and uses it for CONSUMPTION which lasts to TODAY. A COLLAPSE in the WORLD economy is UNFOLDING as we write this. These policies and those of the beltway/Brussels central planners are wrapping themselves like a PYTHON around the private sector and SQUEEZING they life out of its PREY (the private sector). It is too late to prevent this death? Yes. Have you ever seen anything escape a python’s DEADLY embrace? NO.

In order to FINANCE the expansion, the government is BORROWING the money, spending it on EXPANSION of government dependency and the regulatory state and CALLING IT growth in GDP. Twenty four percent of GDP is now the new baseline budget with automatic increases in budgets 2 to 3 times the rate of GDP growth. These laws GUARANTEE that government will ABSORB the private SECTOR through runaway SPENDING increases and the collapse of economic activity DETAILED in the velocity chart.

Look at the structural deficits in 4 of the biggest economies TODAY (www.ft.com). This is capital destruction and misallocation to consumption of the most DAMAGING sort:

Only Germany is thriving using the Austrian Model of economic growth: savings plus capital investment and the creation of REAL wealth through the factory room floor driving wealth creation (now this is ending as you will see below). Do any of you know Germany has no MINIMUM wage? Do you know that Germany has the lowest unemployment in Europe and no problem with youth unemployment?

If anyone REALLY knew the chokehold unions have on employment laws in the southern Eurozone they would VOMIT. Barriers to entry for new companies, economic growth and the source of the youth unemployment. They are absurd barriers to “more for less” aka as capitalism. Repeal these laws and watch UNEMPLOYMENT tumble and productivity SOAR as the unemployed quickly displace overpriced labor and unit labor costs rapidly become more globally competitive. Of course that would be out with the crooks and in with the new as historically repressed groups would be allowed to work in a free rather than a centrally controlled economy.

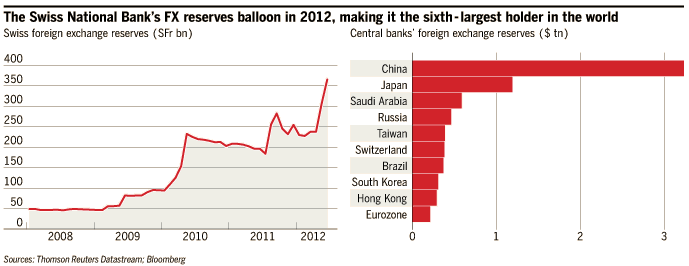

As MASSIVE flight of capital flows into SWITZERLAND seeking the safety of the Swiss franc they are sowing the seeds of their own direction as Gresham’s law: Bad money drives out GOOD money works its destruction:

Wow, since 2008 Swiss national bank (SNB) reserves are up almost 700%. Notice when the Swiss CAPPED the franc at 1.2 to the Euro in August last year. Counting July 2012 which is NOT shown they have DEBASED the currency close to 100% of GDP since last September (when the currency peg was begun). This is unsterilized as the holders are selling FX for Swiss francs and putting them into their accounts and the SNB is putting them into storage (removing euros in the markets) until recently.

Now those forex flows appear to be heading from the SNB to Asia, Canada and Australia creating a big bid in the AUSSIE and New Zealand dollars and main stream Asian currencies in general. Let’s not forget the LOSSES they undoubtedly taking on any euro denominated reserves such as Eurozone government bonds and the upcoming QE which is unavoidable.

Think about it for a moment. Capital flight and fear is prompting flight into the Swiss franc for safety and soundness. But the currency they have converted to has almost been doubled in size (debased by 100%) in 12 months. Theoretically the purchasing power of their sanctuary currency should someday be CUT IN HALF over time.

Unknown to most of these safety seekers is the size of UBS and Credit Swiss balance sheets which are combined approximately 700% the size of the Swiss GDP. Those banks if forced to mark to market mere 15% of their risk weighted assets rather than use tier 3 VALUATION models would instantly VAPORIZE a sum approximately equal to the GDP of Switzerland of 100% of GDP.

So when the ultimate denouements of insolvent banks becomes reality that SAFE Swiss currency will suffer another MIGHTY blow as the printing presses will do WHATEVERS NECCESARY to PRESERVE the Swiss banking system. OUCH, what a reward for seeking safety. YOU CAN NEVER STORE WEALTH IN PAPER EVER AGAIN, until the reformation after the collapse of the fiat currency and monetary systems.

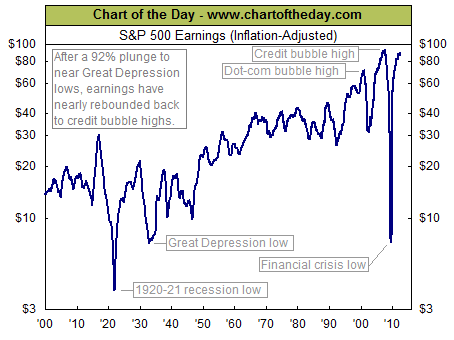

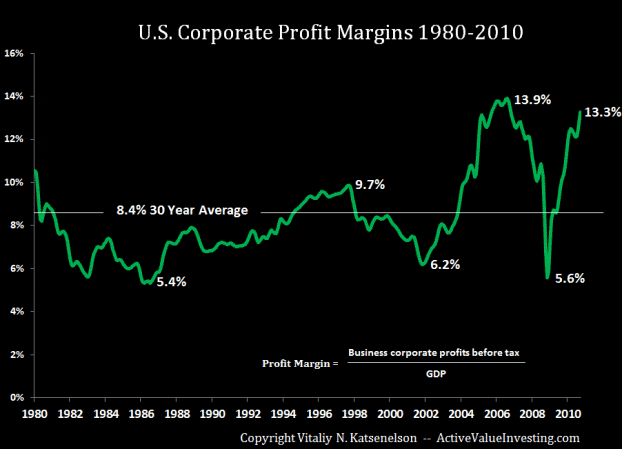

Profits are making double tops in the S&P 500 and are way out of line in historical context. We are going to look at two charts illustrating the absurdity. This is also the face of crony capitalism as I shall outline using a quote from Jeremy Grantham.

Look closely at both charts, both show DOUBLE TOPS and wolf waves like the May edition of of TEDBITS. The wolf waves are FAILING. LOOK OUT BELOW!

Quoting Legendary Investor Investor Jeremy Grantham: "Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system and it is not functioning properly."

Quoting Adam Butler and Mike Philbrick: “On this basis, we can expect profit margins to begin to revert to more normalized ratios over coming months. If so, stocks may face a future where multiples to corporate earnings are contracting at the same time that the growth in earnings is also contracting. This double feedback mechanism may partially explain why our statistical model predicts such low real returns in coming years. Caveat Emptor.”

The highs in profits have occurred and a top is in. Now as the economies embark on their next leg down in equities and economies this secular bear is set to BITE. I expect PE’s to decline to the 6 to 8 range or lower before the public servants wake up. This is a secular bear market and no amount of money printing will stop the decline to these valuations at some point. Do you have “professionally managed” strategies in your portfolio which can make money as markets decline? This is what I do for investors.

I will add this is the face of crony capitalism written LARGE as the Chicago boys in the beltway have regulated new competitors out of the competition by reams of regulations to protect you from the new products and services which would give you more for less of everything into regulatory monopolies (see profits above) who charge MORE FOR LESS of everything you use boosting the bottom lines of their campaign benefactors.

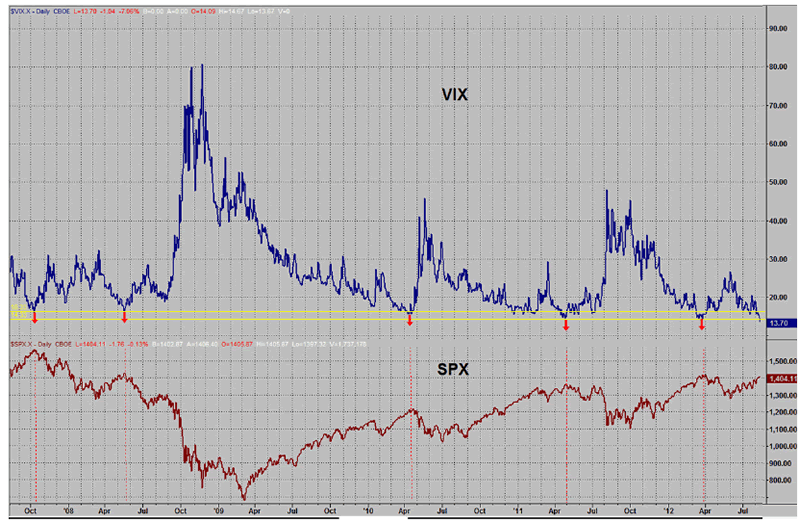

Adding to the idea profits have peaked. A stock market top should be ANTICIPATED if the history of the VIX since 2008 is any guide. Let’s take a look at a chart I just received from market technicians Garrett Jones and Peter Eliades:

The history of the VIX over the last 5 years would indicate Obama is going to get a taste of the medicine John McCain experienced headed into the final 90 days before the election. The next 90 days should be challenging for the stock market and short positions are eerily back NEAR the levels just before the 2008 CRASH. “Vengeance is mine sayeth the lord”. Can High Frequency trading, the president’s working group (PLUNGE PROTECTION TEAM) and the FED save the day for the administration? The public has abandoned the markets…

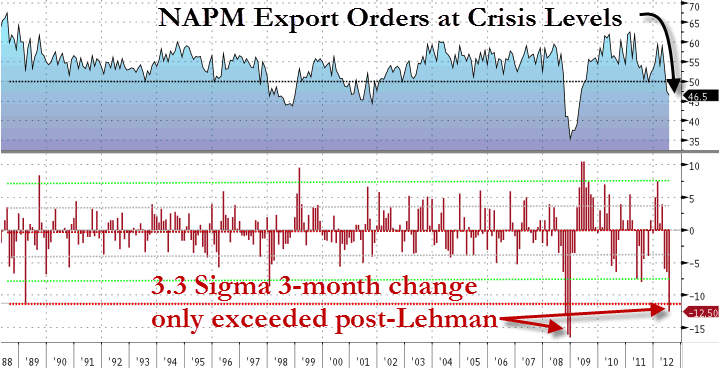

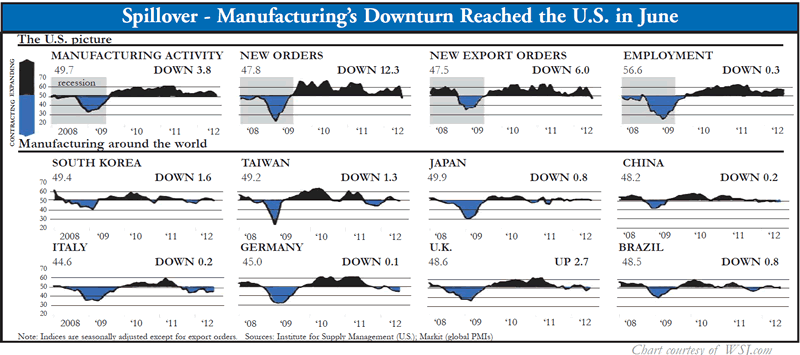

Last but not least in today’s missive is this BLACK SWAN is this NAPM (national association of purchasing managers) export orders from www.zerohedge.com:

This is the face of an export lead recession descending on the WORLD. This is an EXTREMELY rare and IMPORTANT warning shot to global economic activity. Take particular notice the velocity of the decline: much faster than 2008. Notice the last time we saw these levels was OCTOBER through December 2008. Do you remember those dates? They are the depths of the global financial crisis in 2008. This is a subset of the wider NAPM reports.

Last I looked almost 80% of the G20 is in a contraction. Let’s take a look at a few countries scattered around the globe:

See any numbers above 50 in the main indexes? These are a diffusion indexes, anything below 50 signals contraction and the vote is UNANIMOUS. Anybody remotely familiar with the unemployment numbers KNOWS unemployment is several points higher than is reported by the liars with numbers at the Dept. Of labor!

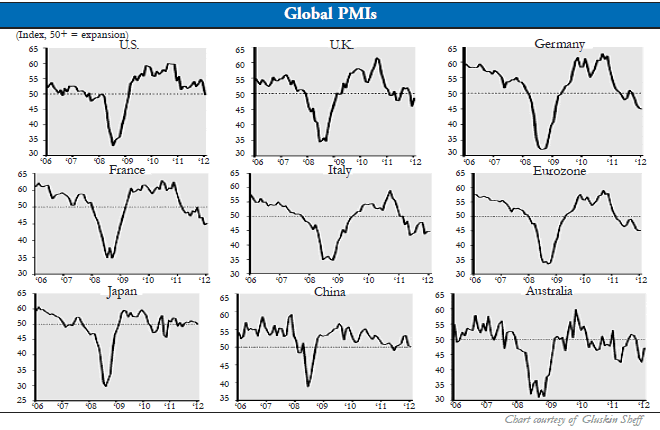

Nope, me neither. Many have fallen further since this chart was created. Let’s look at the Global PMI (purchasing managers indexes):

OOP’s, no growth here or there or anywhere.

In closing,

The rubber band has SNAPPED on the counter trend bounce off the March 2009 economic lows. The LTRO and QE are done everywhere but the UK and Japan. Now its bombs away and look out below? Expect a new round of monetary central bank cannons to fire away as they attempt to overcome EVERMORE POOR economic policies with money printing. QE may work at the bottom of a stock market selloff, but is extremely ineffective at extending highs. NEW Equity BULL markets do not begin with the VIX at 14.

Bill Gross of PIMCO authored an EXCELLENT comment on the “DEATH of Equities” (read it at www.pimco.com ) and his points are all true, but he left the elephant in the room. Failing to mention the illusions spawned by fiat money as stocks can outperform NOMINALLY as they go higher to reflect the lower purchasing power of the currency they are denominated in. During periods of financial repression negative interest rates of 9% or more should push stocks higher an equivalent amount. Don’t be a fool for CENTRAL BANKS, BANKSTERS and PUBLIC servants.

NOMINAL Growth has slowed to zero or lower (back out debt/borrowing called GDP and economies are crashing) depending on which country you view, REAL growth died decades ago. But the payments DUE and compounding on the debts marches on.

Centrally planned socialist economies of the developed world are dying the death they always do. But those in charge WILL NOT restore freedom, repeal legislation and regulations, reduce taxes and quit stealing money through debasement. No amount of money printing, new regulations, higher taxes and less personal freedoms will work to revive growth, although the powers that be will do more of all of them. DESTROYING the INCENTIVES to produce of existing businesses and preventing formation of NEW ones. A Recipe for Economic and SOCIETAL DISASTER!

(Authors note: This is NOT Doom and GLOOM, it is the greatest opportunity in the HISTORY. Invest properly for this outcome and GROW RICH, invest looking in the REARVIEW mirror and your wealth will be irreparably DAMAGED. Volatility is opportunity for the prepared investor. As it is priced in and markets ZOOM higher or LOWER to price in collapsing economies and money printing huge opportunities are created. Is your portfolio structured to thrive? The greatest transfer of wealth from those that hold it in paper and financial assets to those that don’t is UNDERWAY. Restoring fiat currencies to sound money and absolute return alternative investments with the potential to thrive in all market (up, down and sideways) conditions is what I do. If you have an interest in learning more and working with Ty: CLICK HERE).

We at the proverbial end of the line for these policies but those in charge know nothing else. So they will continue until their economies are GROUND to dust under them. It must be mentioned that Mitt Romney has picked up the gauntlet of fiscal and moral solvency with the addition of Paul Ryan (Austrian Economist and devotee). Ryan is truly a Jeffersonian REPUBLICAN.

"I ... place economy among the first and most important of republican virtues, and public debt as the greatest of the dangers to be feared. ... Taxation follows that, and in its turn wretchedness and oppression. ... We must not let our rulers load us with perpetual debt. We must make our election between economy and liberty, or profusion and servitude."

-Thomas Jefferson (1816)

Wretchedness and Oppression are the calling cards of centrally planned governments and socialist progressives. The destruction of the constitution and the US economy are almost complete. The final denouement is at hand. Look throughout the developed world, doesn’t wretchedness and oppression describe the situation TODAY? Don’t most people fear the government? Yes and Yes.

Romney is a smart man and a problem solver as is Ryan. But they need to run after the collapse (which they will be blamed for if in office) though they are just holding the bag for all that has gone before. I support them in their quest for responsibility to us and future generations. This has changed the election from a referendum on Ob@m@nomics to a stark choice of are we going socialist or back to capitalism and I fear for our futures.

Unfortunately the citizens of the US have been impoverished and now constitute a something for nothing society. They live in fear of the future and have lost the ability to believe in themselves and being personally responsible to themselves or their children. They have not been educated in a manner which allows them to compete globally or locally. And are told daily that the government will take care of them since they don’t believe they can take care of themselves. This is an election pitting the makers of wealth versus the takers, and the takers outnumber the makers by large margins.

“It is not an endlessly expanding list of rights ---the “right” to an education; the “right” to health care; the “right” to food and housing. That is not freedom. That is dependency. Those are not rights. Those are the rations of slavery – hay and a barn for human cattle.”

- Alexis de Tocqueville

Over 1/3rd of the UNITED STATES citizens are on the dole (up from 6% in the early 1970’s) in one form or the other and that does not include social security and Medicare. Ob@m@ has been extremely successful in growing government and government dependence of one sort or another (tens of millions of new dolees). Today they may feel secure but their futures are being ruined and his campaign is based on promising more goodies to those his policies have destroyed personally and professionally.

“Men prefer a false promise to a flat refusal…” - Quintus Cicero

They don’t even know his policies are the source of their distress. Most modern elections now go to those who promise the most something’s for nothing without exception. Will this election be different? I don’t believe so.

The American people in general DO NOT have the ability to understand the issues and make the responsible choices; they have been dumbed down and have no knowledge of history or belief in themselves. So they will repeat it.

“Most people want security in this world, not liberty.” – H. L. Mencken

They will surrender freedom and the chance at prosperity for the perceived safety of government programs. It is the end of the FOUNDING FATHERS Empire and the next chapter in dictatorship and socialism which will end as it always does with death and wealth destruction (already underway). Lead by narcissists, socialist/progressive and future dictators. Look at the leadership of the developed world’s governments and for the most part they are the definition of the previous sentence!

Anyone remotely familiar with the federal budget KNOWS that entitlements and mandated spending is GREATER than all the revenues of the federal government. This video sent from Peter Degraaf (www.pdegraaf.com): “It explains why America CANNOT balance its budget, and the consequences of continuing in the same direction. It also discusses what must be done if we are to survive economically. No screaming or yelling, just a calm, cold, factual presentation you really must see.”: http://www.youtube-nocookie.com/embed/EW5IdwltaAc?rel=0 . Have you ever seen the mainstream media report this? NO. Not once, but the useful idiots wouldn’t understand it anyway. I recommend Peters work to anybody that wants excellent precious metals analysis. It is affordable and very helpful.

Thank you for reading TedBits. If you enjoyed it...

Subscribe, it is free:

Send it to a friend:

For greater insight into the philosophy behind Tedbits, have a look at the Tedbits Overview - To help understand our mission in serving you, the TedBits Overview gives a broad description of what's unfolding globally and what you can expect from Tedbits as a regular reader.

By Ty Andros

TraderView

Copyright © 2012 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

FINGERS of INSTABILITY

FINGERS of INSTABILITY