The Bottom Line on Gold, the U.S. Dollar, and the Euro

Commodities / Gold and Silver 2012 Sep 14, 2012 - 10:45 AM GMTBy: Casey_Research

Louis James, Casey Research : One of the points we've made several times over the last year is that traders stuck in an old paradigm are frequently selling gold for the wrong reasons.

Louis James, Casey Research : One of the points we've made several times over the last year is that traders stuck in an old paradigm are frequently selling gold for the wrong reasons.

The most egregious (or just plain silly) example is that gold often drops when the euro drops.

This happens, not because there's anything wrong with gold at such times, but because gold is priced in dollars. Instead of being thought of as a store of value in many investors' minds, gold is viewed as a hedge against weakness in the dollar.

But what are dollars priced in?

Nothing, actually. Purchasing power is the underlying reality any "price" for dollars should get at, but that's hard to measure – and the government can't be trusted to report the truth about this.

Unfortunately, in today's world currencies are valued in many people's minds by their "strength" in foreign exchange markets.

Maybe that's in part because nobody believes CPI statistics anymore.

At any rate, the dollar is frequently valued in relation to its main competitor for reserve currency status. In other words, to many players in the market, the dollar is priced in euros.

So when the euro gets slammed, the dollar rises, and this apparent "strength" of the dollar makes gold seem less attractive as a hedge, and gold sells off.

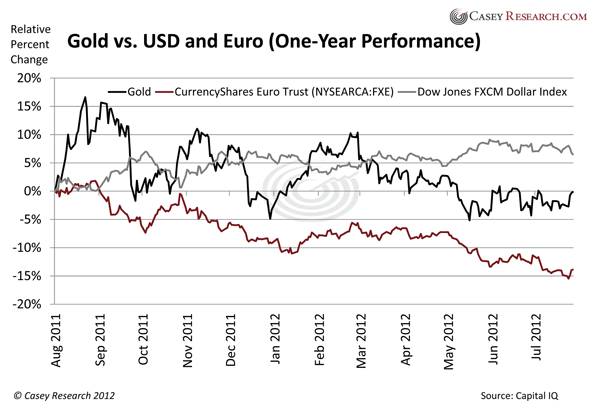

You can see this inverse correlation between gold and the dollar – as well as a very tight correlation between gold and the euro – in this chart of recent price action.

The pattern is very strong. The inverse correlation between the dollar and the euro is extremely high, at -0.92. The inverse correlation between the dollar and gold is not as high, but still very strong: -0.78. And the correlation between gold and the euro is also very high: +0.74.

In our view, this set of relationships clearly shows the error of those caught in this trading paradigm.

The euro is not backed by gold, nor anything at all.

It's a floating abstraction, even more nebulous than the dollar. Gold is a solid commodity, the ultimate safe haven people all around the world turn to when the acceptance of paper currencies and other assets is in doubt.

There's no valid reason for gold to gain and lose value in concert with the euro – it's merely an artifice of both gold and the euro being "not the dollar."

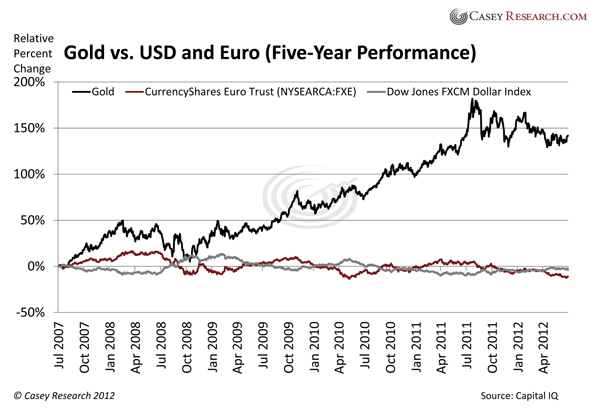

This point is clearly evident in a longer-term chart of the same variables as above.

As you can see, while in the short term gold and the euro seem alike (alternatives to the dollar), over the long term, the euro and the dollar are much more alike, while gold is a beast of an entirely different nature. The euro and the dollar take turns winning and losing against each other, but both are being debased, both are losing ground in the real world, and both have lost a lot of ground against gold.

Now, which of these three would you like to trust your savings to?

And which would you like to speculate on, going forward?

The answers are crystal clear to us here at Casey Research, and they form the basis of our recommendations in our metals newsletters.

Holding precious metals is an excellent way to preserve wealth. Investing in specific mining companies that are poised for growth and/or a takeover by a larger company can be a way to increase your wealth many times over. But not every junior mining company offers such promise... and timing is an essential key to successful investing with this strategy.

Louis James, Casey Research's metals and mining investment strategist, knows the ins and outs of the junior mining sector and has an uncanny ability to sniff out the best prospects. Learn how he does it – and more important, how you can put his expertise to work for you.

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.