Stock Market Sitting on the Precipice

Stock-Markets / Financial Crash Oct 09, 2012 - 02:44 AM GMT The SPX is sitting at Short-term support at the close. My model suggests a very powerful move is in the offing, in which the next target may be as low as mid-Cycle support at 1373.79 before the next bounce back, possibly to the 50-day moving average at 1423.77. Once 1373.79 is crossed the second time, the crash may be underway. The Broadening Wedge at 1320.00 may only enhance the decline, since most Broadening Wedges don’t call for a bounce, while the Orthodox Broadening Tops do.

The SPX is sitting at Short-term support at the close. My model suggests a very powerful move is in the offing, in which the next target may be as low as mid-Cycle support at 1373.79 before the next bounce back, possibly to the 50-day moving average at 1423.77. Once 1373.79 is crossed the second time, the crash may be underway. The Broadening Wedge at 1320.00 may only enhance the decline, since most Broadening Wedges don’t call for a bounce, while the Orthodox Broadening Tops do.

I have studied these formations and once the trigger (1395.00) is crossed, you may have a panic sell-off within 3 days. My Model suggests that the whole decline may be over by Friday. Following that, we should see a minimum 62% rebound out of the low. The rebound out of the Flash Crash low in 2010 was 78%. If you cannot make a quick trade at the low, then stay in cash until the rebound is over. There may be some attempt to keep the market higher until the election. We’ll have to evaluate the conditions as they arise. Suffice it to say, by the time the election is over, the decline will resume in full force.

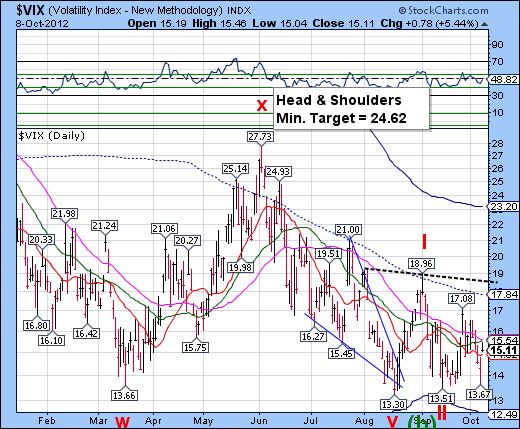

VIX was trapped today between short-term support and 50-day resistance. My Model suggest this condition may not last through the night, as the VIX may be headed above Cycle Top resistance to its current target of 24.62. There it may form a neckline for an inverted Head & Shoulders pattern with a minimum target in the high 30s. Let’s let it play out to see how this rally develops.

NDX has broken support at its Intermediate-term average at 2806.12 and is testing the 50-day moving average at 2774.44. This decline is being led by AAPL, which has already crossed below its 50-day moving average, so the NDX 50-day is at risk as well. It has a giant Broadening Wedge formation that, if triggered 2655.00, has an average target of 2122.00. There are other formations that may indicate deeper lows, if triggered.

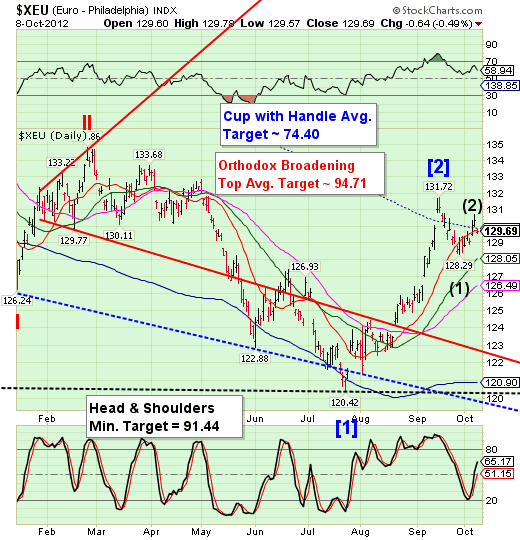

XEU may be starting its wave (3) of [3] of III at this time. It is often signaled by a dramatic acceleration, so it’s time to have your positions prepared for such an event. Virtually all commodities are following the pattern set by XEU.

Time to go.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.