Cost of Presidential Campaigns Show Big Problems for the U.S. Dollar

Currencies / US Dollar Nov 08, 2012 - 01:54 PM GMTBy: William_Bancroft

There has been much discussion recently about the growing cost of running to be President of the United States. The Presidency has been described as the ultimate recession proof commodity. Others might tell you it’s just the price to climb aboard and loot the good ship America.

There has been much discussion recently about the growing cost of running to be President of the United States. The Presidency has been described as the ultimate recession proof commodity. Others might tell you it’s just the price to climb aboard and loot the good ship America.

Whatever is true, the dollar cost of getting into the Oval Office has been rising at a stunning pace, and this is no new phenomenon. Interestingly though, the cost in gold ounces of running for office has not been rising nearly so fast.

Today it requires a block of dollar bills 40 feet by 50 feet by 31.25 feet to run for office, or a bit more than a cubic metre of gold bullion (118.37 cm by 118.37 cm).

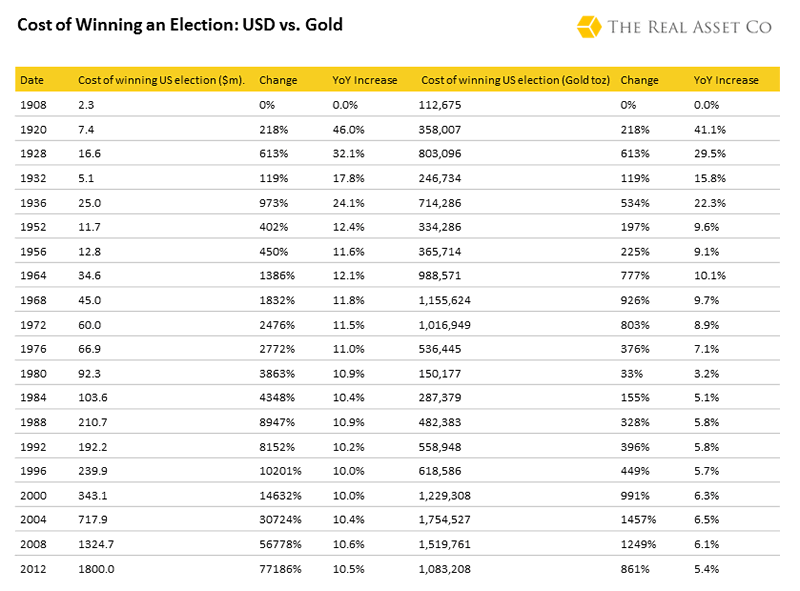

The dollar cost of running for President in 2012 was forecast to be $1.8bn by the Centre for Responsive Politics (a pretty good estimate given the eventual costs of $1.9bn). This is 77,186% higher than it was in 1908, which marks a cost increase of 10.53% every year for 104 years.

Compare this to the cost in gold ounces, which has risen by 861% over this time, a yearly rise of 5.44%.

Planning on running for office? Look to gold bullion

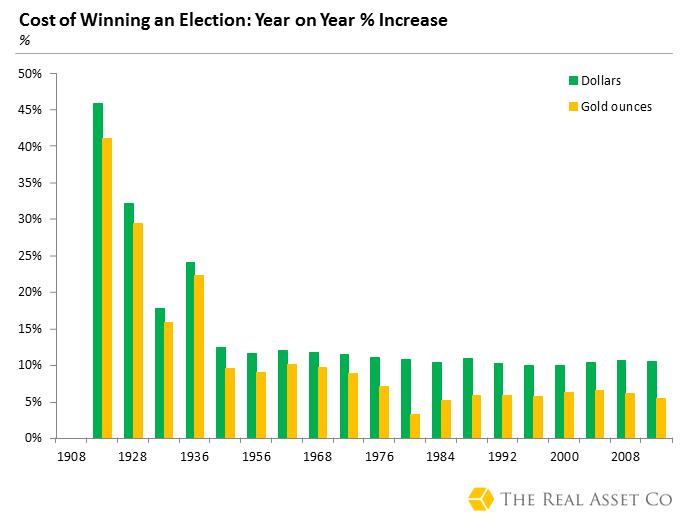

For much of the 20th and early 21st centuries the cost of running for President has been rising nearly twice as fast in greenbacks compared to gold ounces.

Don’t take our word for it, look at the chart below:

NB – We could only find data of $15m attributable to the Republican campaign in 1936, so conservatively guesstimated $10m for the Democratic candidate.

The history of American political funding is one littered with the great names of American business and commerce, who sought to exert their control in the jurisdiction they did business in, later followed by money flowing in from the labour movement as well.

This story, as told by George Thayer in his book, ‘Who shakes the money tree? American campaign financing practices from 1798 to present (1973)’, shows campaign funds rising in a quasi-political cash race for many decades. Thayer’s book provides the data we use for the pre-1972 election races. For data after this we have lent on the excellent Centre for Responsive Politics.

Is this trend set to continue?

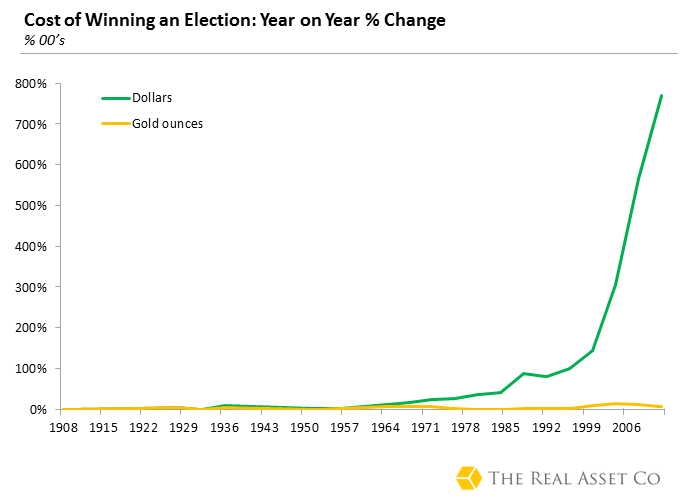

What is most interesting though is how the rising dollar costs have been compounding themselves year on year, taking off like a veritable rocket. The pace of this cost acceleration is significant, and when plotted against the rising costs in gold terms, gives food for thought.

Take a look at the graph below, which takes the data from our table above to show directional trends in funding costs in dollars and gold.

From the 1960s the genie is starting to escape the bottle, and after the 1970s and Nixon’s closing of the Gold Window pass by the trend is really starting to manifest itself.

But, the really breath-taking part of this graph is from 1999 onwards; the era of ‘the Greenspan put’, low interest rates, and what we were told was the ‘Great Moderation’.

From Gold Standards to the closing of the Gold Window

Those with a grasp of monetary history will spot how closely the lines of the graph track each other from 1908 until the late 1950s. For much of this time period the dollar was linked in greater or lesser form to gold.

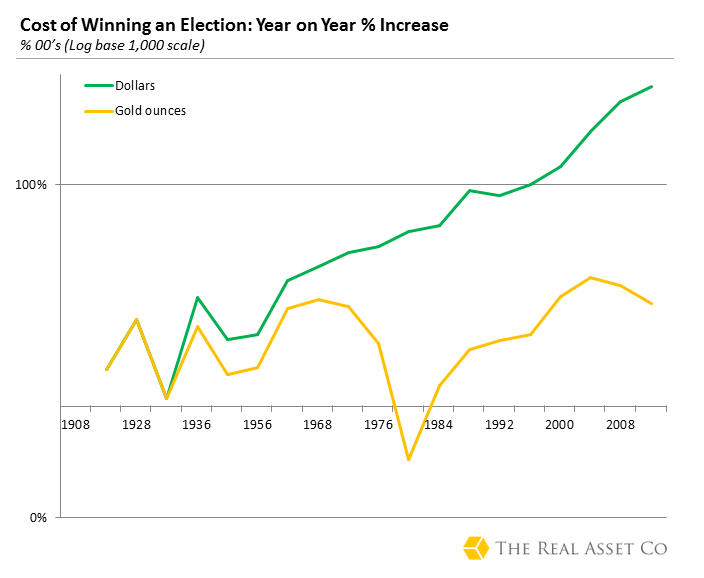

For a twist on the graph above, try the same data plotted against a logarithmic scale. The trend is still there, with a few other interesting bumps along the way.

Note what the 1970s bull market in gold did for the cost of running in gold bullion. The post 2005 period also shows a rising gold bull market exerting its influence on Presidential campaigning costs in this unit of account.

What does it all mean?

Well if we were running a major American party and needing to finance future campaigns, we’d buy gold bullion and keep our party coffers stacked with gold, to then sell in the run up to election times in exchange for dollars. Perhaps in the future we could even sell that gold directly for goods and services, without needing to go via the dollar.

Gold bullion once again proved to be a better storehouse for savings, value, liquidity, or whatever you want to call it.

That’s not to say there hasn’t been inflation in the costs of Presidential campaigning in gold – there has – but it has exhibited itself at a far lower level over a considerable time period. Dollars simply did a worse job for us over this time period, and by quite a margin.

The yellow bars on the chart above, representing gold, consistently stand favourably shorter compared to the green bars, representing dollars.

You might argue the Republican Party is currently most favourable to gold, with Gold Commissions being touted and Congressman Ron Paul holding sway amongst their ranks, but the GOP doesn’t bank roll Presidential elections from a gold vault yet.

Perhaps American parties should buy gold for their future campaigning? Or even better, perhaps party fund raisers should get pally with the world’s largest gold miners and their owners?

If we were managing the long term running costs of a political party we’d be looking at some of the great names in gold mining for help. Think of the likes of Pierre Lassonde, Rob McEwen and Mark Bristow.

US elections certainly prove another example of just how much purchasing power the dollar has been losing since Nixon.

If you want to keep in touch with this debate, the financial crisis and our research, follow us on Twitter or Facebook. You can also subscribe to our RSS feed: Gold Investment news.

Will Bancroft

For The Real Asset Company.

Aside from being Co-Founder and COO, Will regularly contributes to The Real Asset Company’s Research Desk. His passion for politics, philosophy and economics led him to develop a keen interest in Austrian economics, gold and silver. Will holds a BSc Econ Politics from Cardiff University.

© 2012 Copyright Will Bancroft - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.