Popular Delusions, The Bull Case for Safe Havens

Stock-Markets / Financial Markets 2012 Dec 01, 2012 - 12:36 PM GMTBy: John_Mauldin

A month ago in Outside the Box, Dylan Grice made the case for the need for safe havens, due to expansive monetary policy. But what is a safe haven anymore?

A month ago in Outside the Box, Dylan Grice made the case for the need for safe havens, due to expansive monetary policy. But what is a safe haven anymore?

In today’s piece, a follow-up to last month’s, Dylan gives us a very good rundown on the historical relationship between equities and government bonds, in order to point out the very atypical current negative correlation between them. He then observes that

… what constitutes the ‘safe haven’ changes over time. It’s important to remember not only that government bonds aren’t always the market’s safe haven, but that that there will always be a safe haven somewhere. For all the headlines about the billions wiped off stock market values during market routs, that money had to go somewhere. It doesn’t just disappear. It will go into whatever the safe haven is, which in normal times will be bonds. But what happens when government bonds themselves fall victim to the primary ills of the day?

So where are the safe havens when treasuries underperform? Read on!

By the way, I plan to be in London on January 15 to attend a conference sponsored by Societe Generale. My good friends Dylan Grice and Albert Edwards will be speaking, and a few of us will slip away for dinner.

I am sending this OTB from the Lindbergh Terminal of the Minneapolis–St. Paul Airport, on my way back from Bismarck, ND. I have now been to 49 states, with only South Dakota to go. The Bakken oil field is amazing and the helicopter tour was eye-opening. I am going to write about it this weekend as part of looking at the larger picture of energy and change.

It is not just about drilling and finding more oil. The changes here connect to fingers of instability and money all over the world – what happens in the Bakken and other places like it will not stay in the Bakken. I am glad I have a few days to process what I saw, before I write. I really learned a great deal and hope to pass on a few insights, and maybe a story or two.

Having my son Chad with me was really special. He has not been my kid who wanted to just jump on planes and go, but he really did like Bismarck. Dave Hoekstra, the president of BNC Bank in Bismarck, met Chad yesterday morning and grabbed him and took him on a tour of the town, even introducing him to potential employers while I was out touring the oil patch. What a nice thing to do. But everyone I met was gracious and helpful. Quite the friendly place. If cold. It was 9 degrees when we visited the oil rig and the wind chill took it down to minus 10-15. Can you say brutal? Even the locals were cold. Though they pointed out that it’s not officially winter yet.

Assuming American Airlines gets me to Dallas on time (which they seem to be able to do just fine; you’ve got to love it), I will see Andrea Bocelli tonight. I bought tickets the first hour they were offered and have been waiting a long time for this.

I now hit the send button from my Swiss Army knife, aka my iPad. Have a great weekend.

Your ready to be warmer analyst,

John Mauldin, EditorOutside the Box

JohnMauldin@2000wave.com

Popular Delusions

The bull case for safe havens

By Dylan Grice, Societe Generale

Government securities are the default safe haven in times of heightened risk aversion. But what happens when Government finances are the cause of the tension? Where are the safe havens then? We offer some thoughts inside .… and more!

In a marked softening of the IMF’s former tone, its chief economist Olivier Blanchard, speaking in Tokyo, earnestly pronounced that the prudent policy maker should now be "ready to adjust the [budget] targets" if achieving those targets becomes too painful. Is the bitter medicine of the IMF’s hitherto unshakable orthodoxy, once deemed cathartic to emerging market victims of economic calamity past, too bitter a pill for more sensitive Western palates?

A harrowing BBC report suggests Greece is Balkanising once more. We are reminded that its civil war only ended in 1949 and that harsh austerity is reopening deep social wounds. Yet Spain’s civil war ended only a few years earlier, and a generation ago it was a fascist military dictatorship. Couldn’t it go the same way if subject to the same stress?

Thus Nobel Prize winning clever clogs Paul Krugman says austerity is “fundamentally mad” and all reasonable people agree with his diagnosis, it seems. Spain looks set to finally benefit from the ECB’s printing press with only token conditionality. And poor Greece, close to being cut loose earlier in the year, is once more nestling in the warm bosom of the Teutonic embrace … well … it’s being given more time, at least, to pretend it is able to repay the unrepayable ....

The rest of the watching world has learned the lesson too. BoE governor King, with a nudge and a wink in the direction of the UK chancellor, says missing debt targets is fine “so long as there is an excuse". Meanwhile, Ben Bernanke urges Congress to “you know, work together to find a solution” to the looming ‘fiscal cliff’. The grim reaper of fiscal austerity has been banished, it seems. Market relief is palpable.

But is it any different from the relief felt by a chronic alcoholic reaching for the booze once again, convincing himself he’ll give it up tomorrow? The fundamental issue of balance sheet unsustainability has not been addressed. The need to delever remains. Albert and I have always felt that inflation would ultimately prove to be the path of least political resistance, and these events have confirmed that assessment. Deflationary deleveraging is politically non-viable, leaving inflationary deleveraging as the only remaining option, as far as I can see. Economists the world over seem very confident that such inflation can be generated in a controlled and nondisruptive fashion. There is a first time for everything, I suppose. But I’m very sceptical. I wrote a few weeks ago that I feared a Great Disorder and that I remain bullish on ‘safe havens’. But what exactly are suitable safe havens for such a circumstance?

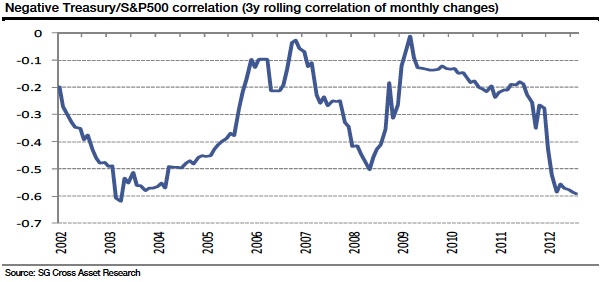

Generally, and especially over the last decade, government bonds have been the safe haven. ‘Risk-on risk-off’ might be the catchy nomenclature du jour, but the fact is that government bonds have generally benefitted from their safe haven status throughout the past decade. The following chart shows that status reflected in the negative correlation between Treasuries and the S&P500 over this period.

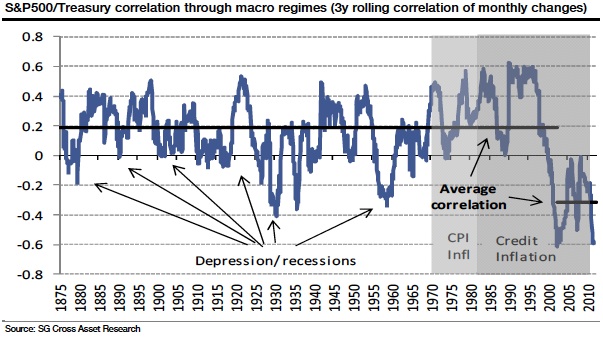

Historically speaking, these last ten years are an outlier. Over time, what’s good for the currency and for government finances (bonds) should be good for the rest of the economy (equities) and vice versa. The correlation should be positive. Indeed, the following chart shows that the correlation generally has been positive, averaging +0.2 between 1875 and 2002, but -0.3 since 2002 (for the whole period, the average was +0.15).

It’s worth pondering this for a few moments. To help, I’ve arbitrarily separated the sample into three periods. The period from 1875 to 1970 saw a number of monetary regimes, each involving a peg to gold in a progressively less robust way. Yet overall inflation expectations were stable during this period. Bonds were reliable safe havens. The correlation would briefly turn negative during recessions or depressions as bond prices rose during stock market declines, but the overriding correlation between them was positive.

Things changed following the collapse of the Bretton Woods regime in 1971 and the embracing of an explicitly unanchored currency. In the 1970s, although the correlation weakened during stock market declines as it had done previously, it didn’t turn negative. In other words, government bond prices no longer rose during stock market declines, they just didn’t fall by as much. Moreover, the overall correlation was positive. What was bad for bonds was bad for equities too. Government securities consequently lost their safe haven status because they were highly vulnerable to the prominent macro risk of the day, inflation In the 1980s and 1990s the inflation dynamic was reversed. As ‘order’ was restored, inflation was brought under control and a spectacular bull market in bonds ensued. What was now very good for bonds was even better for stocks. Again, therefore, the correlation was strongly positive overall. It would fall during equity market decli nes but it never went negative because both the bond and equity bull markets were so powerful and the equity drawdowns so shortlived that the three-year correlation never had a chance to go negative (even in the year of the 1987 crash, stocks finished the year higher than they started it). Ultimately, the bond bull market helped to inflate equities to the unprecedented valuation bubble witnessed at the turn of the century. When that bubble burst, the correlation turned negative, and has remained there ever since. This is Albert’s ‘Ice Age’.

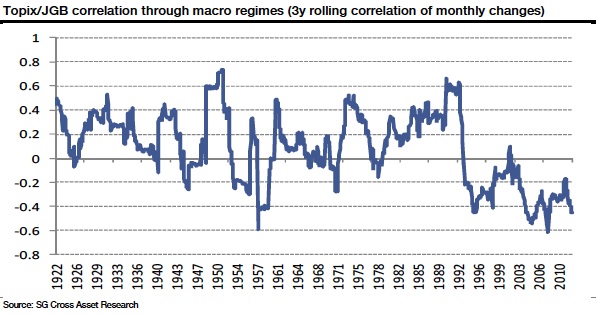

This little exercise gives us an appreciation of how unusual it is for the bond-equity correlation to be negative for any period of time, i.e. for a macro regime to be good for bonds but bad for equities over any medium to long-run period. It’s interesting to think about what sort of regime that is too. I think one possibility has to do with the unwinding of extreme valuations, which has certainly been the story in equity markets over the past decade. It has also been a huge part of Japan’s story. There, the bond-equity correlation also turned, and stayed, negative following the even more extreme equity overvaluation reached in the late 1980s. There is much food for thought here.

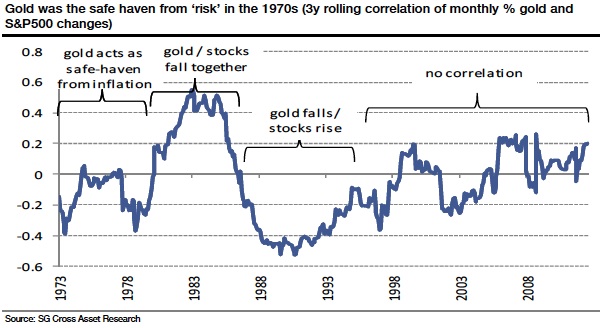

Our second observation is what constitutes the ‘safe haven’ changes over time. It’s important to remember not only that government bonds aren’t always the market’s safe haven, but that that there will always be a safe haven somewhere. For all the headlines about the billions wiped off stock market values during market routs, that money had to go somewhere. It doesn’t just disappear. It will go into whatever the safe haven is, which in normal times will be bonds. But what happens when government bonds themselves fall victim to the primary ills of the day? In the 1970s, bonds were no place to seek refuge from the inflation and so the safe haven mantle passed to gold (see following chart). This is one reason I remain a gold bull.

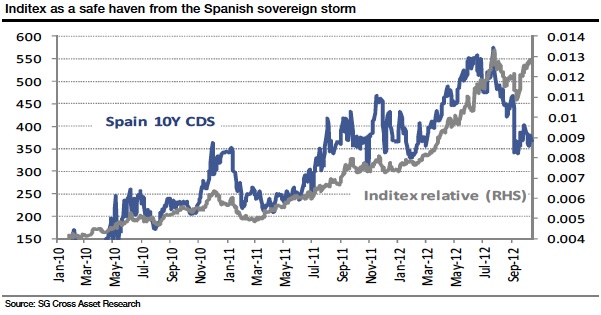

But the eurozone threw up other interesting examples. Before the crisis, Spanish investors, for example, would normally have considered their sovereign bonds a safe haven on ‘risk-off’ days. But that stopped working when their sovereigns became the source of risk rather than a shelter from it. Bunds undoubtedly caught some of that safe haven bid, but did the very high quality, zero debt, local-champion-made-good retailer Inditex catch a similar bid too?

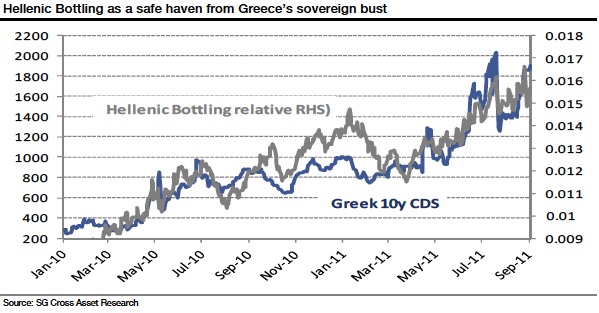

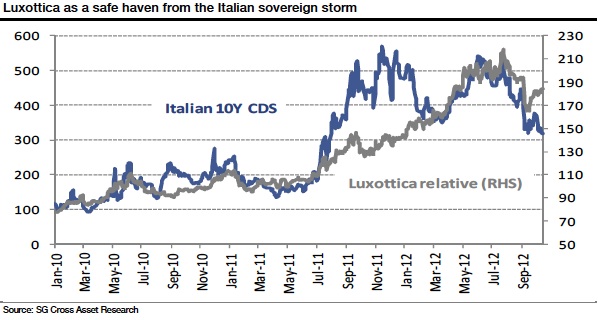

A similar picture emerges with the standard quality equity names in countries afflicted by the eurozone sovereign crisis. For example, Hellenic Bottling (Greece), Luxoticca (Italy) and Kerry Group (Ireland) all followed a similar pattern, outperforming their domestic equity indices and performing the safe haven role vacated by their government bonds (see below).

We see the same effect more generally when we look at Quality Income equities through the same lens. The following chart shows how the relative performance of the SG Quality Income Index relative to the MSCI World has moved with confidence in Italy’s government.

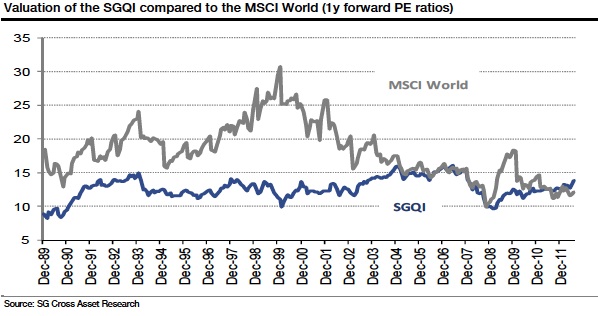

So besides gold, another candidate for safe haven status in the event government bonds become unreliable in that department are equity securities in high quality and robust businesses. I therefore remain very bullish of these too. In recent months, some of you have voiced concern that the time might not be right to buy such names because they have become very overvalued. The following chart suggests otherwise. It compares the forward PE ratios on Quality Income equities (shown here using the SGQI) with those of the overall market. While the overall market is arguably attractively priced (certainly more attractively priced than it has been for some time), the SGQI is priced in line with its historical average.

That implies that expected returns from here should be consistent with its long-run average return, which has been around 6-7%. That’s hardly a once in a lifetime return, but for now, and for a potential safe haven I find it quite attractive because it comes with an embedded robustness. Suppose I’m all wrong in my fears. Suppose that we go all Japanese and the next decades are low-growth muddlethroughs.

A 6-7% return isn’t a bad prospect at all. But now suppose I am right, and government bonds cease acting as safe havens. Owning such equities implies owning the new safe havens (especially if the rest of the portfolio is made up of cash and gold). So we’re on high ground with this strategy, and have a degree of robustness to the reality that we just don’t know what the future holds. That doesn’t guarantee survival from the worst case scenario, but it gives a better chance.

Like Outside the Box? Then we think you'll love John's premium product, Over My Shoulder. Each week John Mauldin sends his Over My Shoulder subscribers the most interesting items that he personally cherry picks from the dozens of books, reports, and articles he reads each week as part of his research.

Learn More About Over My Shoulder

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.