Is the Euro Zone Debt Crisis Really Over?

Stock-Markets / European Stock Markets Feb 12, 2013 - 07:15 PM GMTBy: Clif_Droke

Many investors are wondering what has been behind the relentless rally in stock prices. Look no further than corporate profits.

Many investors are wondering what has been behind the relentless rally in stock prices. Look no further than corporate profits.

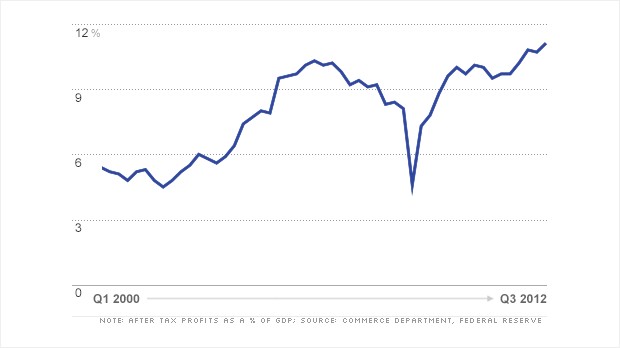

Consider that in the third quarter of 2013, corporate earnings were $1.75 trillion, up 18.6% from a year ago. That took after-tax profits to their greatest percentage of GDP in history. For the most recent quarter, earnings for S&P 500 companies are estimated to have risen 4.7 percent, above a 1.9 percent forecast at the start of the earnings season. See earnings chart shown below.

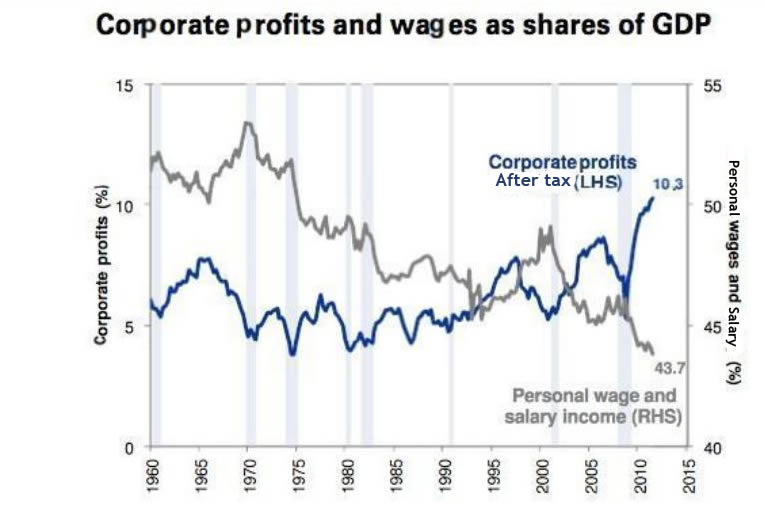

Moreover, corporate profits are up 40% in just the last five years. After-tax corporate profits are at record levels, totaling almost $2 trillion. And just how did U.S. corporations manage this feat? As Tom Hudson of the Miami Herald put it, "Since 2007, companies first focused on cutting costs to survive. Then they concentrated on growing their businesses in ways that didn't require significant investment. As sales have rebounded from the depths of the recession, companies have seen those dollars drop to their bottom lines." In other words, corporate profits have come largely at the expense of wages.

To put into perspective the gap between soaring corporate profits and wages, let's examine the following chart courtesy of Goldman Sachs' David Kostin.

To understand the importance of corporate earnings to today's economy, consider the following statement from a CNNMoney article: "Profits accounted for 11.1% of the U.S. economy last quarter, compared with an average of 8% during the previous economic expansion." Five years ago, the companies in the S&P 500 stock index earned almost $83 per share. This year, those companies are expected to earn more than $112 per share. This explains why the Federal Reserve remains deeply committed to a loose money policy, which chiefly benefits corporate profits.

Of course, Wall Street doesn't care about wages. Rising profits are the main concern at the end of the day, and as long as the profit rally continues, investors will have reason to enough to remain bullish during the rest of the earnings season (i.e. until late February). When it comes to evaluating the disparity between strong corporate profits and a still-tepid job market, it will do us well to remember the maxim of market analyst Steve Todd, who said: "Record earnings are behind the market rally. Looking at the economy is worse than useless. It's harmful to your portfolio. It keeps you out of the market when you should be in."

The immediate-term uptrend remains intact as defined by the relative position of the 15-day moving average. The major indices remain above the 15-day MA and have made late session reversals in the last two days - normally a sign of technical strength. The market has recently been caught in a trading range between investors who are booking profits as the Dow and S&P flirt with the 2007 highs and those who missed the rally and are looking to buy the pullbacks. The buyers are winning the latest battle.

Euro zone crisis isn't over yet

While the U.S. financial market is still currently favorable, investors should be on the lookout for storm clouds on the horizon in the coming months. On Monday the president of Germany's Bundesbank, Jens Weidmann, said there is "no indication euro foreign exchange is seriously overvalued." The comments led to immediate strengthening of the euro currency which translated into dollar weakness.

There was a troubling note to Weidmann's statement, however. There's an old saying: "Official denial is tantamount to tacit admission." In other words, when a bureaucrat insists that a problem is either under control or doesn't exist, the problem is usually far greater than is being admitted. I can't help thinking what my late friend and cycle mentor, Bud Kress, would say about the euro zone crisis which everyone thinks has been "solved for now."

I strongly believe Bud would have said something along the lines of, "The euro crisis is a cancer which is only beginning to metastasize." Those are the exact words he spoke to me concerning the U.S. credit crisis in 2007 and his words at that time proved prescient. To think that a problem which only a few months ago was threatening to engulf Europe in its own version of the credit crisis has now suddenly been "solved" by the confident pronouncements of a couple of central bankers is hard to fathom. The ECB may well be ready and willing to launch the monetary equivalent of a bazooka at the euro zone debt problem, but history suggests the bank will be seriously challenged before this crisis is over. To date there has been no serious challenge.

If the Kress cycle "echo" forecast for this year is correct, we should eventually see problems begin to manifest in Europe later this year. As the second part of the year progresses and we head closer to 2014 (when the 120-year cycle is scheduled to bottom), the problems in Europe should spread overseas and envelope the global economy, including the U.S. and China. As Kress used to say, "The cycles have a way of bringing out the dirty laundry of the nations." This time around should prove to be no exception.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at:

http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.