How to Invest in the Future of Geothermal Energy

Commodities / Energy Resources Jul 29, 2013 - 12:48 PM GMTBy: Jason_Hamlin

Before you click away from this article in the belief that geothermal is just another “green” technology that can’t compete with coal or oil, consider the following…

Before you click away from this article in the belief that geothermal is just another “green” technology that can’t compete with coal or oil, consider the following…

Geothermal is a renewable energy source that is expected to grow fivefold in the next seven years and produces more than double the energy of solar and wind combined. And here is the real rub… unlike solar power, geothermal is cheaper to produce than coal, oil or other “dirty” sources of energy. The most common form of geothermal power costs about $64 a megawatt-hour, according to Bloomberg New Energy Finance, below the $78 for coal, $82 for onshore wind turbines and $142 for traditional solar panels.

And while wind and solar only generate power when the wind blows or the sun shines, geothermal power plants provide electricity almost constantly. This is referred to as baseload power, which is more desirable than the intermittent power provided by other renewable energy sources.

Geothermal energy is generated from the constant and limitless heat of the earth. Below the Earth’s crust, there is a layer of hot and molten rock called magma. Heat is continually produced there, mostly from the decay of naturally radioactive materials such as uranium and potassium. The amount of heat within 10,000 meters (about 33,000 feet) of Earth’s surface contains 50,000 times more energy than all the oil and natural gas resources in the world.

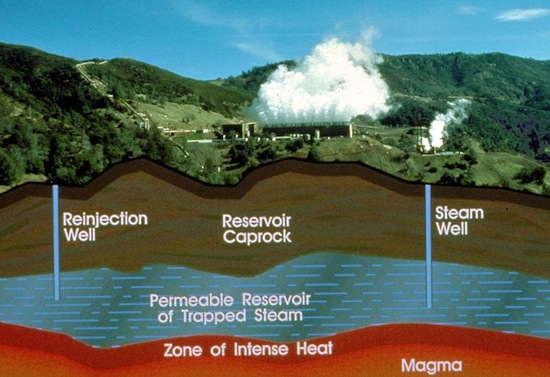

The most common way of capturing the energy from geothermal sources is to tap into naturally occurring “hydrothermal convection” systems where cooler water seeps into earth’s crust, is heated up, and then rises to the surface. When heated water is forced to the surface, it is a relatively simple matter to capture that steam and use it to drive electric generators. Geothermal power plants drill their own holes into the rock to more effectively capture the steam.

In the simplest design, the steam is used for spinning turbine blades and a shaft that connects directly to an electrical generator. The electricity then goes through a transformer and into the power lines that deliver energy to homes and businesses. In a closed loop system, the steam is then re-captured and sent into a condenser where it is converted back into water and fed back through an injection well into the ground to be used again. This is a closed loop system.

Geothermal Energy is Nothing New

(Source, Wikipedia) J. Donald Kroeker designed the first commercial geothermal heat pump to heat the Commonwealth Building (Portland, Oregon) and demonstrated it in 1946. Professor Carl Nielsen of Ohio State University built the first residential open loop version in his home in 1948. The technology became popular in Sweden as a result of the 1973 oil crisis, and has been growing slowly in worldwide acceptance since then.

In 1960, Pacific Gas and Electric began operation of the first successful geothermal electric power plant in the United States at The Geysers in California. The original turbine lasted for more than 30 years and produced 11 MW net power. The binary cycle power plant was first demonstrated in 1967 in the U.S.S.R. and later introduced to the U.S. in 1981. This technology allows the generation of electricity from much lower temperature resources than previously. In 2006, a binary cycle plant in Chena Hot Springs, Alaska, came on-line, producing electricity from a record low fluid temperature of 57 °C (135 °F).

The Geysers geothermal power plants meet nearly 60 percent of the average electrical demand for California’s North Coast region (from the Golden Gate Bridge north to the Oregon border). The plants at the Geysers use an evaporative water-cooling process to create a vacuum that pulls the steam through the turbine, producing power more efficiently. Recycled grey water from local communities is pumped into the wells in order to limit the use of fresh ground water.

While the U.S. leads the world in geothermal energy capacity, Iceland is by far the highest ranked in terms of percentage of national energy production at roughly 66%.

Barriers to Entry and Technological Advancements

The reason that geothermal has not been more widely adopted revolves around limited resource locations, weak economics and burdensome permitting issues. The capital costs are high to build a plant and this is a risk that many investors have avoided. The resource location means that geothermal is only available in areas where high temperatures are available near surface. The following map outlines the concentration of geothermal energy potential in the United States. As with the vast riches of gold in the hills, you can see that Nevada and California are also rich with geothermal resources.

Water supply is another concern, as the capacity of geothermal fields is limited to their recharge rate from aquifers or other sources of water. The hot steam is pumped out to drive turbins but if there isn’t a easy way to refill them, their output will decline. Still, they use an estimated 20 litres (5.3 US gal) of freshwater per MW·h versus over 1,000 litres (260 US gal) per MW·h for nuclear, coal, or oil. And the latest plants that use a closed-loop binary cycle release no fluids or heat-trapping emissions other than water vapor, which may be used for cooling. The video below illustrates how a geothermal plant works and how there is very little water waste when done properly.

These exciting new developments in geothermal will be supported by unprecedented levels of federal R&D funding. Under the American Recovery and Investment Act of 2009, $400 million of new funding was allocated to the DOE’s Geothermal Technologies Program. Of this $90 million is expected to go towards a series of up to 10 demonstration projects to prove the feasibility of EGS technology. Another $50 million will fund up to 20 demonstration projects for other new technologies, including co-production with oil and gas and low temperature geothermal. The remaining funds will go exploration technologies, expanding the deployment of geothermal heat pumps, and other uses. These investments will benefit the industry as a whole and should lead to greater profit opportunities for geothermal companies.

How to Invest in the Future of Geothermal Energy?

I have been watching this sector for a while and the companies playing in this space haven’t inspired much excitement to date. The largest geothermal producer worldwide is actually Chevron, but geothermal only represents a small portion of their overall revenues.

Let’s take a look at some of the other players in this space…

Calpine (CPN, $8.8 Billion market cap) is the largest U.S. producer of geothermal energy and the owner/operator of Calpine Geyers, the largest geothermal complex in the world. However, it is far from a pure play as they derive the bulk of their revenue from natural gas-fired plants elsewhere in the country. Despite these impressive assets, Calpine reported a loss during the second quarter, although revenues were up a robust 79% to $1.5 Billion. Calpine backed its previous full-year profit prediction of $1.50 per share, although analysts expect 54 cents per share. The share price could climb considerably higher if management is correct, but I wouldn’t hold my breath based on year-to-date results.

Calpine’s stock is up 12% in the past year, but has yet to return to pre-financial crisis levels.

Ormat Technologies (ORT, $1 Billion market cap) is more of a pure play on geothermal, although they also generate revenue through recovered energy and remote power solutions. Ormat is a vertically integrated geothermal technology company, as they manufacture a wide range of power plant components at their state-of-the-art facilities. The company has engineered and built power plants, which it currently owns or has supplied to utilities and developers worldwide, totaling approximately 1600 MW of gross capacity. Ormat’s current generating portfolio totals 589 MW (net) in the U.S., Guatemala and Kenya. Yet, despite their four decades of experience and leadership in this sector, Ormat reported declining revenues during the first quarter of 2013 and a loss of $1.9 million, after having earnings of $8.0 million during Q1 of 2012. They chalk it up to derivatives losses, mild weather, margin compression, and a change in sales agreements for its Mammoth, California facility. This will give the company more income over the long run, but it was forced to pay a $9 million termination fee in the first quarter, 2013. I believe this will prove to be a short-term setback and the company will return to profitability by year end.

Ormat’s stock is up 28% in the past year, but has pulled back recently to technical support levels. I think the company should be able to improve financials going into the back half of 2013 and I will be keeping a close eye on their progress.

RAM Power (TSE: RPG or RAMPF, $66 Million market cap) is a pure play on geothermal energy. The company owns and operates a geothermal power plant in Nicaragua that is producing 72MW of power annually. They also have a few late-stage projects in California and several early stage exploration projects throughout the Americas. RAM has signed power purchase agreements for up to 335 MW in California, and 72 MW in Nicaragua. Q1 revenues were up 88% to $11.9 million. Adjusted EBITDA increased 191% to $7.2 million, but the company had a total comprehensive loss of $7.9 million or ($0.03) per share. You can read the full details of their latest financials here.

RAM’s share price is down over 50% since 2010, but the stock has advanced 43% in the past month. With the phase II expansion at San Jacinto, revenues should continue to be strong and earnings should improve. They will need to find financing to move their other projects into production, but I think the company has great potential.

My #1 Geothermal Stock Pick was recently added to the GSB model portfolio. This company has been on my radar for a few years and just reported a quarterly revenue increase of roughly 550%! They swung from a loss during Q1 last year to a profit this year, significantly increasing cash on hand. This was driven by improved operations at their three existing geothermal plants and the recent commissioning of commercial operations at their newest geothermal power plant in the West. The company receives favorable tax credits from both the federal and state governments and enjoys a 22-year loan from the DOE at just 2.6%! To top things off, recent drilling at their next project in Guatemala just returned reservoir temperatures that were significantly higher than expected.

The share price of this stock has advanced nearly 50% in the past three months and I believe we are just seeing the beginning of a powerful and profitable future for this geothermal energy producer!

I realize this is a fairly easy stock tease to figure out with a few minutes of research. However, if you would like to confirm the name and ticker symbol of this company and gain access to all of the stocks in the Gold Stock Bull portfolio, please considering becoming a premium member by clicking here.

You will receive the monthly contrarian newsletter and email trade alerts every time that I am buying or selling a stock. I never accept compensation to promote a stock and usually hold the same positions in my personal portfolio. Best of all, you can try out the newsletter and premium membership for just $39. If you find it worthwhile after the first month, you can switch to a yearly membership at just $25/month. Click here to watch a short intro video or click on the newsletter to get started right away.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $25/month by clicking here.

Copyright © 2013 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.