Is Europe Economy, Stocks Ready to Take Off?

Stock-Markets / European Stock Markets Jul 31, 2013 - 11:51 AM GMTBy: Frank_Holmes

One year ago, European Central Bank President Mario Draghi announced that the central bank had the political will to do "whatever it takes" to save the euro. Now, the worst may be over, as suggested by stronger economic data coming out of Europe. It appears the Continent is finally on the road to a sustained recovery.

One year ago, European Central Bank President Mario Draghi announced that the central bank had the political will to do "whatever it takes" to save the euro. Now, the worst may be over, as suggested by stronger economic data coming out of Europe. It appears the Continent is finally on the road to a sustained recovery.

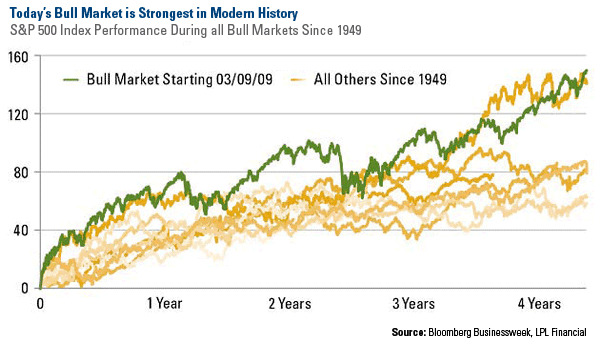

For the past few years, the U.S. has been one of the best places to invest. In fact, the S&P 500 Index has experienced its strongest bull market ever, according to LPL Financial. Highlighted by Bloomberg Businessweek, since the market bottomed in March 2009, the S&P 500 Index has "bested all bull runs since 1949," climbing 154 percent over the past four years.

This year alone through July 26, the S&P 500 Index increased 20 percent. By comparison, the Stoxx Europe 600 Index is up about 10 percent. Although European stocks underperformed, the area offers a better potential value, as equities sell at "11.8 times estimated 2014 earnings, compared with price-to-earnings multiples of 13.7 for the S&P," says Barron's.

After the U.S.'s huge run, is it possible the country will be handing off the baton across the Atlantic for the next leg of the relay race? Here are a few areas of strength that could send European stocks higher:

1. Europe is taking analysts by surprise

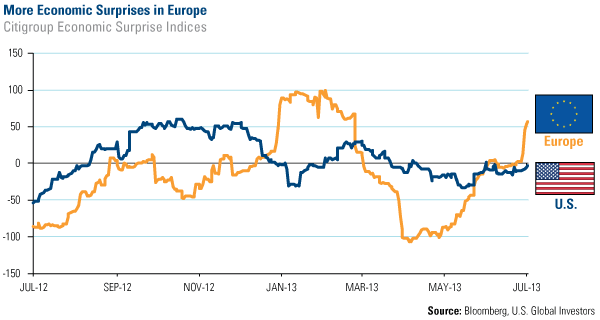

Take a look at the sudden divergence in Citigroup's Economic Surprise Index in Europe compared to the U.S. The indices calculate the difference between economic data releases and survey data. A positive reading suggests economic releases are beating expectations; a negative reading indicates that the market expects better economic data than is actually released.

Recently, economic surprises in Europe have spiked to a reading of nearly 57. This is significantly higher than the U.S.'s, which has been hovering under zero since April.

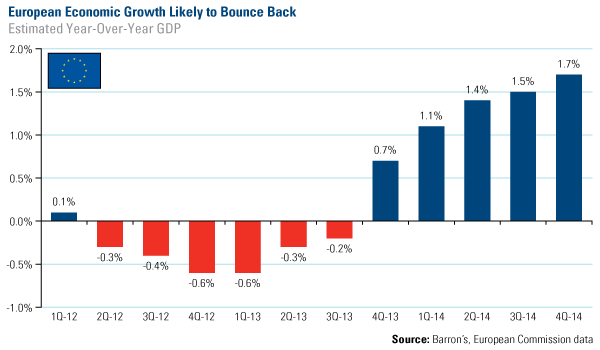

2. Europe's economic growth is improving

The European Union (EU) has had its share of difficulties, but "the Continent seems to have turned a corner," reports Barron's. This is shown in the chart below, where GDP has had negative year-over-year growth each quarter over the past year. Looking forward, the area is anticipated to make significant progress. By the end of 2014, the growth rate could be around 1.7 percent.

Even though Europe has had pockets of turbulence, such as the event in Cyprus, "the eurozone has overcome the threat of systemic failure and dispelled concerns about its long-term viability. The economy is being rebuilt," says Barron's.

3. Some of the riskiest European stocks are showing relative strength

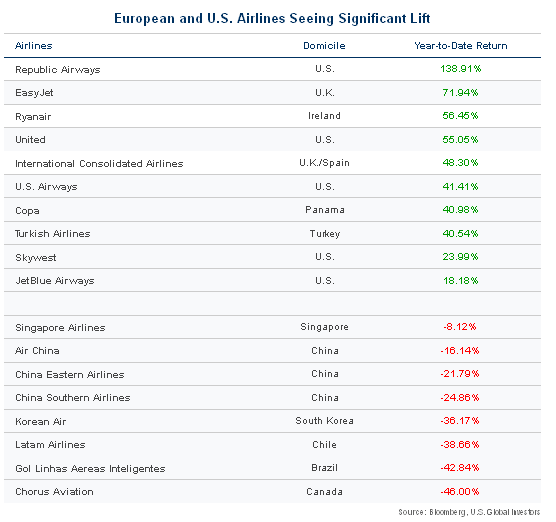

Airlines are considered one of the most economically sensitive areas of the market, with stock prices especially volatile during times of weakness. So when you see certain airline companies gaining relative strength, it's time to take a closer look.

Relative strength is a metric we use to compare the performance of different groups of stocks or sectors to identify areas of the market that are recent strong performers. Being quick to recognize relative strength can provide an edge, as long as you act quickly. In short, we believe investors should buy into strength and avoid the weak.

Of the entire airline industry, European and U.S. carriers dominate the positive momentum list, according to data from BMO Capital Markets. Asian carriers, on the other hand, are showing significant weakness, says BMO. Take a look at the year-to-date returns as of July 26, 2013:

Themes to Capitalize On

Make sure your portfolio takes advantage of the many opportunities throughout Europe.

Emerging Europe especially benefits from a European recovery, says Portfolio Manager Tim Steinle of the Emerging Europe Fund (EUROX). These developing countries are economically tied to their western counterparts through established export trade, putting them in an excellent position to benefit from the Continent's recovery.

Here are only a few examples: More than 80 percent of Czech and Hungarian exports head to Western Europe and about 50 percent of Polish and Turkish goods are exported to Western Europe.

In addition, we expect a continued convergence of European countries. The integration process is currently underway, with emerging countries in the east working to meet the European Union's standards that include living standards, GDP, environmental standards, regulatory standards and infrastructure. See Turkey's concentrated efforts here.

"The quest for membership is a vote of confidence in Europe and its institutions," says Barron's. Next year, Latvia likely will join the EU, giving up its own currency in exchange for the euro. Lithuania also is expected to join the euro, according to Barron's.

It appears that Europe is ready for a take off. Is your portfolio on board?

Want to see more on commodities or emerging markets? Provide us with your email address and you’ll receive a note every time Frank Holmes updates his blog. You can also follow U.S. Global on Twitter or Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.