U.S. Dollar Still Hanging on the Fiat Cliff

Currencies / US Dollar Sep 20, 2013 - 11:10 AM GMTBy: Joseph_Russo

Arguably, throughout the ages, money and the immense power it manifests, is the most potent driver of systemic corruption.

Arguably, throughout the ages, money and the immense power it manifests, is the most potent driver of systemic corruption.

Further to such argument, it is self-evident that high-level branches of modern-day governments and their attendant institutions alongside private foundations and transnational corporate alliances have been wholly subject to such corruption for centuries.

Despite the proven ability of powerful institutions such as the Federal Reserve to dramatically manipulate and distort nearly every facet of the financial sphere, in the first of a possible series of "Witness" publications, we shall nonetheless endeavor to chart the progress of the developing world order using graphic chart illustrations.

In observing the progress of key financial markets that are of critical importance in preserving the existing power structures ability to maintain control, or the public perceptions thereof, the series shall endeavor to chart, simplify, and summarize the ebb and flow of efforts required to preserve the elite's monopoly over global finance, and by extension, the entire world.

Given the reality presented by current events and the whole of recorded history to date, our focus shall center upon the financial markets of the worlds perceived super power, the United States, which covets distinct hegemonic advantage in both its military capabilities and its dominion in presiding over the world's reserve currency within the aging and ailing worldwide monetary order.

In accord with such logic, we shall assign the greatest importance to the US currency unit followed next, by what that currency buys as plotted on the continuous commodity index. The last two charts will observe the long-term rates of interest or cost of borrowing the currency via the bond market, and finally, we will observe the elite's benchmark valuation metric of transnational corporate industries as exemplified in the ebb and flow of the Dow Jones Industrial Average.

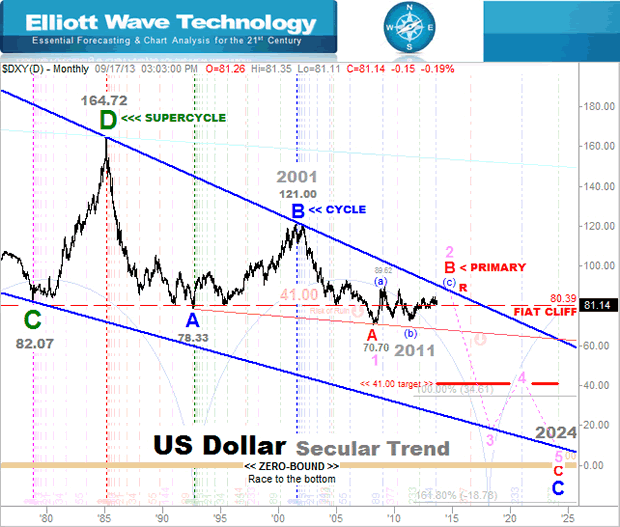

Witness - publication-0001: State of the Developing World Order >> Charting the Big Picture: World Reserve Currency Unit: "STILL HANGING ON"

The perceived and actual value of a nation's currency is the ultimate financial benchmark upon which the long-term economic stability of that nation rests. Since its inception in 1913, the year that an apparently ignorant American congress perpetrated passage of the unequivocally unconstitutional Federal Reserve Act, the US currency has lost more than 95% of its value and purchasing power.

In short, the value of America's national currency has been in a state of perpetual decline ever since criminally adopted by fiat decree in 1913. In the spirit of drawing red lines of sorts, the 80.39 level marks a critical horizontal line in the sand that if breached decisively, will likely instigate a dollar-crisis collapse toward the 41 handle for starters.

From this distant perspective, the US currency unit, as it has been for decades, continues the struggle to maintain a value perception north of 80. Most recently, since the mathematical insolvency event of 2008, the flailing currency unit appears to be doing nothing more (albeit on a smaller scale and within a tighter range) than it has done for the past 30-years.

It is clear to observe the US currency unit's increasingly persistent flirtation with breaching its risk of ruin boundary as it bounces along the bottom, and at times beneath, this rather dangerous line in the sand, otherwise coined as the Fiat-Cliff, which we have noted at the 80.39 price level.

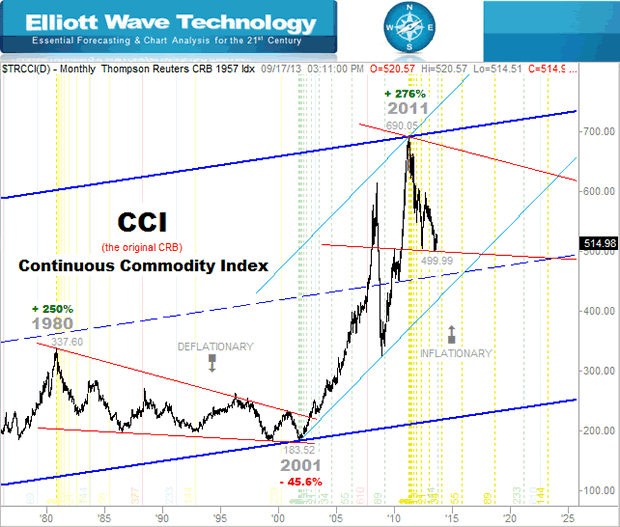

Commodities Priced in the World's Reserve Currency: "HOW MUCH DOES THE CURRENCY BUY"

The continuous commodity index reflects the trajectory and trends in the cost of tangible goods essential for day-to-day needs and long-term survival. In like fashion, but in the totally opposite directional trajectory of the US dollar, as the fiat currency persists in its slow and deliberate 100-year collapse, the real costs for essential tangible goods as represented in the CCI, maintains a varying, but persistent, and similarly inverse exponential rise toward a destructive and mathematically impossible- to-sustain destination of epic destabilization.

As the purchasing value of the national currency intentionally erodes because of willful monetary policies, which currently target inflation (the constant destruction of money's purchasing power) at 2-3% per year, individual incomes, cash flows, and savings rates for the vast majority of citizens falls far short of keeping pace with such misguided exponential models of monetary expansion.

Because of the exponential nature of the simple mathematics involved, when political and monetary experiments of this sort inevitably implode, they appear to collapse all of a sudden, and without any clear warning for the masses. In the interim, a largely unsuspecting citizenry tolerates the insanity so long as they can feed themselves, until one day; things get so out-of-whack that it is simply no longer viable to consider the ongoing arrangement sustainable for another minute.

Reaching a temporary peak in 2011, for the past ten years, since 2001, there has been a marked acceleration in the cost of tangible goods necessary for day-to-day living and long-term survival.

Naturally, this acceleration coincides with, and is a direct result of a marked debasement in the value of the nation's currency unit during the same period.

Perhaps now, one can better understand why the value and stability of a nation's currency trumps all else insofar as creating the foundation for sustainable economic and generational stability of its current and future citizen's.

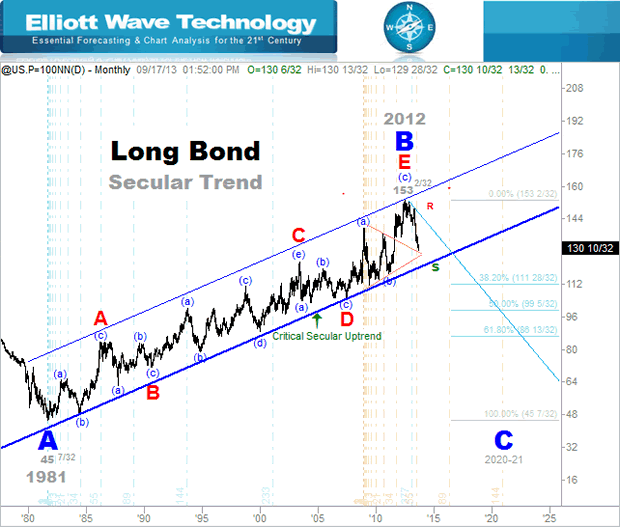

Long-Term Interest Rates on World Reserve Currency: "LESS THAN ZERO PERCENT?"

After more than 30-years of incessantly raping the free market price of credit and by default, the time preference acquisition and cost of borrowed funds, once the zero-threshold is within earshot, there is simply nowhere to go to manipulate the fraud any further. In essence, the criminals in charge, forced to forever double down, shot their final load, and are hoping for the best - but could really care less.

What is interesting, from an Elliott Wave perspective, is the clear lack of impulsive bubble dynamics in the price action over this entire period. The rise in bond prices (decrease in yields), in no manner reflects the exponential blow-off bubbles that the NASDAQ of 1999 or other classic bubbles manifested throughout history.

In our view, the reason for this anomaly is that the free market did not create the bond-bubble. As the choppy corrective upward price-action clearly attests, the criminal monetary and political policies of the global elite imposed the secular bull market in bonds by subversive fiat dictates. The end of this run, as perceived by many a pundit, is a plausible reality simply because technically, interest rates cannot get any lower than zero.

As we continue to profess regardless of market, prevailing trends are never over until decisively confirmed to be over. In this case, that will take a decisive breach of the critical secular uptrend line so noted.

Transnational Stocks Valued in the World Reserve Currency:

SCOREBOARD FOR THE GLOBAL ELITE'S

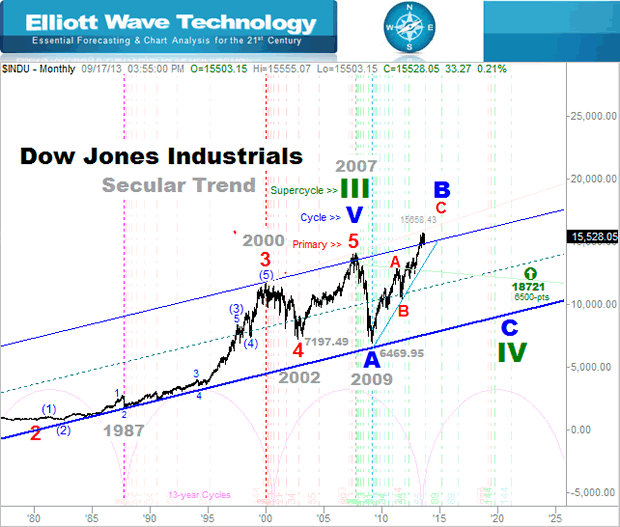

Finally, we behold the Dow Jones Industrial Average, a flexible and ever-changing tool that is highly effective in falsifying the mathematically impossible exponential growth models designed to make the masters of the global universe appear capable and worthy of their self-granted monopoly powers.

It is plain to even the most uneducated eye that the price action within the Dow post 1995 took on a surreal character beyond any realm of logic, rhyme, or reason. It is this very type of price action that we alluded to as absent from the 30-year run up in the bond market.

After peaking in 2000, crashing into 2002, reflating into 2007, crashing again into 2009, and then reflating once again to the present day, it is quite clear that this index and the stock market in general are clear barometers of success for the self-anointed high priests of politics and finance.

If in addition to ample servings of bread and circus, they give their subjects and controllers new perceived highs in stock valuations, in their own demented minds, they remain king of kings for the history books and posterity. In contrast, the truth as most of us are painfully aware - is quite different from what conventional history books are likely to portray.

Any declines back to the mid-channel line of the never-ending secular uptrend are considered disastrous from the perspective of the immortal powers that be.

The subversive shadow controllers of global society view bear market declines that test the lower end of the secular uptrend line as outright systemic failures, or once in a lifetime "opportunities" requiring emergency implementation of extraordinary measures to preserve the standing elite's legacy cartel of criminal monopoly.

In Closing

Harboring clear breaches of numerous constitutional laws, and led by an irrefutable subversive political coup of American sovereignty, as of today, the developing world order is nothing short of a complete fraudulent and criminal nightmare of inconceivable proportion.

Sadly, the unfolding horror is nothing new. The sinful rot began taking root long before Obama, Bush, and Clinton graced us with their administrations respective versions of varied bullshit. There is truly nothing new under the sun. As the never-ending battle between good and evil persists in a diabolic state of perpetuity, it seems that the more we learn, the more we really don't know.

Under the relentless and unyielding control of the military industrial complex, covert alphabet agencies, lobby groups, and criminal-shadow paymasters, historical presidential icons of all stripes along with the attendant 535 ass-clowns in the House and Senate have devolved into complicit actors on a treason-filled stage of unpatriotic cowardice and outright lies.

Amidst the unwinding credit, debt, death, and tyrannical central bank war-model economies, like B-rated wannabe's, sociopath select elite's deceitfully playact their deadly and fraudulent roles as supposed good stewards of a democratic republic, one that is incessantly propagandized by the hyper-controlled mainstream media as the shining light on the hill which can do no wrong.

The 911 Litmus Test: "CAN YOU HANDLE THE TRUTH?"

To help us close the case on this horrific reality, we ask that you take a firm position one way or the other on the official story of 911 - and draw your own red line in the sand if you will. Your position on 911 is the quintessential litmus test that shall determine whether or not you are at all cognizant of the world around you, or if you are asleep at the wheel.

To assist you in the rather illuminating endeavor of developing a fully informed and rational position on this defining matter, we ask that you consider taking in just over 15-minutes of the "Echoes of Darkness," as a shortcut to help you reach such noble ends.

For those in search of a far more comprehensive presentation in developing their positions on this matter of existential importance, we direct your attention and inquiring minds to a fascinating 3-hour exhaustive expose of impeccable evidentiary content found in "Behind the Smoke Curtain."

Ending our video trilogy on a positive note, for a rather refreshing and optimistic view of a plausible financial model that could actually be of systemic benefit to the whole of global societies from the bottom up, we suggest one seriously consider the merits of such a framework presented by Catherine Austin Fitts.

In the end, no matter what unfolds, when or how, we should all realize that amidst the unfolding world order, an abundance of shocks lay in destiny's queue that will affect everyone's immediate and longer-term future.

As such, if you have yet to do so, there is no time like the present to take essential precautions.

Ten things you can do right now to buffer inevitable shocks of all shapes and sizes:

- Get out of debt (100% debt free is the ultimate goal)

- Covet and protect your cash flows

- Maintain physical cash on hand (6-12 months of living expenses)

- Maintain physical possession of Gold and Silver (re-balance annually at 15% of net worth)

- Maintain a 3-12 month supply of non-perishable food reserves and water

- Protect your stock investments from broker bankruptcy & theft

- Learn about the safe use of firearms for personal security

- Hedge all bets using separate brokerages accounts that enable true strategic diversification

- Use timeframe specific strategies to manage like accounts

- Maintain prudent unbiased disciplines in executing and managing your strategic plans

Additional Resources:

For the average long-term investor self-directing exposure to the S&P 500, Gold, and Silver, the Guardian Revere Trend Monitor is an excellent long-term market timing and alert-service with an outstanding record of accomplishment in keeping its members on the right side of long-term trends.

For active traders and investors, the Chart Cast Pilot takes it up several notches in sharing its programmed trades across all three time-frames in the major indices and amongst a basket of the most widely held stocks.

It is time to consider seriously, moving toward that which best assures safe and profitable passage.

If you are uncertain what kind of trader/investor you are, click here to consider which of our electronic trading-alert services might suit you best in this endeavor. For additional information and verified performance statistics, click here, or here.

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.