Big Ideas on Gold and Resources in the Big Easy

Commodities / Gold and Silver Stocks 2013 Nov 13, 2013 - 10:08 AM GMTBy: Frank_Holmes

For nearly four decades, curious investors have made their way to the Big Easy for a taste of New Orleans and several helpings of advice and perspective at the New Orleans Investment Conference.

For nearly four decades, curious investors have made their way to the Big Easy for a taste of New Orleans and several helpings of advice and perspective at the New Orleans Investment Conference.

Coincidentally, President Barack Obama was in the city recently, speaking at the Louisiana port, which was the setting to showcase his focus on the nation's economy.

Although the speakers and audience at the Investment Conference will likely have very different political opinions from President Obama, we can all agree with him when he said, "The first thing we should do is stop doing things that undermine our businesses and our economy."

I, for one, would love to have him read my blog post on this subject that discusses how Texas is becoming the nation's poster child of how companies, communities, and individuals flourish when allowed to operate under a more business-friendly atmosphere.

This is likely a contrarian view to the folks in the White House, but I think investors benefit from being contrarian and thinking differently. In preparation for my presentations in New Orleans as well as for the Metals & Minerals Investment Conference in San Francisco and the Mines and Money in London in a few weeks, I've been pulling together this kind of research that we can all put to use now.

One contrarian idea these days is investing in resources. This is an unloved and underowned area of the market, but there is a case to be made for owning commodities.

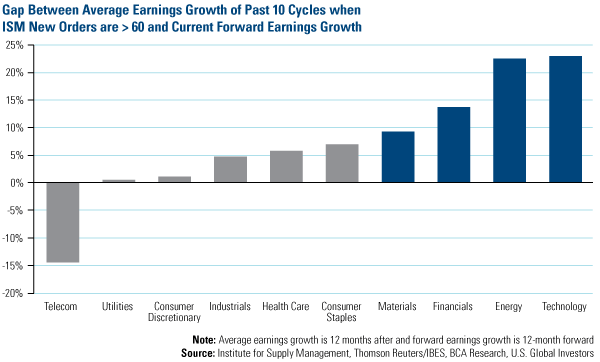

Consider the low expectations that analysts have on earnings growth for cyclical industries. BCA Research looked at times when the Institute for Supply Management (ISM) new orders index were more than 60, and calculated the average earnings growth in the following 12 months. The chart shows the gap between past earnings performance and what analysts are anticipating in the next 12 months.

According to BCA, sectors including energy and materials stand out "as having overly bearish expectations compared with their historical performance patterns."

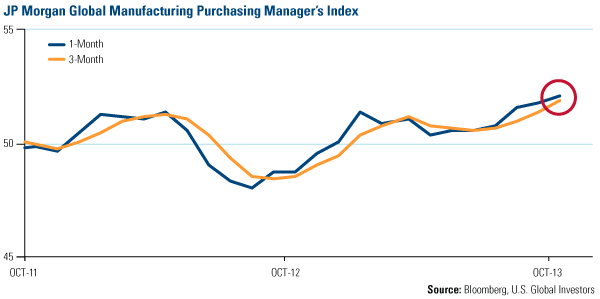

These analysts are bearish even though the world is experiencing an earth-shaking resurgence in manufacturing. In October, the JP Morgan Global Manufacturing Purchasing Managers' Index (PMI) grew to an incredible 29-month high, rising to 52.1 in October. A number above 50 indicates expansion in manufacturing, and if manufacturing is expanding, so should the economy.

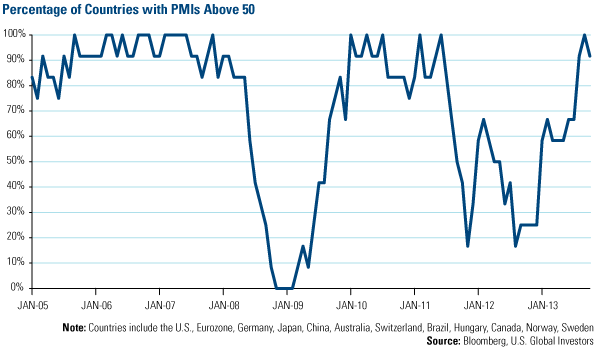

If you look at the PMIs of individual countries, including the data coming out of the U.S., Europe, Japan, China, Brazil, and Australia, more than 90 percent are above 50. Historically, when an overwhelming majority of countries see this level of manufacturing expansion, world-wide growth remains elevated for an extended period of time. Since January 2005, there were two previous times when PMIs remained high: From 2005 until the Great Recession in 2008, and from January 2010 through the middle of 2012.

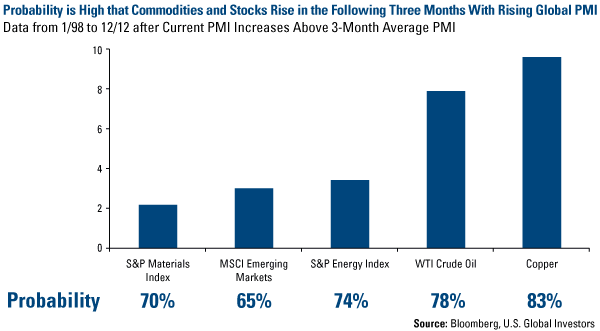

What's exciting about this revival in global manufacturing is the relationship between growing strength in PMIs and higher returns from certain commodities, including copper, crude oil, as well as energy and materials stocks. Based on 23 observations from January 1998 to December 2012, there is a high mathematical probability that physical commodities and commodity stocks rise in the three months after the current PMI number rises above its 3-month moving average.

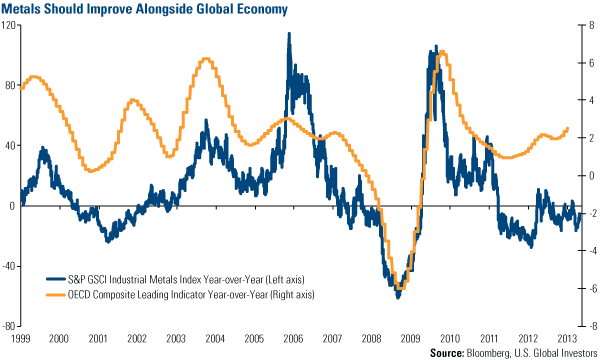

In addition, the Organisation for Economic Co-operation and Development (OECD) Composite Leading Indicator has been heading in a positive direction. This leading indicator provides early signals of turning points in business cycles, including economic activity. Historically, metals performance has closely followed this leading indicator, so as developed markets improved, the S&P GSCI Industrial Metals Index increased.

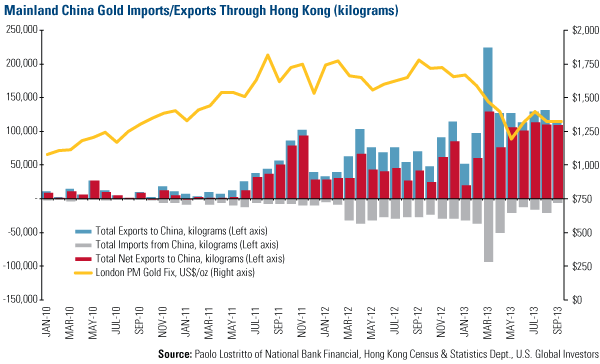

Gold is certainly a contrarian buy these days, but the big story that is affecting the supply of gold is how the physical metal continues to migrate east. According to Paolo Lostritto of National Bank, year-to-date net physical imports by China equate to approximately 50 percent of global mine supply. This is in addition to the reports from GFMS suggesting that China is the world's largest gold producer with an estimated 400-plus tonnes annually, or roughly 14 percent of global mine supply.

As Portfolio Manager Ralph Aldis likes to say, the gold going into China won't be coming back to the market. This journey is a one-way trip for gold.

However, Chinese demand for gold is only one ingredient in the very significant Love Trade. With the increasing gold import restrictions in India, the country's leading position as the world's biggest buyer of gold is in jeopardy. I'd like to get a firsthand perspective on what is really taking place with the demand for gold and get a flavor for what's going on, so I'll be traveling to India later this month.

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.