Gold Bull Market Drivers: Cheap Money, Rapid Inflation

Commodities / Gold & Silver Apr 23, 2008 - 08:08 PM GMTBy: Jim_Willie_CB

The two primary engines pushing the US Dollar down are extraordinarily low borrowing costs and extraordinarily high monetary growth. Money is very cheap to borrow, which encourages speculation for basic reason that many investments are rising in price. That covers the demand side for money. The money supply is growing out of control. It is hard to describe any modern day monetary event as like Weimar German times, but this is becoming close. The supply of new money is growing so fast that it is causing internal problems that are not fixable. Prices are rising broadly in the US Economy, since the nation imports everything. Too bad then nation cannot import leaders for government, the financial sector, economic counsel, regulatory bodies, debt rating agencies. While you are at it, import a free press network system.

The two primary engines pushing the US Dollar down are extraordinarily low borrowing costs and extraordinarily high monetary growth. Money is very cheap to borrow, which encourages speculation for basic reason that many investments are rising in price. That covers the demand side for money. The money supply is growing out of control. It is hard to describe any modern day monetary event as like Weimar German times, but this is becoming close. The supply of new money is growing so fast that it is causing internal problems that are not fixable. Prices are rising broadly in the US Economy, since the nation imports everything. Too bad then nation cannot import leaders for government, the financial sector, economic counsel, regulatory bodies, debt rating agencies. While you are at it, import a free press network system.

NEGATIVE BORROWING COSTS FOR MONEY

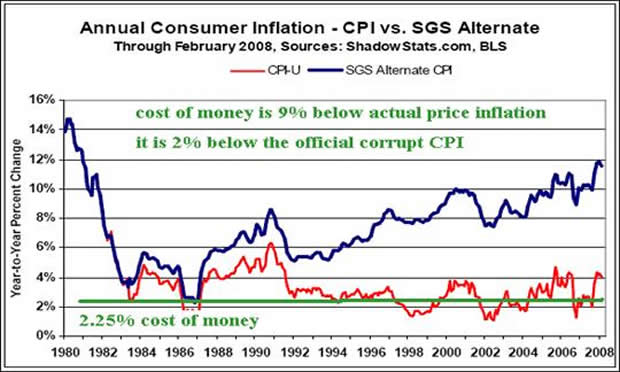

If one can achieve investment gains on par with the rise in prices, then borrowing money at a rate considerably below the current of rising prices is surely worth the risk. The cost of borrowing money at the Fed Funds 2.25% rate serves as a benchmark. If one uses the official Consumer Price Inflation index, then something close to a 4% CPI is the prevailing figure. The ‘Real Cost of Money' is Minus 1.75% but only one resorts to a bogus CPI figure posted. But wait! The US Govt reported CPI is the biggest elaborate joke ever played upon the US public. Its purpose is to minimize Social Security annual increases, to limit federal pension lifts, to offer low phony inflation adjustments to many other statistics like economic growth (GDP), and to maintain a charade for selling US Govt debt wrapped in USTreasurys at low yield. The divergence of the CPI from reality is a story in itself.

Rely upon the Shadow Govt Statistics measures in what follows. They remove nonsense, gimmickry, false lifts from corrupt hedonic adjustments. The US Govt figures are the most corrupt in the world, of any nations. The SGS folks offer a shadow of great value. Below, the true Consumer Price Inflation is shown as raging near 12%, as its divergence from the baseline false statistic is widening steadily. This means the cost of borrowing money at the Fed Funds 2.25% rate is over 9% lower than the CPI.

So money really costs MINUS 9%, which breeds speculation, and rewards it heavily. This differential is astonishing in its magnitude. Borrowing money is not only incredibly cheap, it will soon be even cheaper. Both ends will pull the differential wider, even lower rates and even higher CPI in future months. The US Fed is not finished cutting interest rates, as conditions will keep it responding in desperate fashion on the defensive. The valid CPI figure is still trending up. By year end 2008, possibly the Real Cost of Money in the US might Minus 12%. That fuels speculation and a broad attempt to seek effective inflation hedges in protection. And speculators like energy and precious metals traditionally. It is a no-brainer!

Michael Lewis is global head of commodities research at DeutscheBank. He made a quote recently that caught my attention, exactly the point made above. He said, “The sudden price pull-back across the precious metal complex during March has raised concerns that the bull run in this sector has drawn to a close. We disagree. We believe weakness in the US dollar has not been exhausted and with US real interest rates expected to move deeper into negative territory , we are maintaining our bullish outlook towards gold and silver prices.”

Bear in mind that some significant new money goes directly into hidden caverns of bank core holdings, providing relief to the bankers, but not yet enabling any grand overflow into the system. My conjecture, soon perhaps to be verified, is that the big banks are borrowing money on a grand scale and speculating in crude oil and natural gas contracts. The Senators from the State of Oil running the White House will hardly stand in the way. They might assist the effort, even as they decry the higher energy prices. Duplicity is not new to this team. The pendulum might soon swing from energy contracts to gold contracts. A Battle Royal might ensue as some banks in the field fight to survive, while other banks close to the corrupt leadership fight to continue the corrupted support mechanisms for the USDollar. The former will buy gold in whatever form, while the latter will sell gold paper.

THE MESSAGE IS CLEAR: WITH NEGATIVE BORROWING COSTS, GOLD RISES IN A BIG POWERFUL WAY. IT ALWAYS HAS IN SUCH CONDITIONS, AND ALWAYS WILL. THE NEGATIVE COST OF MONEY WILL BECOME EVEN LOWER NEGATIVE IN TIME.

By the way, import prices taken in by the USEconomy are rising at a 14.8% annual rate, dominated by crude oil. China though is raising prices uniformly and regularly on exported items. Finally, the pendulum has swung, whereby the US is importing inflation. For 25 years, the USEconomy exported inflation to Asia . Trade deficits were packaged in the form of debt securities, lapped up by Asians. If truth be known, the Asians have practically stopped buying USTreasurys from the US system for over two years. In recent months, higher Asian costs have been passed on to US customers who purchase finished Asian products. Compounding the problem is the potential of looming sales of US$-based bonds by Asians.

They are eager to ramp up their Sovereign Wealth Funds, to invest in meaningful concepts like energy, metals, and the properties that contain them. SWFunds have turned their noses up at more garbage debt securities from the US . So far, mortgage bonds are identified as rubbish. In time, foreigners will begin to regard US corporate debt and USTreasury debt as rubbish too. Most debt securities issued from the United States is subprime by any definition that incorporates the ongoing recession.

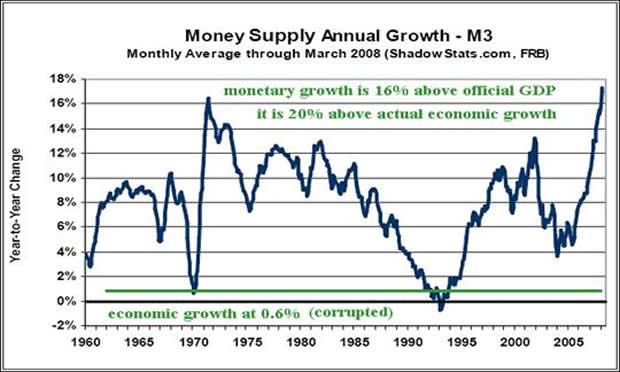

MONEY SUPPLY GROWTH BEYOND ECONOMIC BASIS

If the USEconomy endures a float of an increasing amount of money, above and beyond what the economy itself can justify, then overflow occurs. With the overflow comes a powerful mixture of imbalances, bubbles, contortions, disruptions, and crises. Greenspan committed the Original Sin back in 1994 by permitting the money supply to grow, with only a queer blind eye kept trained on the CPI. The rampant money supply growth is now feeding the energy market prices. It has fed the gold market also in recent years, and will continue to do so. The excess of money must flow into something, since it is not flowing into strong industrial plant, viable business capital, and functional economic foundation. It is flowing into the parade of sick bubbles endemic to the USEconomy. In the late 1990 decade it was stocks that rose in a bubble then busted. In the 2000 decade it was housing and mortgage bonds that rose in a pair of connected bubbles, then busted. Now it is flowing into energy and precious metals.

Below, the Money Supply rate is shown as raging over 17% on the broad M3 measure. This means immediately that the monetary aggregate is growing at least 16% faster than the USEconomy. However, given the corrupt nature of the Gross Domestic Product statistic, courtesy of the USGovt, the money supply is expanding much faster than actual economic growth, like 19% to 20% faster. Some call the difference between the monetary growth rate and the economic growth rate to be the 'Real Inflation Rate' since adjusted for baseline growth necessities. As the funding requirements continue for the damaged bank assets, for the mortgage bonds, for the housing loan renegotiations, look for the monetary aggregate to continue in this upward trajectory. The central bankers, past and present, are even joining the fight to lay blame at the feet of their contemporaries. A circus sideshow has developed.

By the way, the euro money supply is growing in the neighborhood of 12% annually. That spurs bubble growth in Europe , along with speculative flow into energy and precious metals. That fact that euro monetary growth is 6% below US$ monetary growth means the USDollar will continue to fall relative to the euro.

OVER-ARCHING USDOLLAR FACTORS

Basic forces are at work. The speculative movement will continue to respond positively to the giveaway of money. The USDollar will continue to respond negatively to rabid money supply growth. Expect new arenas to respond to the rampant money supply growth, since its destinations cannot be controlled. Its direction can only be steered, encouraged, and directed to follow trends. Therefore, for these two reasons, the USDollar is falling into crisis mode. Gold & silver respond in opposite fashion, rising in price. Unless and until the cost of money and the growth of money return to normalcy, the USDollar will continue down steadily, and precious metals will continue up steadily in price.

The US financial system is in tatters. The failure of the financial networks to report this story is yet another travesty heaped upon the US public, which is slowly grasping the gravity of the situation. They see the home foreclosure signs. They see the rising gasoline prices. They read about the suspicious Wall Street play on key stories. They see the job losses, and Chinese labels on many finished products. They see the drop in interest rates, but the system continuing to break down. They continue to deal with mortgage rate resets, the next big round to involve Exploding Adjustable Rate Mortgages this summer. These will feature the Negative Amortization loans, the Option ARMs, the Hybrid ARMs, and much more. Watch California sink into a morass.

The US financial system has several pillars, all either underwater or tilting toward insolvency. Vicious cycles have begun to work their powerful wreckage, rendering solution as extremely elusive and difficult. The breakdown must run its course. The momentum to unwind 15 to 20 years of abuse will take many years more.

- USGovt is running huge federal deficits, to grow worse as recession worsens

- US trade deficit is widening, as is the corresponding Current Account Deficit

- US bank system is in technical insolvency, with negative non-borrowed core assets

- Nearly 10% of homeowners have negative equity in homes, to reach 20% by year end

- US car industry is reeling from higher gasoline costs, and piglike SUV emphasis

- US airline industry is reeling from higher jet fuel costs, and strangled networks

- US truckers are being squeezed, as highway actions are on the rise

The United States is tragically entering a gradual state of failure, from insolvency, corruption, and indescribably horrible economic counsel. An astronomical rise in USGovt federal deficits could occur in the next few months. Capitalism has failed in an historical spectacle of catastrophe. The nation has lost its legitimate income sources from industry. The nation has relied upon inflation contraptions and financial engineering devices for two decades. The exotic devices have blown up in our faces. The reflection upon the USDollar is certain to continue. Recent adoptions of broader US Federal Reserve lending facilities has given a cup of water, a piece of bread, and a peptalk to a crippled man burdened by a 150-lb backpack of debt even as Wall Street thieves empty his pockets of loose money and all pension receipts. To accept that the worst is over is an exercise in stupidity, naivety, and further con game victimizations. The more realistic story is that the United States is entering a failed state condition. In that respect, it is in a race with Mexico , which again is covered with an update in the April issue of the Hat Trick Letter. The trade surplus driven by Mexican oil exports is fast vanishing, exacerbated by a huge rise in imported gasoline.

If you do not believe the claim of a failed state, watch the abandonment of mortgages rise to alarming levels, watch the reaction to closure of gasoline stations from lack of profit potential, watch the horrendous list of job losses across the broad spectrum of the USEconomy, watch the continued magnificent declines in US housing prices, watch the next rounds of personal bankruptcies as credit cards no longer keep them afloat, watch the next round of mortgage bond losses for big banks, and watch the foreign reaction to amplified USTreasury Bond auctions to cover the growing federal debt. The word crisis will be used to cover much more than the falsely reported subprime mortgage problem, which is a mortgage bust in a total sense.

FRAUD BY USGOVT, WALL STREET & THE S.E.C.

The official USGovt economic statistics are by far the most corrupt in the world, the land of Institutionalized Dishonesty . The latest episode centered upon Bear Stearns should have demonstrated that amply. Will any investigation be done of the JPMorgan raid, using USFed credit, designed with phony price points? Will any investigation be done of the massive option put contracts hastily approved and bought on the exchanges, $50 below the BSC current price, with a mere five days to go? No! Of course not, especially not in a land whose governing bodies conform to the guidelines of the Fascist Business Model. View the bounces, intrigue, and drama behind the Bear Stearns BSC stock price movement as a colossal sanctioned corrupt raid and insider manipulation that will stand as a punctuation mark on US stock fraud. Regard it as a successful attempt by insiders, both management and well heeled professionals, to steal pension money from Bear Stearns employees past and present. Regard it as a second chapter to the mortgage fraud story itself.

The Congressional query into the JPMorgan and Bear Stearns interplay was more a window dressing than anything else. The members of Congress are outmatched by savvy slick thieves, who not only operate in circles beyond the comprehension of legislators, but also speak in a language over their heads as well. Much of the big bank executive testimony was lies mixed with falsely represented hearsay as an effective distraction. The Securities & Exchange Commission cannot very well investigate what it approved to begin with under extraordinarily suspicious surroundings. The SEC approved option put contracts so far out of the money, with so little time left before expiration, that they must have been part of the game played. The losers are stockholders, the investment community, and the US financial sector reputation still in a nosedive from mortgage bond fraud. By the way, prosecution for the mortgage bond fraud creeps slowly along. It was interrupted by the Spitzer side show, whose story might be only half true.

NEXT UGLY BIZARRE TWIST

Fanny Mae properties will be a mainstream concept before long. The New Resolution Trust Corp will feature a mortgage bond cemetery (to buy failed bonds, to bury them deep), and a mortgage finance centrifuge (to spread a mortgage fund recycle). The third function to assist in renegotiated loans will not involve any incremental ownership of property titles, but it will add notably to the USGovt federal deficit. The bond cemetery and mortgage centrifuge will require that Fannie Mae & Freddie Mac, the dynamic corrupt fat bankrupt duo, to own title on a very long list of properties. Decisions will eventually be made NOT to dump the properties on the market for sale. The concept of earning an income from rent will be recognized. The shareholders of FNM and FRD will benefit from a dividend earned from home rentals. Why sell in a depressed housing market when rents are on an upward trend?

The road to serfdom will involve the USGovt through its corrupt, insolvent, and revived mortgage apparatus to becoming the biggest national homeowners in the land. What an embarrassment! But watch for how the story is spun! If alive today, Thomas Jefferson would spit in the eye of the president, the Treasury Secretary, the USFed Chairman, the Congressional leaders, and any Wall Street CEO who crossed his path!!!

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“You are able to consume and regurgitate complicated information into layman's terms. It shows that you understand your subject well. It is very easy to take complicated material and repackage it as complicated material. You, however, have the ability to take the complicated and make it understandable to the common man.” (RickS in Californiaa)

“Keep up the good work, and stay safe- the world needs your interpretative skills. “From your radio interviews, I know that your quick wit and conviction are genuine. Your confidence and eloquence comes across just as strongly. You make specific, seemingly outrageous predictions with specific timing, and you are very often right. Really, can one offer any higher praise to an analyst?” (TomH in California )

“The unfortunate demise of Dr. Kurt Richebacher leaves Jim Willie, Bob Chapman, and Jim Sinclair as the finest financial minds on the scene today.” (DougR in Nevada )

“There are four writers that I MUST READ. You are absolutely one of those favorites!! William Buckler, Ty Andros, Richard Russell, and YOU!!” (BettyS in Missouri )

“Your newsletter caught my attention when the Richebächer report ended. Yours has more depth and is broader in coverage for the difficult topics of relevance today. You pick up where he left off, and take it one level deeper, a tribute.” (JoeS in New York )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retaicl forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.