Message to the U.S. Fed: Here Are a Few Things That You Can’t Do

Interest-Rates / US Federal Reserve Bank Mar 24, 2014 - 06:12 PM GMTBy: F_F_Wiley

[A]sset purchases are not on a preset course, and the Committee’s decisions about their pace will remain contingent on the Committee’s outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases. -March 19 FOMC statement

[A]sset purchases are not on a preset course, and the Committee’s decisions about their pace will remain contingent on the Committee’s outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases. -March 19 FOMC statement

The excerpt above or some variation has appeared in every one of the Fed’s post-FOMC meeting statements since the beginning of QE3 in September 2012.

Unfortunately, it doesn’t give us much comfort. We don’t see evidence of the Fed’s economists accurately gauging QE’s “efficacy and costs,” notwithstanding its oh-so-slow wind down. On the contrary, history shows that these economists have an inflated view of what they can achieve with monetary policy.

Take the link between QE and jobs, for example. We were struck by the following question, asked recently by commenter “liongterm investor”:

How does a dollar (or trillion dollars) added to the Fed balance sheet create a job? This is a serious question; I am not trying to bait someone into an argument … What I do understand about QE is how money the ends up [in] excess reserves earning interest from the Fed larger than what my deposits or short term treasuries earn. I also understand how the money can end up driving up equity prices. But job creation??

We don’t doubt that “liongterm investor” is aware of “wealth effects” – the idea that a booming stock market encourages happy investors to buy an extra luxury item or two, and this might eventually create a few positions at, say, Tiffany. But it’s not a very powerful effect, is it? Nor can we be sure that it won’t come back to bite us, for reasons we’ve written about in the past (see here, here, here or here).

What’s more, questions of what the Fed can and can’t achieve go beyond QE. We touched on the limitations of monetary intervention in recent research on where the economy stands today:

- “What Needs to Happen Before We See a Big Recovery?”

- “Corporate Capex Fallacies and Why You Shouldn’t Rely on CNBC”

We’ll build on that research below with a handful of charts showing that there are many things the Fed can’t do when it comes to manipulating the economy.

Household borrowing and spending: What the Fed can’t do

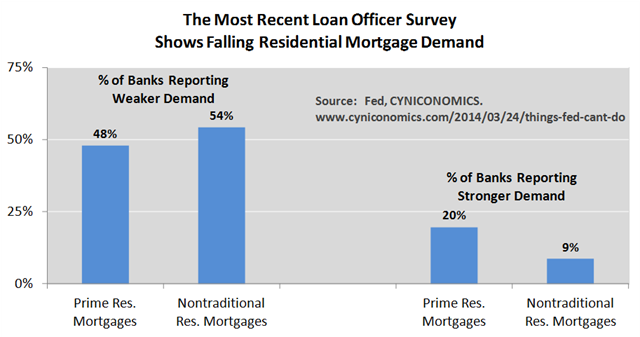

In a debt-saturated household sector, the Fed can’t prevent mortgage demand from stagnating:

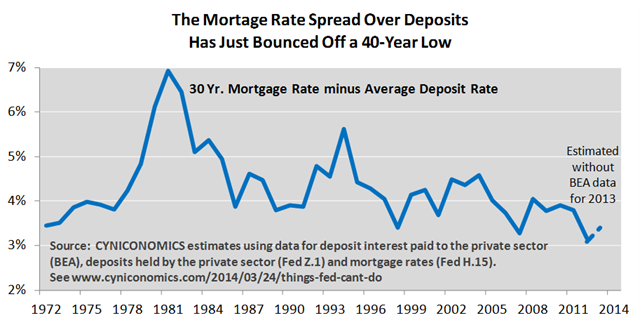

Based on 40 years of history (and the fact that banks need to cover their costs), the Fed can’t shrink the spread between mortgage and deposit rates much further than it did in 2012:

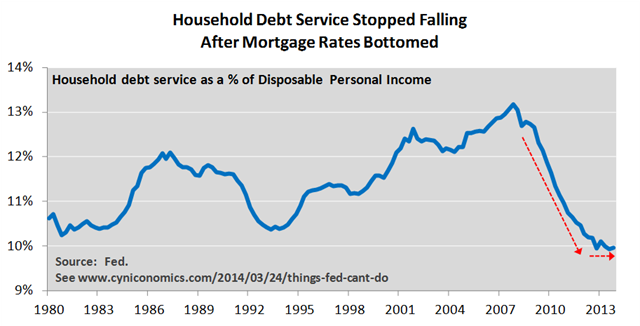

Consequently, the Fed can’t push debt service costs much below current levels:

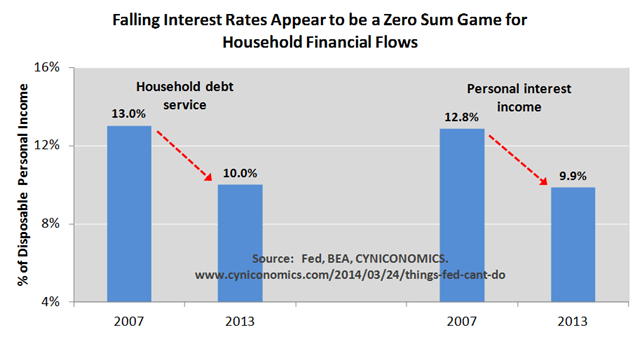

Nor can lower debt payments provide much of a subsidy in the first place, since falling debt service is matched by declining interest income:

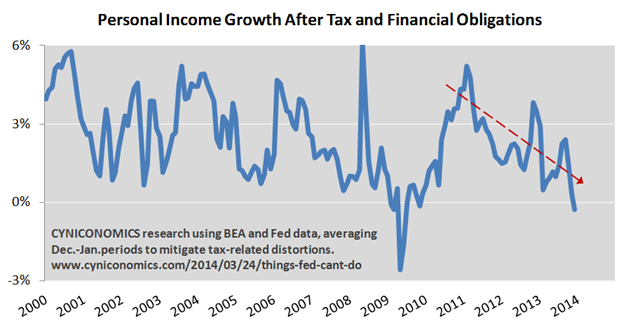

More broadly, there’s a downwards trend in income after tax and financial obligations, and the Fed can do little about this:

Business borrowing and spending: What the Fed can’t do

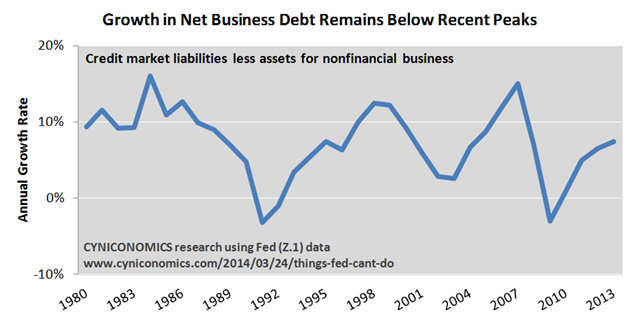

The Fed can’t convince businesses to revert right away to the borrowing habits of recent bubbles:

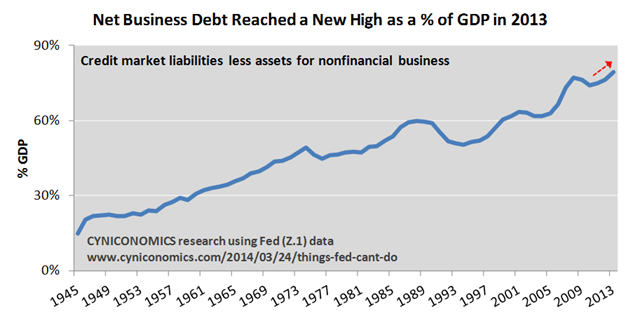

Especially as net business debt is already at an all-time high:

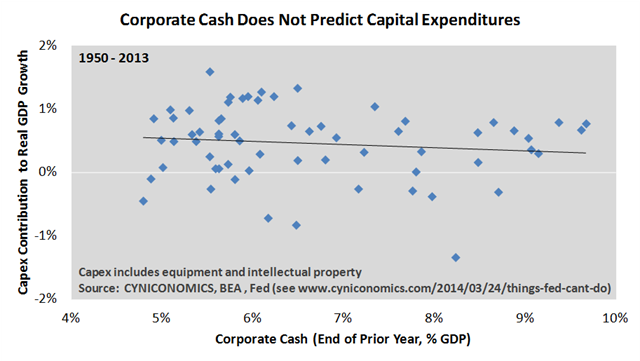

And while the Fed can affect the amount of cash deposits, it can’t force businesses to make spending decisions based on those cash balances:

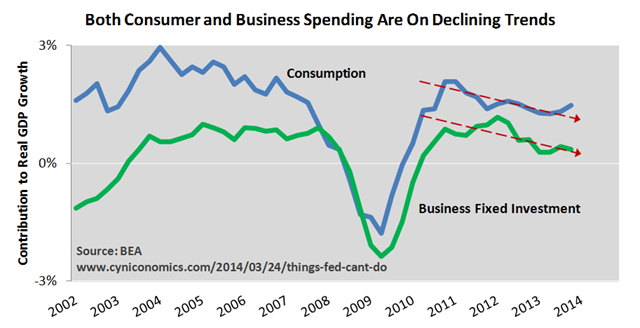

Consequently, business spending growth has slowed alongside consumer spending, and the Fed can do little about either of these developments:

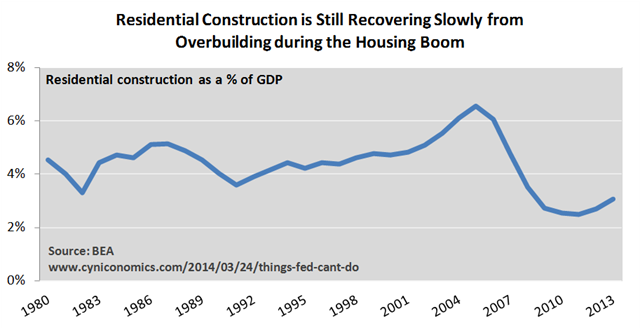

Housing: What the Fed can’t do

The Fed can’t undo past overbuilding, and therefore, it can’t conjure up another residential construction boom (for awhile, at least):

What the Fed can do

On the other hand, here are a few developments that our central bank can accurately claim to have achieved:

- Lifting prices on stocks, houses and other risky assets, which creates a wealth effect and boost for high-end consumption.

- Creating windfall profits for financial firms aiming to exploit the bubble, then bust and then bubble again pattern in the housing market.

- Creating windfall profits for primary dealers through the Fed’s Treasury and mortgage purchases (even as central bankers may occasionally discipline traders who aren’t careful).

- Preserving the “heads I win, tails you (the taxpayer) lose” mentality in the financial sector that leads to reckless risk-taking.

What the Fed shouldn’t do

Another way to look at the data and observations above is to ask why the Fed’s achievements have been so limited (and of dubious value). It’s evident that the economy isn’t growing strongly because of conditions that central bankers themselves created, by encouraging excessive borrowing and disregarding moral hazard.

In other words, the problem isn’t so much that the Fed can’t deliver another debt-fueled boom, but that it shouldn’t be trying to cure a credit bust with more borrowing in the first place.

Sadly, though, this idea falls in the same category as the notion that the Fed’s balance sheet isn’t the right tool for job creation. It’s too damning a thought to be accepted by central bankers who’ve shackled themselves to a philosophy of ceaseless intervention. It’s also too basic for economists who prefer abstract theories and mathematical models over reality-based thinking.

Such straightforward concepts as not fighting a debt hangover with more debt just don’t enter into the Fed’s calculus about “efficacy and costs,” even as they make perfect sense to so many of the rest of us.

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2014 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.