What the Google (Nasdaq: GOOG) Stock Split Means for Investors

Companies / Google Apr 03, 2014 - 03:07 PM GMTBy: Money_Morning

Kyle Anderson writes: The Google Inc. (Nasdaq: GOOG) stock split happens tomorrow (Wednesday, April 2), meaning Google shareholders of record as of March 27 will own two shares tomorrow for every share they own today.

Kyle Anderson writes: The Google Inc. (Nasdaq: GOOG) stock split happens tomorrow (Wednesday, April 2), meaning Google shareholders of record as of March 27 will own two shares tomorrow for every share they own today.

Following the split, Google will have twice as many shares outstanding than it currently does. Google's "Class A" shares will trade under the ticker GOOGL, while the company's "Class C" shares will remain on the company's current ticker GOOG.

Nasdaq: GOOGThe main purpose of the stock split is for Google Founders Larry Page and Sergey Brin to maintain the control they have over Google...

In addition to Class A and Class C shares, there is a third class of shares, "Class B." Page and Brin own the Class B shares, and they do not trade publicly.

When it comes to voting rights, each share of Class A stock comes with one vote. Each share of Class B stock (owned exclusively by Page and Brin) comes with 10 votes.

Importantly, Class C shares do not come with any voting rights, meaning that Page and Brin are preventing any further dilution of their power in the company. The company is expected to only issue shares of Class C moving forward.

Currently, the two founders control 56% of Google's voting power. They will maintain the majority control by only issuing stocks without voting power moving forward.

When the split occurs, Page and Brin will be given an additional share for every Class B share they own, just like investors who own Class A shares. But like everyone else obtaining a Class C share, the ones Page and Brin obtain will have no voting rights.

It's clear that Page and Brin will maintain voting power among Google shareholders, but that's not the only part of the Google stock split that bears watching...

How the Google Stock Split Benefits GOOG

While BGC Analyst Colin Gills recently described the stock split to MarketWatch as a typical move by company founders looking to maintain control, it does have other impacts on GOOG stock. Specifically, Gills pointed out that the deal allows for more flexibility in M&A deals and allows the company to offer additional stock incentives.

"They couldn't do a big deal before using stock because it changes the voting rights," Gills told MarketWatch. "Now, they've got a mechanism where they can use their paper for deals and not lose their majority voting rights."

Another area where GOOG investors will see a change is in earnings per share (EPS). In March, Google officials announced that investors should not expect the usual value that they're used to seeing in the company's generally accepted accounting principles (GAAP) EPS.

"Our Q1 GAAP EPS will be half what we would otherwise report because our net earnings are divided into twice as many shares," the company said in a statement.

That means the EPS figure will be split over two stock classes. Essentially, the total will be the same, however. So seeing EPS half of what it used to be will not be a concern for investors.

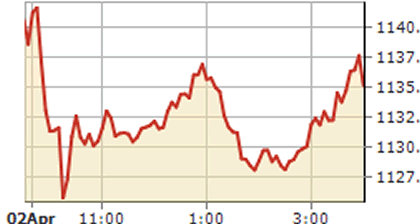

Another likely side effect of the stock split is a short-term run up in the company's stock prices. Google stock is very expensive today, trading at more than $1,125 per share. When the stock splits, its value will be halved to approximately $562 per share.

That will make it more available to everyday investors or "retail investors" who can't afford a stock that trades over $1,000 a share. More retail investors should be expected to buy into GOOG following the split, thus driving the price higher in the short-term.

Finally, as more retail investors buy in, GOOG's volatility is expected to increase.

"Letting the individual stock price go up very high kept a lot of the riff raff out of the market (day traders) and this made the stock far less volatile," Rob Enderle of the Enderle Group told MarketWatch."By doing a split it will bring more investors in and likely result in a much higher valuation and the result should still be reasonably high but volatility will likely increase somewhat."

GOOG stock has climbed 41% in the last year, but recently the stock is down almost 7% in the last month. Expect a short-term gain from GOOG stock moving forward.

Do you own GOOG stock? Did you buy into the stock before the March 27 date of record? Join the conversation on Twitter @<a target="_blank" href="http://twitter.com/moneymorning" rel="external nofollow">moneymorning using #Google.

The U.S. dollar is still the world's reserve currency, but it faces increasing threats. In fact, the clock is ticking on this massive currency shift...

Source : http://moneymorning.com/2014/04/01/google-nasdaq-goog-stock-split-means-investors/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.