China and India Changing the Global Marketplace

Stock-Markets / Emerging Markets Oct 28, 2014 - 05:55 PM GMTBy: Harry_Dent

China is looking at investing in infrastructure in India. That’s the best idea I’ve heard in a long time.

China is looking at investing in infrastructure in India. That’s the best idea I’ve heard in a long time.

China has overinvested — like 12 to 15 years of future urban migration out — with 27% of home vacancies in cities. India has underinvested in everything. The roads are terrible, electricity is nearly non-existent in rural areas and it’s shoddy at best in urban sectors. Water and sewer services are not up to snuff and there are slums everywhere.

This means the Indian population on the whole has to work much harder than emerging world competitors like China or Malaysia. I’ve always said that if the Indian government just made much larger investments in infrastructure… it would attract strong foreign investment and its development would accelerate at a faster pace just like China did.

India Becomes A Major Player

India looks like the next big thing to me and will likely be the first foreign country we advise to invest in after the next crash ahead, likely by late 2016 to early 2017. Much of the rest of the emerging world is too linked to commodity exports and won’t see a sustainable turnaround until that 30-year commodity cycle bottoms between 2020 and 2023.

India has a population of 1.271 billion, close to China’s at 1.395 billion. That’s 17.4% of the world’s population, but it’s growing at a much faster pace than China…

By 2050, India will be larger than China in population and China is already on the road to a shrinking workforce followed soon by declining population.

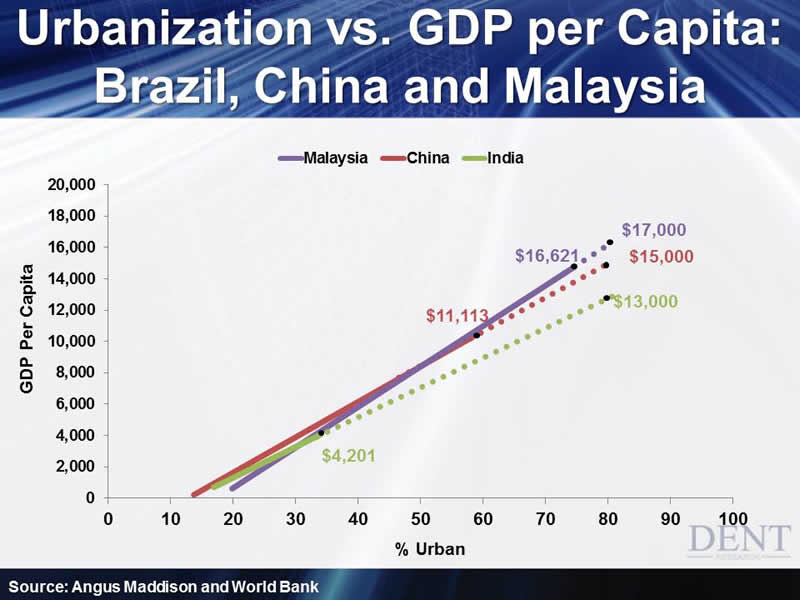

The biggest driving factor in emerging countries is the rate and slope of urbanization vs. GDP per capita. India has a slope nearly as high as China and Malaysia, the two strongest in the emerging world.

India is only 33% urban and will not mature to 80% for at least another 50 years. China is at 56% and will likely slow dramatically over the next decade after so much overbuilding and the highest rate of urban migration in history in the past 15 years. The following chart summarizes the urbanization trends and projections for three major emerging countries at different stages.

India’s workforce growth, the key demographic indicator for emerging countries, will grow rapidly into 2050 followed by a plateau moving into 2060 and then it’ll only slowly decline. Urbanization will continue to grow until at least 2070. Combining urbanization and demographic trends, I see India continuing to grow into the mid- to late 2060s before it slows down.

China’s workforce growth already peaked back in 2012. Malaysia will peak around 2040 demographically with their urbanization peaking well before that.

Bank by BRICS

But here’s perhaps the most interesting trend. The major BRICS (Brazil, Russia, India, China and South Africa) are talking about an international bank to help finance their growth and political issues like the IMF for the world. China is talking about investing in India. Why not Southeast Asia that has much potential for urbanization and modernization as well?

The 3 Trends That Will Dominate This Decade

Three trends will define this decade:

- Deflation…

- Debt deleveraging…

- Demographics…

Listen to this interview with rogue economist Harry Dent to learn what these trends will do to the economy and the markets… This interview is free to watch.

Combine China, India and Southeast Asia and it’s close to 50% of the world’s population in one giant and connected emerging region… That is formidable.

The Asian Union (AU) is likely the next big thing as well, but India more so, especially now that it has the first progressive and capitalistic leader in its history with newly elected Narendra Modi… and he’s already meeting with the U.S. and China.

While the European Union faces more pressure, demographic slowing, high debt, banking and trade imbalances; I could see an AU emerging increasingly over the coming years. And it just makes sense for China to invest in India and Southeast Asia, now that it has overinvested in its own country.

It makes sense for the wealthiest western nations to invest in Asian emerging countries that are experiencing the highest growth. Japan and the East Asian “tigers” should do so as well seeing as they’re faced with stagnating growth and deteriorating infrastructures and yet… they have much higher wealth to invest.

I’ve stressed for many years that investors from developed countries will get higher returns by investing in the emerging world after this winter season and great reset.

We’ll keep monitoring India as the first emerging country and we’ll likely recommend it for longer term investments after the next big crash well before the winter season finally ends between 2020 and 2022. I cover this topic in more depth in this November’s issue of Boom & Bust.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2014 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.