The Singularity Means that Google Could Dominate the Future

Companies / Google Nov 08, 2014 - 12:24 PM GMTBy: Money_Morning

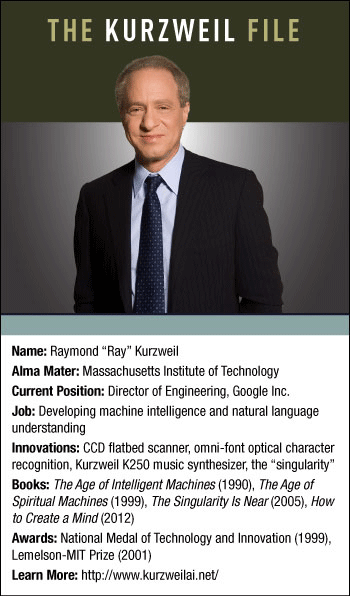

Michael A. Robinson writes: You’d be hard pressed to find two guys more different than Warren Buffett and Ray Kurzweil.

Michael A. Robinson writes: You’d be hard pressed to find two guys more different than Warren Buffett and Ray Kurzweil.

Buffett, probably the world’s most famous investor, had steered clear of high tech until just the last few years, saying he didn’t understand the field.

Kurzweil, on the other hand, has pushed the boundaries of innovation for more than five decades. As a teenager, he created a groundbreaking computer program that could play classical music and netted him an appearance on the TV game show I’ve Got a Secret.

He’s never turned back, inventing omni-font optical character recognition, flat-bed scanners, text-to-speech programs and artificial intelligence for trading the markets.

Now, he may be best known for his prediction that in the near future man and machine will become intertwined in an event he calls the “singularity.”

Today, I want to tell you about an intriguing tech investment with enormous upside.

This industry leader has somehow combined Buffett’s business genius and Kurzweil’s futurist brains…

Not Standing Pat

As a former part-time musician, I’ve followed Kurzweil’s work for many years now. His Kurzweil K250 synthesizers that debuted in 1984 redefined electronic music.

The sounds from those devices were so realistic that in some tests professionals couldn’t tell the difference between a K250 and a real grand piano.

A list of Kurzweil’s many inventions would run several paragraphs. When it comes to high tech, few can match his track record.

So, when our favorite futurist took a high-profile Silicon Valley job two years ago, I was excited to see what he might come up with.

Kurzweil has said many times that the three areas most vital to the next phase of human development are what he calls “GNR” – genetics, nanotechnology and robotics.

Kurzweil has said many times that the three areas most vital to the next phase of human development are what he calls “GNR” – genetics, nanotechnology and robotics.

I certainly don’t disagree with that.

And so I think you all should take a close look at Kurzweil’s work at Google Inc. (Nasdaq: GOOG), where he’s a director of engineering.

It’s not well known, but even before Kurzweil’s arrival, the Internet search giant had been making great strides in GNR through its secretive Google X facility.

First, in 2010, came a driverless car. And since then, we’ve seen Google Glass, glucose-monitoring contact lenses and other biotech projects, Project Wing (drone delivery), and Project Loon (Internet service via high-altitude balloons) come out of the Google X labs.

Wall Street analysts and other investors often criticize Google X’s “science fiction-sounding solutions.” They claim the company is preoccupied with futuristic technology and doesn’t pay enough attention to core search products.

In a recent interview with the Financial Times, Google CEO Larry Page rejected that criticism outright. Page says he emulates none other than Warren Buffett, whose Berkshire Hathaway Inc. (NYSE: BRK.A) is the most successful conglomerate in history; shares of its Series A stock are priced at nearly $216,000.

Page says he’s on a mission to make Google the Berkshire Hathaway of high tech. He told FT that his “patient capital” approach will pay off handsomely for investors over the long haul – and I concur.

If Google wants to compete with Apple Inc. (Nasdaq: AAPL) and other tech leaders and up-and-comers, there’s no way it can stand pat.

With that in mind, I want to let you know more about the fascinating breakthroughs Google is making in Kurzweil’s GNR.

Let’s take a look.

Genetics: Defeating Death

Google launched California Life Sciences LLC (aka Calico) last year to focus on anti-aging research.

Essentially, Page, Kurzweil and other top executives at the Googleplex want to “cure” death.

Like Google X, Calico has been surrounded by mystery and even some controversy. Most new ventures seek attention and court press coverage. In the months that followed the unveiling; however, both Google and Calico remained very circumspect about their plans.

Calico recently announced a joint venture with biotech leader AbbVie Inc. (NYSE: ABBV). The two companies have agreed to invest up to $1.5 billion in drug research.

Now we know that Calico specializes in analyzing genetic data. The company’s leader, current Apple Chairman and former Genentech Inc. CEO Arthur Levinson, intends to use this information to create innovative treatments for age-related diseases.

Here’s Calico’s mission – to identify what inside them makes people live longer or makes them prone to diseases. Calico scientists will use what they find to create new life-extending drugs.

Calico is set to build an R&D facility in the San Francisco region. The facility will house drug development and clinical trials.

Calico and AbbVie are targeting genetics-based research on cancers and neurodegenerative diseases such as Parkinson’s and Alzheimer’s.

Nanotech: Beating Cancer

Imagine a pill that will detect cancers and other diseases by sending out magnetic nanoparticles throughout your bloodstream that patrol your body.

Andrew Conrad, head of the Life Sciences team at Google X, has confirmed they’re working on just that.

These nanoparticles are less than one-thousandth the width of a red blood cell. If the Googlers’ designs work, the particles will bind themselves to cells, proteins and other molecules inside the body and serve as a constant cancer early-warning system.

Google also is working on a wearable monitoring device – which will use a magnet to attract and count the particles.

The final product will take several years to pass a series of U.S. Food and Drug Administration clinical trials and reach the market. But that’s true of all new drugs and medical devices.

Robotics: Hands-Free Driving

Just about every auto firm in the world and plenty of tech companies are working on driverless cars. But no one has done more for this field than Google.

Too operate without steering wheels Google Self-Driving Cars are equipped with such complex software, a bevy of motion sensors, collision avoidance systems, 3D maps and lasers.

In a recent blog entry, the project’s director noted that Google “bot cars” have already logged more than 700,000 miles on the road. The program began in secret back in 2009.

But driverless cars are only the public face of Google’s robotics efforts.

Behind the scenes, the Mountain View, California-based company has moved aggressively. It’s bought at least seven robotics firms in the last few years, including the pioneering Boston Dynamics, which makes four-legged pack bots for the Pentagon.

Search: Party On

Like I mentioned before, some critics say Google’s fascination with futurism means it is ignoring its core online search business.

However, Kurzweil will be a big boost for the company here, too. He is one of the world’s foremost experts on artificial intelligence – and he’s confirmed that Google is building that technology into a next-gen search platform.

Thus, Google is a unique investment opportunity. Think of Google as an exchange-traded fund (ETF) that is stuffed with future-tech small caps – and that generates huge cash flow right now.

With a market cap of $371.9 billion, the stock trades at $555. It has operating margins of 23% and earns 14% on stockholders equity. Last year, it brought in $5.4 billion in free cash flow.

Larry Page is correct. Google stock has lagged the market over the past year and is a long-term play.

Here’s a hint of the potential: Exactly 30 years ago last week, Berkshire Hathaway Series A stock was worth $1,300 a share, giving it a 16,054% return since then.

If Google did just 2% as well over the next 10 years, it would give us a 321% return. I bet Warren Buffett would like that.

Patient investors who realize Google, Page and Kurzweil are building the ultimate company of the future will be richly rewarded.

Source : http://strategictechinvestor.com/2014/11/thanks-secret-side-company-will-dominate-future/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.