Currency Wars - U.S. Dollar Soars, Economy Disappoints

Currencies / US Dollar Mar 14, 2015 - 04:38 PM GMTBy: John_Rubino

The point of competitive devaluation, aka currency war, is that a cheaper currency gives a country several advantages over its trading partners, leading to better growth and generally happier voters. The trading partners, meanwhile, get the ugly mirror image -- slowing growth and disgruntled citizens -- so they eventually respond in kind, with devaluations of their own. If nothing happens to stop the war, everyone's currency ends up being worth a lot less and a whole generation of savers is partially wiped out.

The point of competitive devaluation, aka currency war, is that a cheaper currency gives a country several advantages over its trading partners, leading to better growth and generally happier voters. The trading partners, meanwhile, get the ugly mirror image -- slowing growth and disgruntled citizens -- so they eventually respond in kind, with devaluations of their own. If nothing happens to stop the war, everyone's currency ends up being worth a lot less and a whole generation of savers is partially wiped out.

In the current skirmish, Europe is crushing the US, which is to say the dollar is soaring against the euro. So if the script holds, the US should be suffering. And -- despite all the breathless reports of plentiful jobs and plunging unemployment -- the recent numbers do paint a picture of a country hobbled by a too-strong currency. From Bloomberg this morning:

Surprise: U.S. Economic Data Have Been the World's Most Disappointing

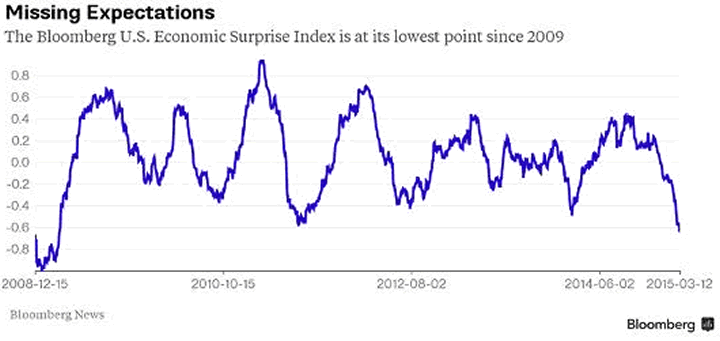

It's not only the just-released University of Michigan consumer confidence report and February retail sales on Thursday that surprised economists and investors with another dose of underwhelming news. Overall, U.S. economic data have been falling short of prognosticators' expectations by the most in six years.The Bloomberg ECO U.S. Surprise Index, which measures whether data beat or miss forecasts, fell to the lowest since 2009, when the nation was in the deepest recession since the Great Depression.

There's been one notable exception to the gloom, and it's a big one: payrolls. The economy added 295,000 jobs in February and 1.3 million over four months, a reflection of a healthier labor market in which the unemployment rate has fallen to the lowest in almost seven years.

Most everything else? Blah.

This month alone, personal income and spending, manufacturing as measured by the Institute for Supply Management, auto sales, factory orders, and retail sales have all come in a bit weak.

Citigroup keeps economic surprise indexes for the world, and its scoreboard shows the U.S. is most disappointing relative to consensus forecasts, with Latin America and Canada next, as of March 12. Emerging markets were supposed to be hurt by falling oil prices but are now delivering positive surprises. U.S. policymakers frequently talk about weakness in Europe and China, though both are exceeding expectations.

Some thoughts

Coming after five years of huge deficits and zero interest rates, a US slowdown would either invalidate the concept of QE -- or invalidate the concept of finite QE.

Since giving up on easy money would leave the authorities with zero policy tools to hype during the coming election cycle, surrender is a non-starter. So the idea that we haven't done enough will soon be embraced by everyone from Paul Krugman (who's been saying it all along) to the entire democrat party to most major corporations (who have had enough of a strong currency and long for a euro-style 1/3-off sale).

But the timing depends on the stock market. If it keeps rising then hope will endure of a "wealth effect" boost to second-half growth. If it tanks then all hesitancy will evaporate and the Fed will see Draghi's trillion and raise him another. Bond yields will go negative, and bank savings accounts even more so.

At which point the question will shift from "is there really a currency war?" to "where will they find more stuff to buy once they have all the bonds?"

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.