The Double-Edged Sword of a Strong U.S. Dollar

Stock-Markets / US Dollar Mar 19, 2015 - 01:54 PM GMTBy: Clif_Droke

Until the latest pullback on Wednesday, the U.S. dollar index had been on a rip-and-tear for most of this year. Earlier this week the dollar hit a new multi-year high as concerns over Europe and China have fueled foreign interest in U.S. assets. The greenback's relentless strength is also a cause for concern among investors who fear that a stronger dollar will erode corporate profits this year. Since much of the bull market of the last few years was based on the bull market in corporate profits, this point is being taken seriously by Wall Street pros. It's also worth examining in this our latest installment.

Until the latest pullback on Wednesday, the U.S. dollar index had been on a rip-and-tear for most of this year. Earlier this week the dollar hit a new multi-year high as concerns over Europe and China have fueled foreign interest in U.S. assets. The greenback's relentless strength is also a cause for concern among investors who fear that a stronger dollar will erode corporate profits this year. Since much of the bull market of the last few years was based on the bull market in corporate profits, this point is being taken seriously by Wall Street pros. It's also worth examining in this our latest installment.

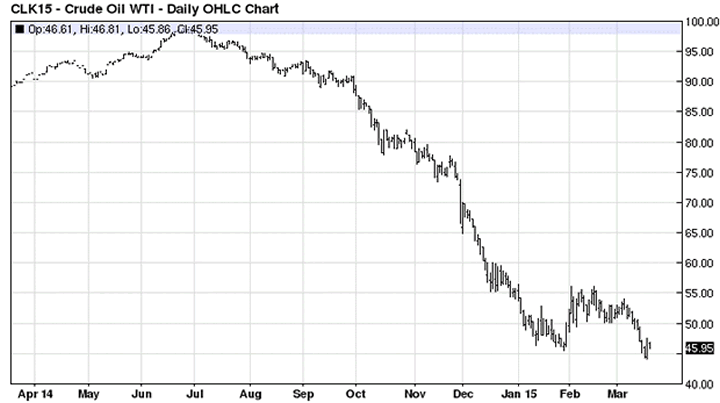

Also of concern to investors is the weak oil sector. The WTI crude oil price (basis May futures) fell to a nominal 5-year low of $44.84/barrel earlier this week after testing the January bottom. A decisive break below this level would likely catalyze another selling event in crude oil as protective stops are taken out, but if the crude price can stabilize above this pivotal low the market will get a needed reprieve.

Weakness in the oil market has also put significant pressure on oil and gas stocks for much of this year to date. Most of the new 52-week lows on the NYSE recently have been in the oil/gas sector. This in turn put some short-term downward pressure on the overall stock market; remember that a persistently high number of new 52-week lows (i.e. above 40) is often a sign of internal weakness. That may soon change, however, now that the Fed has once again given its assurance that it won't be hiking interest rates anytime soon.

The strengthening dollar is actually a double-edged sword. While it hurts the profitability of corporations in the export market, it also helps consumers by lower prices for goods on the domestic level. It also encourages inflows of foreign capital, i.e. "hot money," which often has the effect of lifting U.S. financial markets. U.S. equities have been prime recipients of the weakness in foreign currency markets in the last year or so, but certain municipal real estate markets in the U.S. have been huge recipients of foreign investment. A substantial part of the demand in U.S. commercial real estate in several major cities, for instance, is coming from Chinese nationals.

Veteran market analyst Bert Dohmen points out that flight capital can result in major economic booms/bubbles, but since it represents far less than the amount of total wealth of foreign investors, when the flight capital is exhausted demand dries up. Concerning the flood of foreign hot money into U.S. markets, Dohmen writes: "Those foreigners who have most of their assets in their own countries are growing poorer. They will eventually start conserving capital and defer all new purchases."

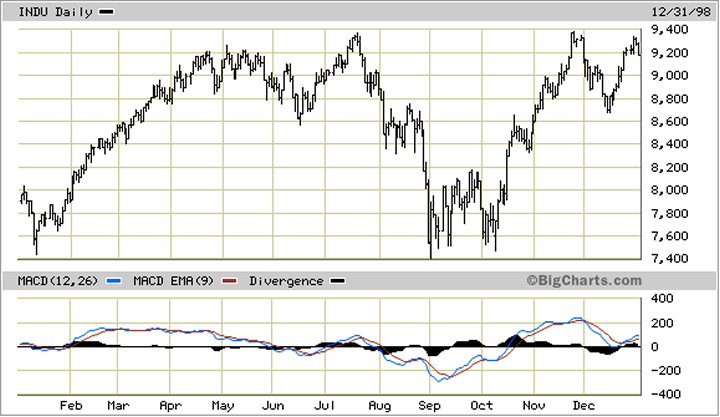

The dollar bull market is reminiscent of the strong dollar environment of the late 1990s. Back in 1998-99, relentless strength in the dollar index - and a corresponding crash in several foreign currencies - led to a flood tide of capital into U.S. financial markets. U.S. stocks and bonds were highly sought after and the Internet stock bubble of those days was at least partly fueled by foreign flight capital. The late '90s dollar bull market also led to a veritable bull market for U.S. consumers as retail prices plunged to levels not seen in many years. Gasoline pump prices fell to just under $1/gallon as crude oil dropped to $10/barrel.

At that time the strong dollar was also part of President Clinton's fiscal policy as then Treasury Secretary Robert Rubin, a former Goldman Sachs partner, masterminded the currency policy in the wake of the East Asian financial crisis. The strong dollar, however, eventually led to its own set of financial problems as the economies of several countries imploded in 1998 and nearly kicked off a global commodities price collapse. It also ignited a mini bear market in the U.S. stock market in the summer of '98, which lasted all of 10 weeks.

So, we can see from history that while a strong dollar can definitely fuel a strong domestic economy and an equities bull market for a while, it eventually evokes its own reversal. As Dohmen points out, since the dollar's strength comes at the expense of foreign currency weakness. And persistent weakness in foreign countries means that "hot money" capital flows from those countries into the U.S. will eventually cease. When the flight capital coming into U.S. markets ceases so does the upside momentum in financial prices.

I believe we're still probably at least a year or two away from the proverbial "danger zone" when persistent dollar strength creates major problems for the U.S. If anything, we're probably closer to the "sweet spot" of the currency cycle where a strengthening dollar provides economic leverage for consumers as well as investors. But as with any persistent trend, the pendulum will swing too far in one direction and will eventually swing back in the other direction. Let's keep that in mind as we look for opportunities in the coming months.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, "Mastering Moving Averages," I remove the mystique behind stock and ETF trading and reveal a completely simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, "The Best Strategies For Momentum Traders." Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.